Month: July 2022

Inflation and or recession- that is the question

When will inflation in the US (9.1% in June) peak? My answer is about now. And the surveys of inflation and the state of the financial markets support this proposition. If month to month increases in the US CPI revert to something like the 20 year average, inflation in the US will be trending well below 7% by year end and fall back to 2% p.a. by late 2023. Bloomberg surveys conducted in July indicate in inflation in Europe- now over 8% p.a. to recede to 2% by year end. Inflation in SA, still to peak at over 7%, is expected decline to 5% by late 2023.

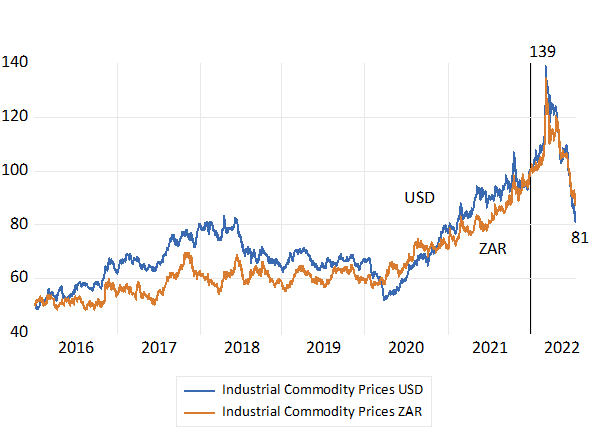

The supply side disruptions that ramped up oil, grains, shipping costs and metal prices (unfortunately for the South African economy) have abated. They are all well off their recent peaks. Industrial Commodity and Metal prices are 50% lower than their peak values of January 2022. These prices may remain at high levels, but they are no longer rising to force inflation higher.

Industrial Commodity Price Index. January 2022=100. Daily Data

Source; Bloomberg and Investec Wealth and Investment

Prices have their supply and demand causes as they have had in our post Covid, post Russian invasion world. They also have their intended effects. They have helped repress demand for goods, more than for services, in the developed world and South Africa. Inflation is properly defined as a continuous increase in the CPI. It takes more than essentially temporary supply side shocks for inflation to proceed at persistently higher levels. Inflation can only be sustained with continued stimulation of demand. Without additional demand, the higher prices perhaps planned in advance by suppliers with price setting powers, cannot be sustained. Without support from the demand side of the economy, from further injections of demand, stimulated by central banks and governments, the market-place will not t absorb higher prices. In the absence of supportive demand, prices will, perhaps only gradually, adjust lower in response to help sustain sales revenues and bottom lines.

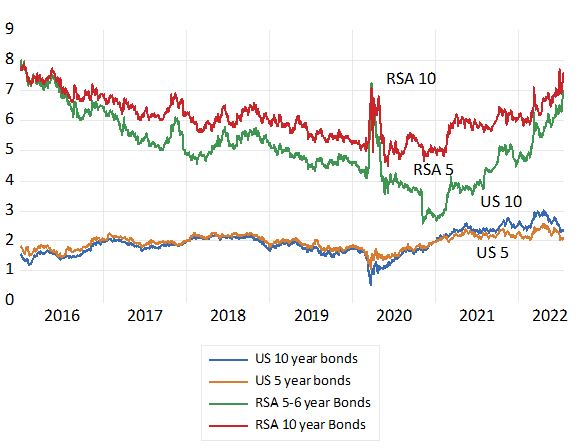

Prices are not what firms would like them to be, higher usually, but are conditioned by what their customers will bear. Expecting more inflation and setting higher prices accordingly regardless of the stae of demand cannot be a self-fulfilling prophecy. It is not consistent with economic rationality. The clear evidence from the recent surveys and the bond markets is that economic actors are not naively extrapolating recent inflation into the distant future. They are wisely seeing beyond current inflation to the longer-term demand and supply forces that will act on prices- including the role expected to be played by fiscal and monetary policy. As with the surveys, inflation expected, as priced in the market for US Treasury Bonds, so called break-even rates, have receded in the past week-despite higher realized inflation.

The US bond market expects inflation to average 2.1% p.a. over the next five years and 2.3% p.a. over the next ten years- very close to the 2% p.a. Fed target for inflation. The SA bond market is now offering still higher rewards for bearing inflation risk- despite the inflation-fighting zeal of our Reserve Bank. The money and bond markets in the US are priced for a reversal of the direction of interest rates next year, with the peak in short rates having been brought sharply forward to January 2023 at 3.25%. The SA money market predicts much higher interest rates for a much more extended period. One hopes wrongly given the absence of demand side pressures on prices and the state of the economy.

Inflation expectations revealed in the Treasury and RSA bond markets. Daily data.

Source; Bloomberg and Investec Wealth and Investment

The best reason to expect inflation to subside in the US, Europe and South Africa is that the demands for goods and many services are already well depressed, thanks to higher prices. Spending is no longer being supported by additional income subsidies or by rapid growth in the money supply and bank credit. The money supply in the US (M2) has ground to a halt. The essential question is still to be answered. Is the US and Europe heading for recession aided and abetted by central banks intent on raising interest rates too aggressively and indeed unnecessarily fighting the last war? Central banks should know better than to lead their economies into recession while inflation is moving in the right direction and their economies head in the wrong direction.

May I say I told you so

We like to think that evidence changes beliefs. The problem with beliefs or rather opinions about economic life is that the economy never stands still to conduct experiments with. The management of Naspers conducted an experiment in September 2019 to reduce the huge gap between the value of the assets on its books, its Net Asset Value (NAV) or sum of its parts, mostly in the form of its enormously valuable shareholding in Tencent a fabulously successful internet company listed in Hong Kong, and the market value of its shares listed on the JSE.

The board and its management have seemingly learned a great deal from the expensive experiment – unexpectedly so surely – because restructuring its shareholding, establishing a subsidiary company in Amsterdam Prosus (PRX) to hold its Tencent shares and other offshore investments went so badly. The value gap, the difference between the NAV and Market Value(MV) of both NPN and PRX rather than narrow had widened significantly after 2019 despite or rather in small part because of the restructuring. By early June 2022 the discount for NPN (NAV- MV)/NAV)*100 was of the order of 62% and 51% for PRX

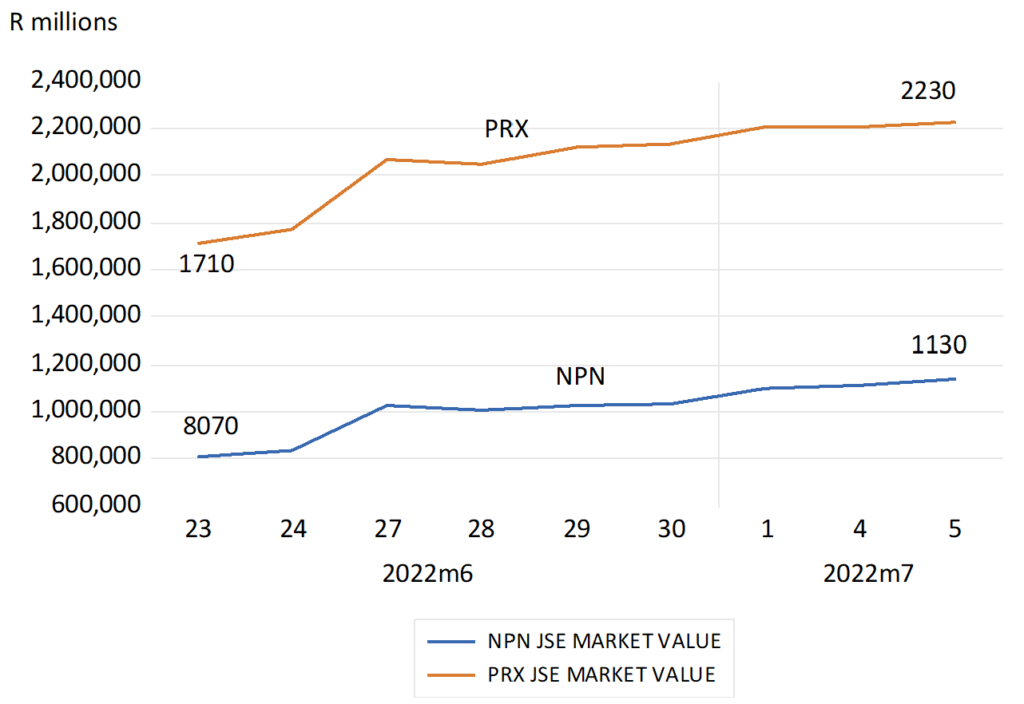

Such new awareness has been received with great appreciation and delight of its shareholders these past few weeks. As a result of its change of mind, in the form of a mea-culpa about past actions and the much more tangible decision to sell as much as 2% a year of its holding in Tencent shares, worth potentially USD 10 billion a year, and to return the cash realized to shareholders buying back its shares. Since the announcement of June 23rd, shareholders in NPN have seen their shares appreciate by 34% adding 323 billion rands to its market value by July 5th while shares in the associate company Prosus (PRX) are up by 26% worth a extra R520 billion rand and the discount has substantially narrowed to the 30% range for PRX and 40% for NPN. A further decision to include success in narrowing the value gap as a key management performance indicator was also helpful. All achieved in days while the JSE has moved sideways.

Daily share price moves and the JSE All Share Index June 23rd – July 5th (June 23rd=100)

Source; Bloomberg and Investec Wealth and Investment

Market Value; Naspers and Prosus, Rand millions

Source; Bloomberg and Investec Wealth and Investment

Naspers and the Value Gap 2010 – 2019 Month end data.

Source; Bloomberg and Investec Wealth and Investment

The Naspers board had been of the view that it was the South African and JSE connections, higher SA risk premiums and a limited shareholding opportunity in SA, where NPN featured so largely, stood in the way of their receiving proper recognition for their vigorous efforts in diversifying their balance sheets. Hence the restructuring. My opinion, long shared with whoever might read or listen to them,[1] was that the difference between the market value of the sum of parts of any investment holding company and its share market value including NPN and PRX could be largely attributed to three factors. And that where a company was domiciled or listed would be of minor consequence.

Firstly that the reported value of unlisted subsidiary companies could be over-estimated to exaggerate NAV. Secondly that the estimated future costs of maintain a head office, including the employment benefits (including share options and issues) expected to be realized to senior management would be present valued to reduce the market value of the holding company shares. Managers can prove very expensive stakeholders.

And thirdly and most importantly would be the investors or potential investors estimate of the present value of the investment programme of the holding company. They might well judge and expect that the future value of the investments and acquisitions to be made by the Holding Company will be worth less, perhaps much less, than they will cost shareholders in cash or returns foregone. And the more investments undertaken the more value destruction and the lower the value of the shares in the holding company priced lower to promise a market related return for shareholders. If such were the market view the less cash invested, the more returned to shareholders by way of dividends, share buy backs or via the unbundling of mature investments, the more value created for shareholders. Naspers/Prosus is helping to prove my theory.

[1] Follow for examples these BD links https://www.businesslive.co.za/bd/companies/2020-09-14-watch-is-nasperss-management-destroying-its-value/

Working from home (WFH) will work out well

A growing number of employers have insisted that their employees must come back to their work- places. Elon Musk, has demanded that Tesla or Space Ex staff spend at least 40 hours in their offices and that those who do not want to do so “…. Should pretend to work somewhere else…” He also wrote “Tesla has and will create and actually manufacture the most exciting and meaningful products of any company on Earth, this will not happen by phoning it in.” Many other firms, feel the same disillusionment.

WFH is an option – not a compulsion. But an option modern technology has now made possible in ways that were not possible before. Homework was hardly unknown before. Writers, composers and artists as well as weavers and sewers, home bakers, worked from home long before the gig-workers who congregate at the internet café. You may you noticed how the coffee mavens all look up from their laptops to appraise the new arrivals? Seeking company no doubt that they could find at the water cooler.

Being able to measure accurately the relationship between how they reward their employees and how much they contribute to the output and profits of the firm is an essential responsibility of any business. It could not hope to survive without accurate calculations of the costs and benefits of alternative working arrangements. And the firms faced with WFH preferences have been learning by doing as they always do.

It can be assumed with great confidence that the great majority of employees will be paid no more or less than the value they will be expected to add for their employer – be it from the office or home. Furthermore, as clearly, nobody will be rewarded for the time they spend commuting. It is paid for in income or leisure sacrificed by the commuter. Recent evidence that the revealed willingness to go back to the office in the US is inversely related to the time spent commuting is no surprise. The lucky winners from the enforced lockdowns have been those who to live far from the office – that they chose to do for – their own good reasons – pre the lockdowns.

Employers are not the only party with the right to choose where best to work. Workers will make their own choices. The ratio of job openings to work seekers in the US has never been higher and the opportunity to work from home has not been greater this century.

The Tesla office worker who has remained in California, even though the Tesla office is now in Texas, may well tell Elon what to do with his job. They may even accept a lower salary to WFH – the cost of the commute is their bargaining chip. As is the saved rental and all other not at all insignificant costs of supplying an office desk that may improve their case to WFH. They may even be able to do two jobs from home- as many do- given the time freed up and the absence of supervision or whistle blowers. Elon and other collaboration mindful employers may have to offer a premium to get the preferred workers to the office- if they are more productive there.

The individual households who choose where and how they live will help determine how the world of work will look in ten years or more. The developers of offices and homes and retail space will respond rationally to the choices and ongoing experiments of all those who hire and supply labour of all kinds- billions of decisions will prove decisive. The world of work and production evolves continuously, usually in an imperceptible way, to the signals provided from the market for labour. There is no design – just efficient outcomes. Employers no longer requiring office workers to attend on Saturdays, or offering extended annual holidays, are not providing charity but are making a considered response to market forces- necessary to attract workers of the right kind and at the right price. They will continue to respond accordingly.

The responses to the opportunity to work from home that technology has made possible- and made the lockdowns possible – will evolve sensibly and rationally. Provided freedom to choose is respected as the essential ingredient for a successful, highly adaptive economy.