More than a year ago we indicated the potential of natural gas extracted from shale rock and that the SA Karoo basin covered in shale rock might contain a great deal of this new source of energy. In a report in the Calgary Herald, of 18 April, Peter Terzakian referred to a very recent assessment of shale gas potential in 48 basins in 32 countries released by the US Energy Information Agency.

To quote the Calgary Herald: “ The numbers are staggering: over a six-fold increase in the 1,001 trillion cubic feet (Tcf) of natural gas that was previously known to be “proven” reserves. According to the EIA report, over 6,600 Tcf of shale gas resources are estimated to be technically recoverable”. As the Calgary Herald explains “……..To put this in perspective, 1,000 Tcf of natural gas contains the equivalent energy to 166 billion barrels of oil – a staggering amount considering that the discovery of 10 billion barrels of conventional oil these days is a rare occurrence….”

We might add by way of comparison that the annual global consumption of oil is of the order of 87m barrels per day of which SA consumes about approximately 555 000 barrels per day.

The Calgary Herald produced a table of the largest 15 such shale gas reserves to point to the vast recoverable resource in China. But as may be seen below the estimate of the technically recoverable resource in South Africa at 500 TCF (none yet proven) is no small potatoes either- it is the fifth largest such resource and equivalent to 83billion barrels.

Were this potential output of natural gas, estimated as recoverable by the US EIA, to be captured from the Karoo shale it would be very large potatoes indeed. It would be the equivalent to about 400 years of SA consumption of oil at current rates: 365*550 00 = 202.575m per annum; (83000mb/202.575mbpa) = 402 years

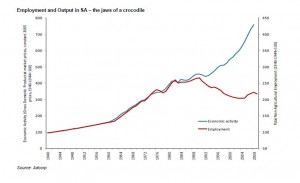

These numbers derived from estimates that are as objective and scientific as any should help concentrate minds at the SA Department of Mineral Resources that has placed a freeze on rights to explore for natural gas in SA until it has formulated a policy. The benefits of discoveries of natural gas in SA of anything like this order of magnitude would very obviously be transformational for the SA economy. It would offer the prospect of much faster growth in national output and in incomes, including the incomes to be received by the SA government and of the poor to whom it may be hoped a good portion of the extra income would be distributed.

There might well be damage to the environment to be traded off for these great potential benefits. Such tradeoffs can presumably be calculated and compensation offered if necessary to those negatively affected. There is too much at stake for any other approach to be adopted.

How much actual damage to be caused will continue to be disputed. However what should be borne in mind is that the damage to the environment caused by extracting other sources of energy in SA especially open cast or even deep level coal mining, would need to be brought into the calculation. Or in other words, less damage to the Waterberg traded off for damage to the Karoo

In many countries the prospects of shale gas have been greeted like the proverbial manna from heaven. Technically recoverable gas is being converted into proven reserves and actual output at a rapid rate. The economics of shale gas are rapidly transforming the energy equation in the US. But in SA the green movement seemed to have sounded an alarm that has deafened any account of the potential benefits. That the Karoo farmers have (recently) been denied any direct benefits from the gas under their land has no doubt added to the cacophony of protest.

Shell Oil, which appears to be well ahead in the race for Karoo gas, has argued (Business Report May 3 2011 p 17) to the contrary, that the process of extracting gas from shale “can be done without significant environmental damage”. That Shell has an interest in such arguments does not make the argument invalid. Furthermore the actual experience of damage to the environment in shale basins where gas is already being extracted in significant volumes will provide very important evidence.

The negative external effects of extraction or of any minerals in the ground do not remove the necessity to actually calculate the relevant tradeoffs as best as science will allow. Without such calculations and tradeoffs, economic development itself becomes much more difficult to realise. This is a fact of economic life well enough known to the greens who have no taste for the rising incomes and especially the rising consumption power of the masses.

Such an environmental assessment would then enable full compensation to be actually paid out to those damaged directly. The great potential extra income to be generated from natural gas potentially available deep under the Karoo shale rock is very likely to greatly exceed the damage caused to neighbours. If this is not the case then the project should not be allowed to go ahead.

The Department of Mineral Resources should however be well aware when establishing its policy that not only will natural gas discoveries on this potential scale be transformational for the SA economy, it will prove even more transforming of the energy sector of the economy. The Department should know that transformation of this order of magnitude will naturally not only be resisted by those directly in the path of discovery. Resistance would also come from those who think they may lose the race for supremacy for natural gas from SA sources because they have been slow out the blocks. The national interest in economic growth will count for little when opposed by vested interests.

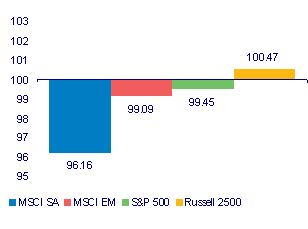

To view the graphs and tables referred to in the article, see Daily Ideas in todays Daily View: Natural gas: Economic development vs the status quo