The Reserve Bank on Friday 9 April reported the number of its notes circulating at the end of March. This enables us to update our Hard Number Index (HNI) of the SA Business Cycle that combines vehicle sales, also available for March 2010, with the real money base, that is the note issue deflated by the CPI.

The HNI is pointing firmly upwards, confirming very clearly that the SA economy has entered a new upswing phase in the SA business cycle (see below). Higher numbers indicate that the economy is expanding, that is, the economy is delivering positive rates of growth that will be confirmed in due course by a much wider selection of economic time series. First quarter GDP numbers for example will only be released in June 2010.

The second derivative of the business cycle, that is the rate of change of the HNI, is also in positive territory and indicates that growth is accelerating. The economy according to the HNI began to grow again in the fourth quarter of 2009, as confirmed by the National Income statistics for the quarter. It is picking up momentum.

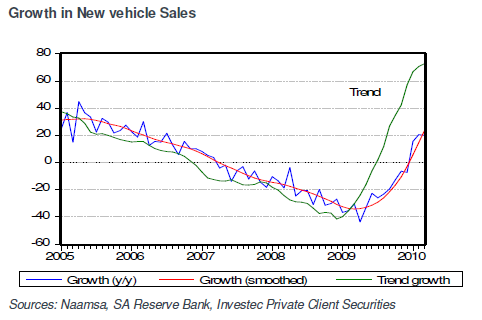

As we reported previously, the new vehicle cycle is demonstrating very strong growth. The growth trend in vehicle sales is pointing sharply higher.

The growth in the note issue picked up in March 2010. However when these numbers are adjusted for the declining trend in the CPI the real money base is indicating positive growth rates at a modest rate (see below).

It should be appreciated that the note issue will grow in line with extra demands for cash that reflect the state of the economy. It is therefore a very good coinciding indicator of the state of the economy rather than a leading indicator. Growth in the supply of cash does not lead the economy but follows it. Nor is it a policy instrument of the Reserve Bank, though we have argued it should be. However the note issue has the great advantage for economic forecasters of being a very up to date indicator of the current state of the economy. Most economic indicators provide only a rear view mirror of the state of the economy.

The HNI overcomes the problem of driving along the economic track through the rear view mirror. The index, as we have shown, tracks the official business cycle indicator of the Reserve Bank very closely. It has the advantage of being very up to date as well as being based on hard numbers – actual vehicle sales and the note issue. The release of the Reserve Bank’s Coinciding Indicator of the SA business cycle by contrast lags behind economic events by three to four months (the latest number is for December).

The HNI therefore estimates the immediate state of the economy and the current estimate leaves little doubt that the economy is in a cyclical upswing and is accelerating.