Shoprite is an outstandingly successful South African business as its interim results to December 2023 confirm. It has grown rand revenues and volumes by taking an increased share of the retail market. The return on the capital invested in the business remains impressively high. Post Covid returns on capital invested has encouragingly picked up again.

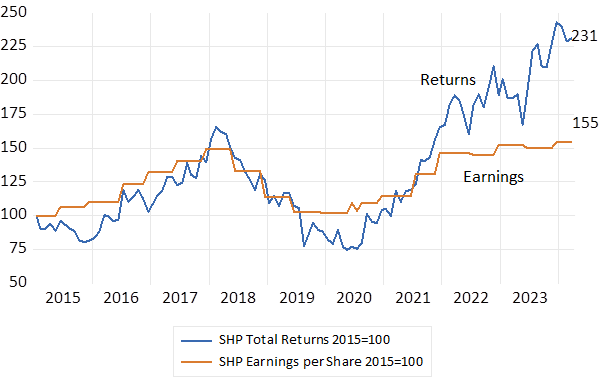

R100 invested in SHP shares in 2015, with dividends reinvested in SHP, would have grown to R231 by March 2024. Earnings per share have grown by 55% since January 2015. (see below) The same R100 invested in the JSE All Share Index would have grown to a similar R198 over the same period. (see below) Though SHP bottom earnings per share seemed to have something of a recent plateau – load shedding and the associated costs of keeping the lights on have raised costs.

SHP Total Returns and Earnings (2015=100)

Source; Bloomberg and Investec Wealth and Investment

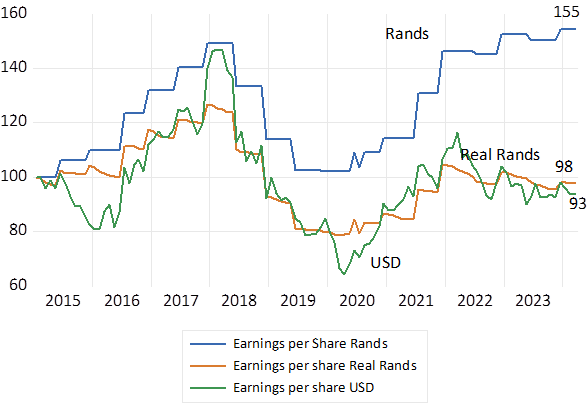

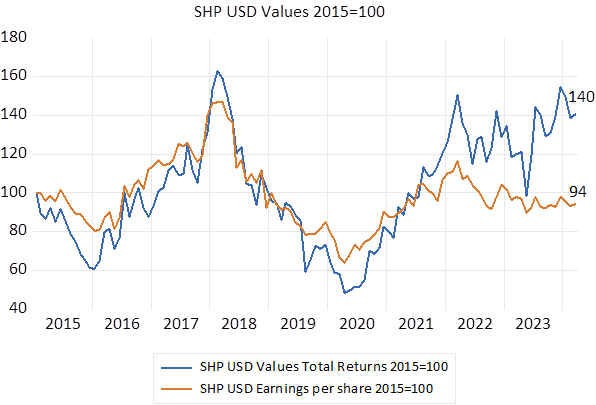

But earnings and returns for shareholders in rands of the day that consistently lose purchasing power need an adjustment for inflation. The performance of SHP in real deflated rands or in USD dollars has not been nearly as imposing. Recent earnings when deflated by the CPI or when converted into USD are still marginally below levels of January 2015 and well below real or dollar earnings that peaked in 2017. (see below) The average annual returns for a USD investor in SHP since 2015 would have been about 6% p.a. compared to 10.6% p.a. on average for the Rand investor. SHP earnings in US dollars are now 6% below their levels of 2015.

Shoprite Earnings in Rands, Real Rands and US dollars (2015=100)

Source; Bloomberg and Investec Wealth and Investment

Shoprite- performance in USD (2015=100)

Source; Bloomberg and Investec Wealth and Investment

The SHP returns realised for shareholders compare closely with those of the JSE All Share Index but have lagged well behind the rand returns realised on the S&P 500 Index. (see below) Even a great SA business has not rewarded investors very well when compared to returns realised in New York. It would have taken a great business encouraged by a growing economy to have done so.

The depressingly slow growth rates realised and expected are implicit in very undemanding valuations of SA economy facing enterprises. The investment case for SHP and every SA economy facing business, at current valuations would have to be made on the possibility of SA GDP growth rates surprising on the upside.

It will take structural supply side reforms to surprise on the upside. Of the kind indeed offered by the Treasury in its 2024 Budget and Review. The Treasury makes the case for less government spending and a lesser tax burden to raise SA’s growth potential. It makes the right noises and calls for public – private partnerships and “crowding in private capital”. The help for the economy would come all the sooner in the form of lower interest rates, less rand weakness expected and less inflation, were these proposals regarded as credible. With more growth expected fiscal sustainability would become much more likely. Long term interest rates would decline as the appetite for RSA debt improved. And lower discount rates attached to SA earnings would command more market value.

Lower long term interest rates (after inflation) would reduce the high real cost of capital that SA businesses have now to hurdle over. Whichever fewer businesses are understandably attempting to do. Without expected growth in the demand for their goods and services, businesses will not invest much in additional plant or people. SHF perhaps excepted. The current lack of business capex severely undermines the growth potential of the SA economy over the long term.

Yet SA suffers not only from a supply side problem. The economy also suffers from a lack of demand for goods and services. Demand leads supply as much as supply constrains incomes and demands for goods and services. The case for significantly lower short term interest rates to immediately stimulate more spending by households – seems incontestable- outside perhaps of the Reserve Bank.