Is debt cheaper than equity? PPC shareholders will argue otherwise.

That debt is cheaper than equity is one of the conventional wisdoms of financial theory and perhaps practice. It appears to reduce the weighted average cost of capital (WACC). The more interest-bearing debt as an alternative to equity capital used to fund an enterprise, and the higher the company tax rate, the lower the WACC.

Yet while debt may save taxes it is also a much more risky form of capital. Even satisfactory operating profits may prove insufficient to pay a heavy interest bill or, perhaps more important, allow for the rescheduling of debts should they become due at an inconvenient moment. And so what is gained in taxes saved may be off-set (and more) by the risks of default incorporated in the cost of capital (the risk adjusted returns demanded and expected by shareholders) the firm may be required to satisfy.

Hence debt may raise rather than reduce the cost of capital for a firm when the cost of capital is defined correctly, not as the weighted by debt costs of finance, but as the returns required of any company to justify allocating equity and debt capital to it – capital that has many alternative applications. It is a required return understood as an opportunity rather than an interest cost of capital employed – equity capital included – the cost of which does not have a line on any profit and loss statement.

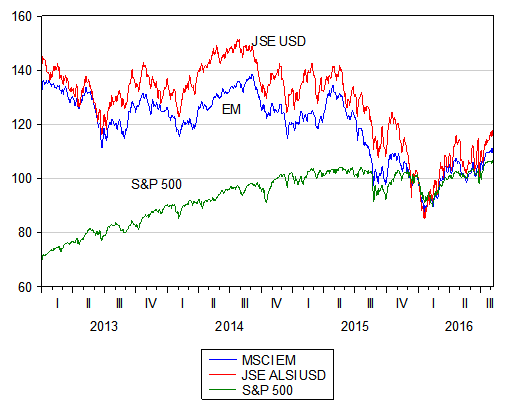

With hindsight the shareholders in PPC would surely have much preferred to have supplied the company with the extra R4bn of equity capital, before the company embarked on its expansion drive outside of SA in 2010, as they have now being called upon to do to pay back debts that unexpectedly came due. And had they, or rather their underwriters (for a 3% fee) not proved willing to add equity capital – the company would have in all likelihood gone under – and much of the R9 per share stake in the company they still owned on 23 August when the plans for a rights issue were concluded, might have been lost. Their losses as shareholders facing the prospect of defaulting on their debts to date have been very large ones, as we show in the figure below, but the R4bn rights issue promises to stop the rot of share value destruction.

The debt crisis for PPC was caused by a sharp credit ratings downgrade by S&P. This allowed the owners of R1.6bn of short term notes issued by PPC to demand immediate repayment of this capital and interest, which they did. Banks were called upon to rescue the company and the rights issue became an expensive condition of their assistance. That the company could make its self so vulnerable to a ratings downgrade, something not under its own control, speaks of very poor debt management, as well as what appears again with hindsight, as too much debt.

Having said that, on the face of it, the company has maintained a large enough gap between its earnings before interest and its interest expenses to sustain itself. In FY2016 these so-called “jaws” are expected to close sharply, on lower sales revenue, though they are expected to widen sharply again in 2017. According to Bloomberg, in FY2015, PPC earnings before interest were R1.660bn and its interest expense R490m, leaving R1.052bn of income after interest. In FY2016, earnings before interest are expected to decline sharply to R751m, the result of lower sales volumes, while interest expenses are expected to fall to R318m, leaving earnings after interest of R507m. Adding depreciation of R393m leaves the company with earnings before interest tax depreciation and amortisation (EBITDA) of R1.144bn in 2016 – just enough to fund about R1.068bn of additional capex. A marked improvement in sales, earnings and cash flows in the years to come has been predicted.

The rights at R4 per additional share were offered on Tuesday 23 August at a large discount of 55.5% to the then share price of R8.99. This discount is of little consequence to the existing shareholders. The cheaper the price of the shares they are issuing to themselves, the more shares they will have the presumed valuable rights to subscribe for or dispose of. Their share of the company is thus not being reduced even though many more PPC shares may be issued. They can choose to maintain their proportionate share of the company, or to be fully compensated for giving up a share by selling their rights to subscribe to others at their market value.

What is of significance to actual or potential shareholders is the amount of the capital being raised. The R4bn capital raised through the issue of 1 billion additional shares (previously 602m) should be compared with the share market value of the company that was but R5.477bn on 24 August 2016. The capital raising exercise is a large one and the success with which this extra capital is utilised will determine the future of the company.

The circular accompanying the Final Terms of the Rights Issue refers to a theoretical value of the shares once they begin trading after 16 September as R5.92 per share, that is given the share price on the day of the announcement, of R8.99. A better description of this theoretical value would be to describe it as the break-even price of the shares. This is the price that would enable shareholders or underwriters to recover the additional R4bn they will have invested in the company when the shares trade ex-rights. In other words it is the future price for the 1.6 billion shares in issue that would raise the market value of the company by an extra R4bn. equivalent to the extra capital raised – or from the R5.66bn it was worth on 23 August to R9.66bn.

Since the additional R4bn raised by the company is assured by the underwriters, the question the shareholders will have to ask themselves is whether or not the extra capital they subscribe to at R4 per share will come to be worth more than R4 per share plus an extra – say 15% p.a. – in the years to come. 15% is the sum of the risk free rate, the return on a RSA 10 year bond of about 9% plus an assumed equity risk premium of 6% p.a., being the returns they could expect from an alternatively risky investment. If the answer is a positive one, they should take up their rights, and if not they should sell their rights to others who think differently. Though any reluctance to take up the rights will reduce their value.

Until the rights offer closes on Friday 16 September and until shareholders have made up their minds to follow their rights or sell them, the target they will be aiming at (for their proportionate share of an extra R4bn of value) will be a moving one, as the PPC share price changes and as both the shares and the rights trade between 2 September and 19 September 2016. The higher (lower) the share price between now and then the higher (lower) will be this break even share price1. The PPC share price closed on Friday 26 August at R8.75, reducing the breakeven price from R6 marginally to R5.91 per share.

The value of a PPC share hereafter, initially with and later without rights, will depend on how well its managers are expected deploy the extra capital they will have at their disposal both now and in the future. Reducing the debt of the company by R3bn, as intended, appears necessary to secure the survival of the company. This reduction in debt will reduce its risks of failure and perhaps add value for shareholders by reducing for now the risk-adjusted returns required by shareholders. That is to reduce the discount rate applied to future expected cash flows.

What however will be the most decisive influence on the PPC share price over the next 10 years or more will not be its capital structure (more or less debt to equity) but the return on the capital it realises and is expected to realise. How the capital is raised, be it from lenders, new shareholders or from established shareholders in the form of cash retained, will be of very secondary importance. Unless, that is, the company again fails to manage its debt and equity competently – a surely much less complicated task than managing complex projects. 29 August 2016

1The breakeven price (P2) can be found by solving the following equation P2=(S1*P1)+k))/S2, where S1 is the number of shares in issue before the rights issue (602m) in the case of PPC and S2 the augmented number (1602m) while the additional capital to be raised, k, is R4bn. P1 is the share price before the rights can be exercised (R5.92 on 23 August) change or the share price plus the market value of the right – in the PPC case the right to subscribe to an extra 1.6 shares at R4 a share.