Attached is a presentation on the 2011 National Budget for South Africa: The economy and the markets after the budget

Month: February 2011

2011-2012 Budget: Getting value for government money

The first impression one has of the Budget proposals is just how strongly government revenues have grown over the past fiscal year, something around 13%. Also, how strongly tax revenues (not tax rates) are expected to increase over the next few years. At around a 10% per annum rate, or in real terms by about 5%, government expenditure is planned to grow at around an 8% rate or around equivalent to a 3% rate in expected inflation adjusted terms.

Read the full story in the Daily View here: 2011-2012 Budget: Getting value for government money

Earnings: Growth is accelerating – perhaps faster than expected

The much anticipated recovery in JSE earnings off a global financial crisis depressed base is now well under way. The results reported by Anglo and BHP Billiton (with a combined ALSI weight of about 24.7%) have contributed meaningfully to the reported growth rates. As we show below, ALSI earnings per share are now 36% higher than a year ago while in real CPI deflated terms the growth is 32% and in US dollars an even more impressive 46% higher than February 2010.

Continue reading Earnings: Growth is accelerating – perhaps faster than expected

SA economy: Moving in step

We have made the point recently that the companies listed on JSE, have become increasingly exposed to the state of the global rather than the SA economy. Hence the close links between JSE earnings (and performance) in US dollars and emerging markets earnings.

The rand: A hopeful portend of better markets to come?

Last week was a better one for the rand. After an extended period of rand weakness that began at the turn of the year, the rand, on a trade weighted basis held its own.

Accordingly the JSE proved to be one of the better emerging equity markets last week (measured in US dollars) though emerging markets again lagged behind the S&P 500 – a trend that has persisted since the beginning of the year. Until the year end the JSE had been an outperforming emerging market during a period when emerging markets had outperformed the S&P 500.

Continue reading The rand: A hopeful portend of better markets to come?

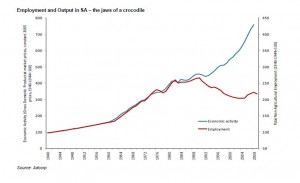

Employment: A call for economic realism, not wishful thinking

The employment problem in SA has become a major focus of government action. Employment in the formal sector, that is with employers who provide medical and pension benefits and collect PAYE , has lagged well behind GDP growth since the mid 1990s.

Furthermore real remuneration per worker since then has increased significantly over the same period. The two figures below, provided by Adcorp, tell the full story of much better jobs for far fewer workers. The SA economy, or at least the formal part of it, has become much less labour intensive, and much more capital and skilled labour intensive. Decent jobs, but only for the fortunate few, is the SA reality.

The less fortunate or less well endowed with skills get by finding work outside the recorded regulated sector and depend increasingly on welfare grants. Immigrants, of whose large numbers we are uninformed about, without cash grants support from the SA government (i.e. the taxpayer) seem to find work easily enough, though no doubt at highly competitive wages.

Click figures to see full size

Continue reading Employment: A call for economic realism, not wishful thinking

Rand and the economy: Why a strong rand is good for SA business

The notion that the strong rand makes life tough for SA mining enterprises is belied by the earnings now being reported by the mining companies. Anglo Plats just reported headline earnings per share of 1 935c in 2010, up from 289c in 2009, an increase of 570%. The higher US dollar price of platinum metals clearly more than made up for what a stronger rand took away.

Continue reading Rand and the economy: Why a strong rand is good for SA business

The Hard Number Index: Recovery remains well on course

The Reserve Bank announced its note issue for January this morning. This enables us to complete our Hard Number Index (HNI) of the immediate state of the SA economy. Our HNI combines unit vehicle sales with the note issue (adjusted for inflation in equal weights) to provide a very up to date indicator. We compare trends in the HNI with the Reserve Bank coinciding indicator of the state of the business cycle, although this has only been updated to October 2010. Three months can be a very long time in economic life. Continue reading The Hard Number Index: Recovery remains well on course

New vehicle sales: A bright start to the year

The first bit of news about the SA economy in 2011 has been released by NAAMSA in the form of new vehicle sales in January. 45 135 new units were sold in January 2011, up from 39 504 in December 2010. But this does not tell the full story of very robust sales. January and December are usually well below par months for selling new vehicles. Holiday makers are more likely to buying Christmas presents for others than new toys for themselves.

On a seasonally adjusted basis new vehicle sales were up from 45 404 units in December to 45 758 units in January, an increase of 7.4%. This followed a very strong November. If these trends are sustained, sales in 2011 will approximate 585 000 units, up 18% from the 494 340 units sold in 2010. Continue reading New vehicle sales: A bright start to the year

Value for money and value add at the GSB Cape Town

Our readers may not have noticed but the Financial Times ranking of Business Schools around the world was published yesterday. The top schools as estimated by the schools themselves and by the opinions of their alumni were jointly the London Business School and the Wharton School at the University of Pennsylvania. Third was Harvard and joint fourth, Insead and Stanford Business School.

In 60th place up from 89 in 2010 was the GSB at the University of Cape Town. It is the only business school in Africa that is ranked in the FT top 100. Most interestingly the Cape Town GSB ranked first in the Value for Money Category. This has a low three per cent weight in the overall score and so could not have made a great difference to the ranking order. Much more important for the ranking Measure are the categories Weighted Salary with a 20% weight (the average alumnus salary today with adjustment for salary variations between industry sectors. Includes data for the current year and the one or two preceding years where available) and the Salary Percentage Increase with another 20% weight (The percentage increase in average alumnus salary from before the MBA to today as a percentage of the pre-MBA salary). Continue reading Value for money and value add at the GSB Cape Town

In 60th place up from 89 in 2010 was the GSB at the University of Cape Town. It is the only business school in Africa that is ranked in the FT top 100. Most interestingly the Cape Town GSB ranked first in the Value for Money Category. This has a low three per cent weight in the overall score and so could not have made a great difference to the ranking order. Much more important for the ranking Measure are the categories Weighted Salary with a 20% weight (the average alumnus salary today with adjustment for salary variations between industry sectors. Includes data for the current year and the one or two preceding years where available) and the Salary Percentage Increase with another 20% weight (The percentage increase in average alumnus salary from before the MBA to today as a percentage of the pre-MBA salary). Continue reading Value for money and value add at the GSB Cape Town

The rand: What a growing global economy can do

In our recent asset allocation overview we had made the case for overweight equities. However our ranking order, based on our valuation exercises, indicated a preference for developed markets (represented by the S&P 500) over emerging markets generally (represented by the MSCI EM Index) over the JSE All Share Index.

The indexes this year have behaved very much in line with our ranking order. We compare the performance of the respective Indexes this year in USD below. As may be seen the S&P was the out performer and the JSE the distinct underperformer in January 2011.

Continue reading the full Daily View here: Daily View, 1 February 2011 – The rand: What a growing global economy can do