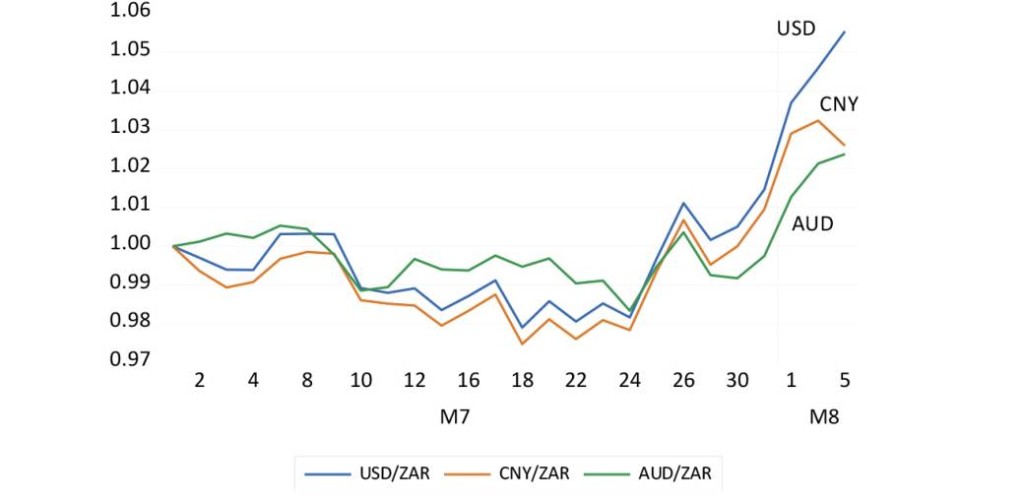

The famous phrase by Yogi Berra, “It’s déjà vu all over again,” does not quite do justice to the recent turmoil in the SA currency and debt markets. The hope for a weaker dollar and stronger rand, as well as the lower interest rates, inflation, and faster growth that comes with a stronger rand, has once more been dashed.

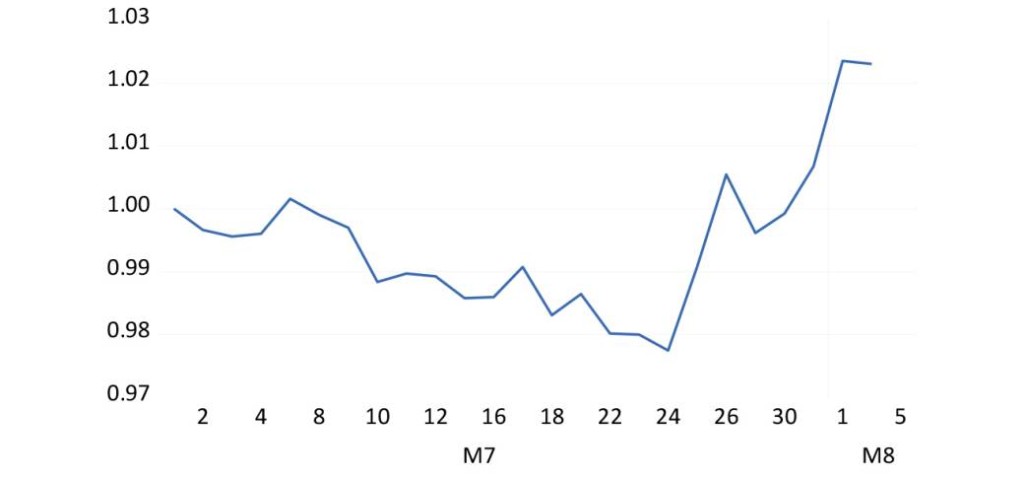

Trade wars and currency manipulation do less damage to the US economy than to others, simply because the US is less dependent on global trade and more dependent on the US consumer. Hence in times of trouble, capital flows towards the US, raises the exchange value of the US dollar and depresses bond yields. Emerging market exchange rates weaken more than most and emerging market bond yields rise. The rand generally falls more than most other emerging market currencies.

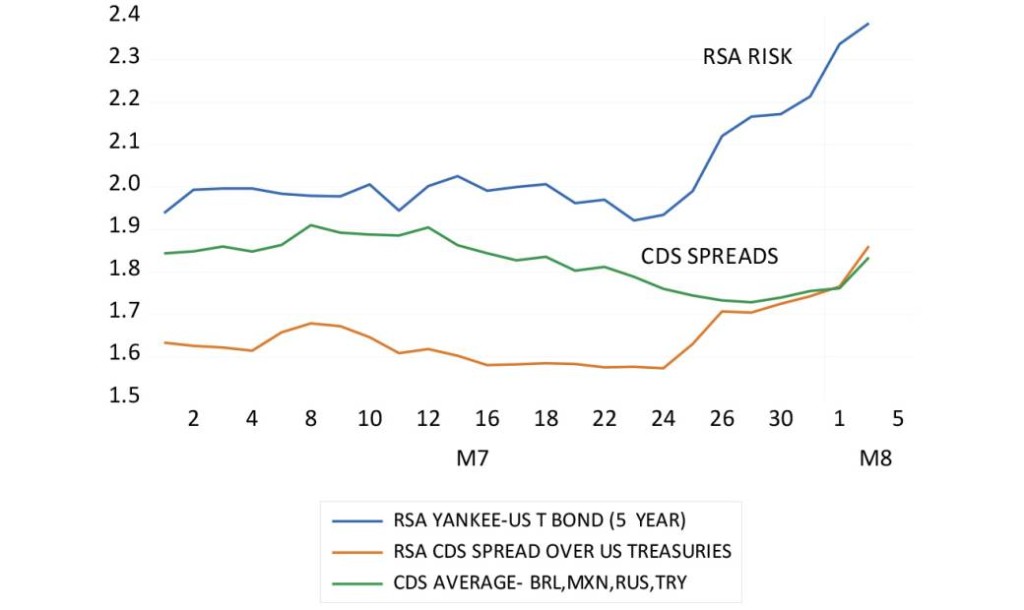

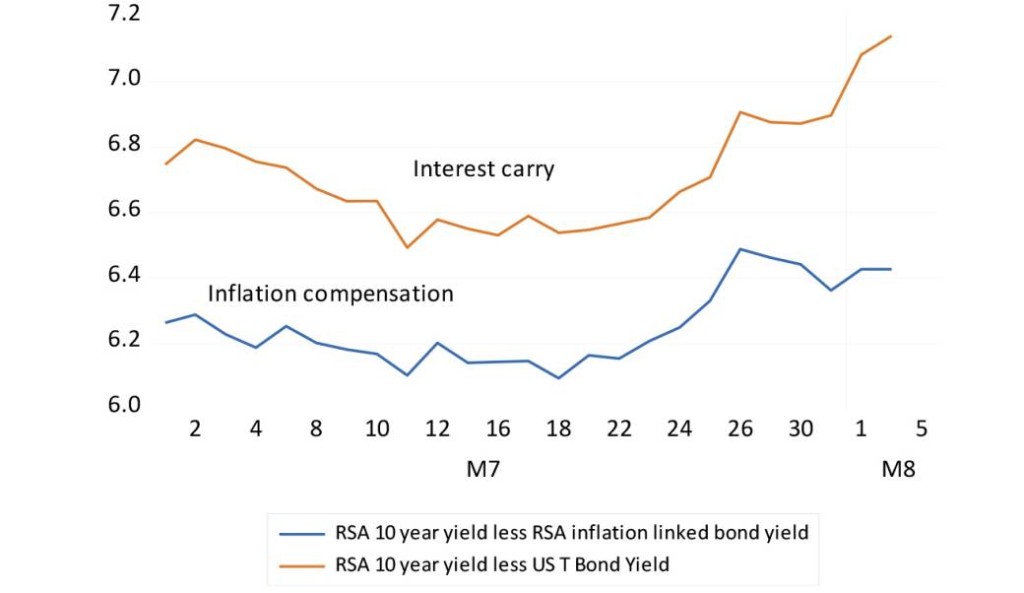

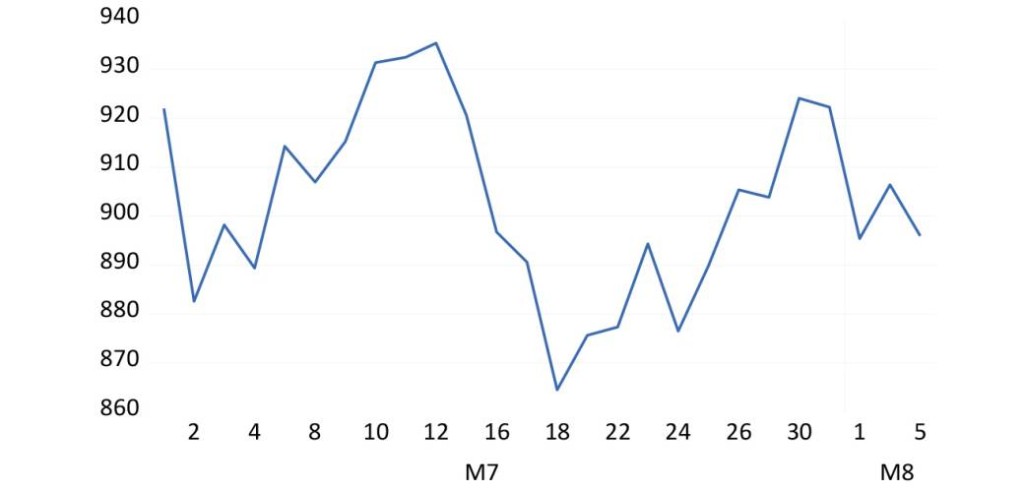

Funding government debt has become more expensive, even as the volume of debt to fund extraordinary spending on Eskom increases at a very rapid rate. Long-dated SA government-issued (RSA) debt now offers an extra 8% over US Treasury bonds and almost as much extra when compared to other developed market issuers (many of whom now borrow at negative interest rates). SA is now paying 3% more than the average emerging market on its debt (in their domestic currencies).

For the government, raising US dollars has also become more expensive. Raising five-year dollar-denominated debt now requires an extra 0.4 percentage points (40 basis points) more than it did in early July 2019. The cost of insuring RSA foreign-currency debt against default has risen similarly and more than it has for other emerging market borrowers.