The National Budget to be presented next Wednesday may well be the last under the full control of the ANC led government. The ANC may need support the from other parties to govern after the elections to set Budgets. And these other parties should have different and perhaps even better ideas about taxes and government expenditure. They might even mirabile dictu insist that continuing to award comparatively well paid and well cossetted public sector officials well above inflation increases in their compensation is not the best way to utilize tax revenues. That employing more doctors, nurses, teachers and prosecutors, unable for want of a large enough budget to break into public sector employment, might be a much better idea than paying the establishment more. They may understand that ever rising tax revenues are a major drag on economic growth and that the country therefore cannot afford to increase government expenditure at the rate it has been increasing over many years now. It has meant an ever-growing interest bill that crowds out other spending and threatens fiscal sustainability and brings very high borrowing costs in its wake.

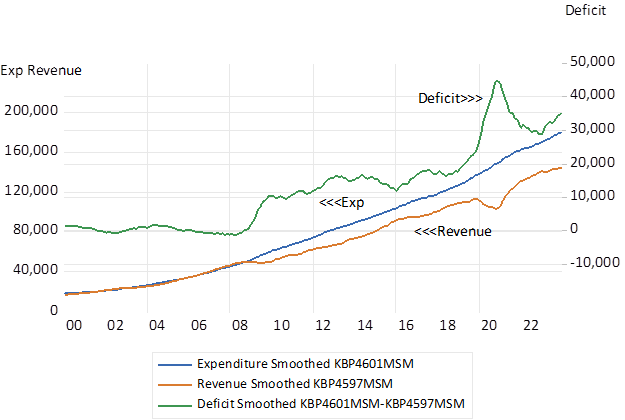

Though the major threat to the Budget outcomes this year has been the lack of revenue. The weak economy and its negative impact on company earnings and taxes has taken a heavy toll on revenues. They are expected to fall some R80b below year ago estimates- about a 4 % miss. Weaker prices for our metal and mineral exports have dragged on mining revenues and earnings. It will all mean more borrowing, perhaps also some drawing down on Treasury cash and foreign exchange reserves to reduce debt issuance. But this will but paper over the cracks. Something very different is called for.

Higher tax rates will seem counter productive and expenditure growth will have to be constrained even in an election year. Though it is surely hard to argue that the SA economy has suffered for want of government spending. The opposite must be argued – that the economy has suffered from too much and too much unproductive government spending and hence too heavy a burden of taxes.

Ever since the recession of 2009 government spending and tax collected at national level have grown at a rapid clip – ahead of inflation and nominal GDP. With the growth in expenditure slightly faster than the growth in revenues and the consistent shortfalls made up with much extra borrowing. You can describe it, up to a point, as conservative budgeting. Necessarily so in the circumstances, but surely economic policy must hope to do better than slowly strangle an economy. Being re-elected demands no less.

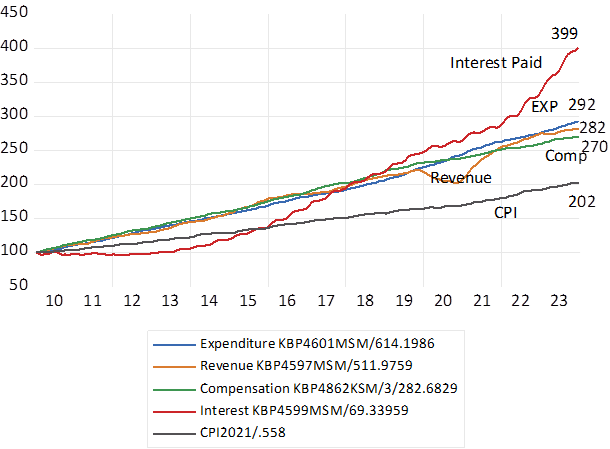

If we base our fiscal history on 2010 levels, National Government Expenditure is up 2.9 times, Revenue up 2.8 times, compensation of public officials up 2.7 times while interest paid is 3.39 times higher than it was in 2010 and runs at about R28 billion a month- a heavy price to pay for the mere right to borrow more. The CPI is up a mere 2 times since 2010. And the ratio of revenue to GDP is up from about 22% to 26%. These are the unimpressive statistics that damage growth and make losing elections inevitable.

A Fiscal Summary

Key Fiscal Statistics (2010=100)

South African fiscal policy settings have been seen by investors in RSA bonds and bills as a slow-moving train wreck. They have demanded high interest rate premiums to overcome the risks to fiscal sustainability undermined fundamentally by slow growth and insufficiently restrined spending and taxing. And to satisfy their expectation that the rand will weaken consistently and inflation stay at high levels and eat into their rand incomes in real or USD dollar equivalents. It will take a much different fiscal path to reverse such expectations and lift growth rates. That is in short for government spending and revenues to grow no faster than the real economy. Will the next SA government be able to grasp this nettle?