December 5, 2018

The global financial markets are reacting to two forces at work. About what Fed Chairman Powell might do to the US economy with interest rates and what President Trump might do to the Chinese economy with tariffs.

Interest rates set by the Fed might or might not prove helpful for the US economy. Given its unknown future path. It is not Potus but market forces that are restraining interest rate increases in the US. The absence of which is helpful to share prices- all else, expectations of earnings growth for example, remaining unchanged.

It is the US bond market itself that has eliminated any rational basis for the Fed to raise short term interest rates. Should the Fed pursue any aggressive intent with its own lending and borrowing rates, interest rates in the US market place, beyond the very shortest rates, are very likely to fall rather than rise.

Hence the cost of funding US corporations that typically borrow at fixed rates for three or more years and the cost of funding a home that is mostly fixed for twenty years or more, would likely fall rather than rise. And so make credit cheaper rather than more expensive.

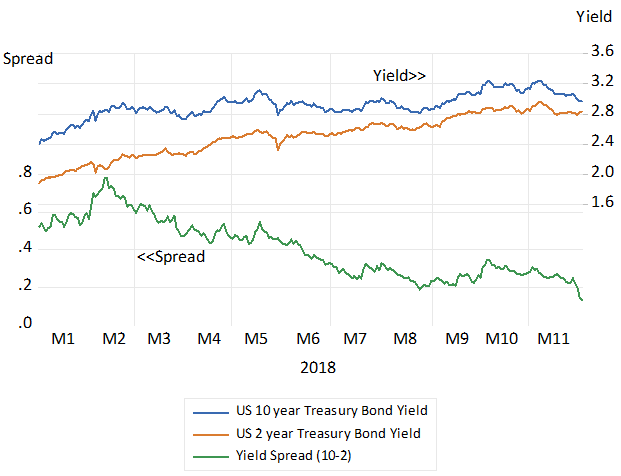

The term structure of interest rates in the US has become ever flatter over the past few months. The difference between ten-year and two-year interest rates offered by the US Treasury has narrowed sharply. Ten year loans now yield only fractionally more (0.13% p.a) than two year loans. (See figure below)

Fig.1: Interest rates in the US and the spread between ten year and two year Treasury Bond yields

Source; Bloomberg and Investec Wealth and Investmment

This difference in the cost of a short term and long term loan could easily turn negative- that is longer term interest rates falling below short rates should the Fed persist with raising its rates. Which it is unlikely to do beyond the 0.25% increase widely expected in December for term structure reasns.

The US capital market is not expecting interest rates to rise from current levels in the future. Given the opportunity to borrow or lend for shorter or longer periods at pre-determined fixed rates, the longer term rate will be the average of the short rates expected over the longer period. Lending for two years at a fixed rate must be expected to return as much as would a one year loan- renegotiated for a further year at prevailing rates. Otherwise money would move from the longer to the shorter end of the yield curve or vice versa to remove any expected benefit or cost.

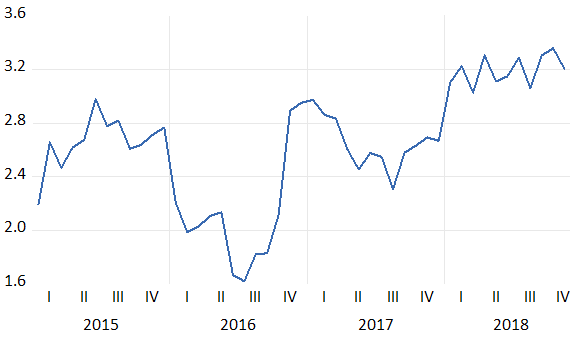

By interpolation of the US treasury yield curve, the interest rate expected to be paid or earned in the US for a one year loan in five years time, has stabilized at about 3.2% p.a. or only about 0.5% p.a more than the current one year rate. These modest expectations should be comforting to investors. They are not expectations with which the Fed can easily argue- for fear of sending interest rates lower not higher.

Fig.2; US One year rates expected in five years

The market believes that interest rates will not move much higher because market forces will not act that way. Increased demands for loans at current interest rates – are not expected to materialize. They are considered unlikely because real growth in the US is not expected to gain further momentum and is more likely to slow down from its recent peak rate of growth. Furthermore, given the outlook for real growth, inflation is unlikely to pick up momentum. For which lenders would demand upfront compensation in the form of higher yields.

The market of course might change its collective mind – redirecting the yield curve steeper or shallower. And in turn giving the Fed more or less reason to intervene helpfully. Interest rate settings should not unsettle the market place. They are very likely to be pro-cyclical

But the more important known unknown for the market will be Donald Trump and his economic relationship with the rest of the world. Perhaps Trump himself can also be helpfully constrained by the market place. The approval of the market place can surely help his re-election prospects.