Introduction

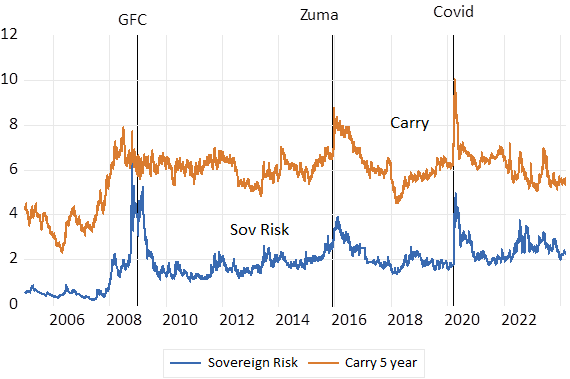

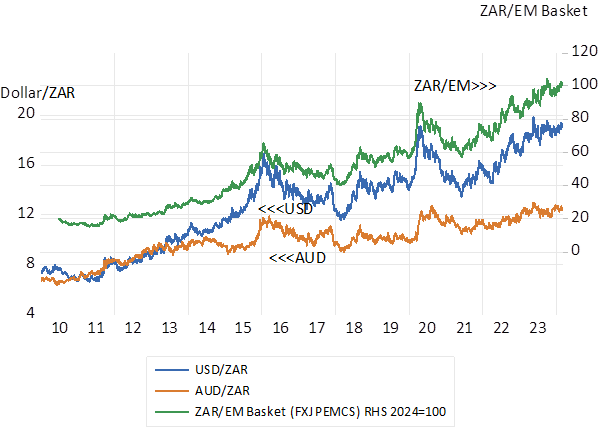

In my pre-Budget comments I had argued that SA could only hope to for SA to escape its debt and slow growth trap by ensuring that government spending and revenues grow no faster than the real economy. I asked whether the SA government would be able to grasp this nettle? Given its long term trend of rising real levels of government spending and taxing – with taxes playing a growth suffocating catch up with spending – and government debt ever increasing as a ratio to GDP and spending of interest rising to over 20% of all spending the danger is that SA will resort to its central bank for funding and the inflation, to inevitably follow, will push up interest rates that will reduce the value of long-term RSA bonds outstanding and weaken the rand. Default through inflation becomes more likely and so lenders demand compensation in the form of higher initial yields and risk spreads. That make borrowing more expensive and a debt trap ever more likely. The earlier pre budget comment is available here.

An emphatic response Spending growing at a slower rate than GDP

The short post-Budget answer is that the government has delivered a Budget that would take fiscal policy on a very different and very necessary path. For all the good reasons made very clear in the Budget Review. Almost to the point that the Treasury presents itself as an alternative and highly critical government agency. It is a top-down plan that deserves full support and for which the governments to come should be held fully accountable.

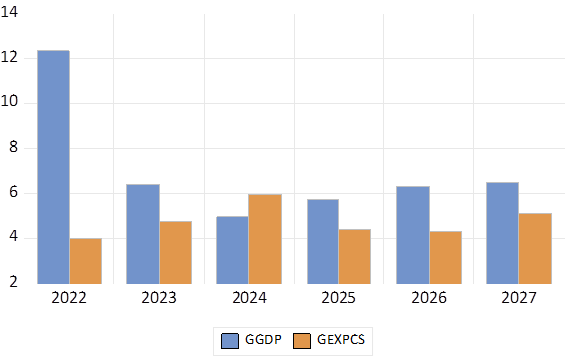

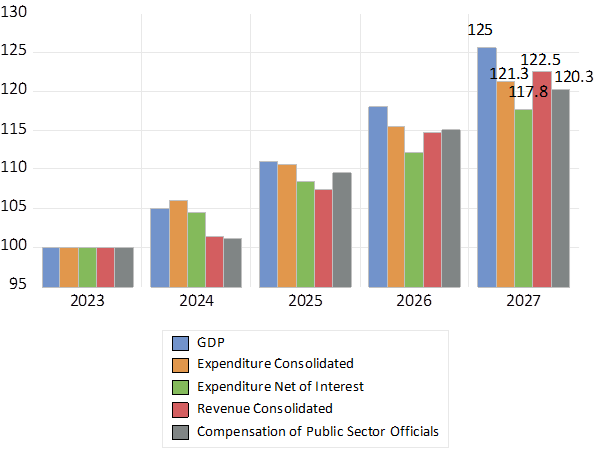

Between 2024/5 and 27/28, GDP in current prices is predicted to grow by 25% – or at an average rate of 5.9% p.a. All government spending is planned to increase by 21%, by 27/28 or an average 5% p.a. while taxes will grow faster by 24% or an average 5.2% a year over the same period. Government spending, excluding interest payments is more heavily constrained to grow at well below the growth in GDP, at a very demanding mere 4.2% a year. The payroll for the 216000 government officials employed by the central government, at an average R470000 a year, is expected to increase at 4.2% a year until 1927/28 with minimal increases in the numbers employed, and well below inflation expected.

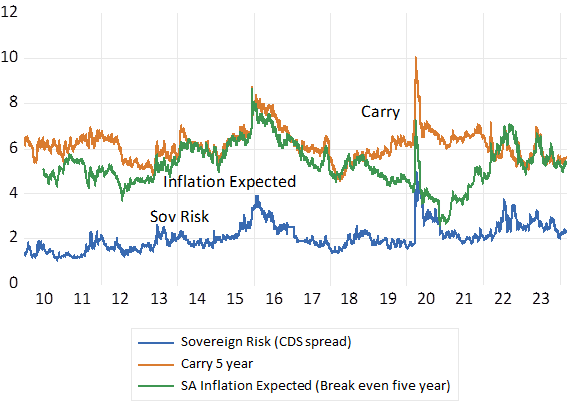

All this genuine austerity would mean reducing the real burden of government spending (exp/GDP) and to a lesser degree the real burden on taxpayers (Rev/GDP) and allow the debt to GDP ratios to stabilise and decline. Especially should these very different long-term trends impress investors in SA enough to have them supply extra capital to reduce the risk premium and the interest they demand of the RSA and to factor in less persistent weakness of the rand Vs the major currencies. As is very much the Treasury intention.

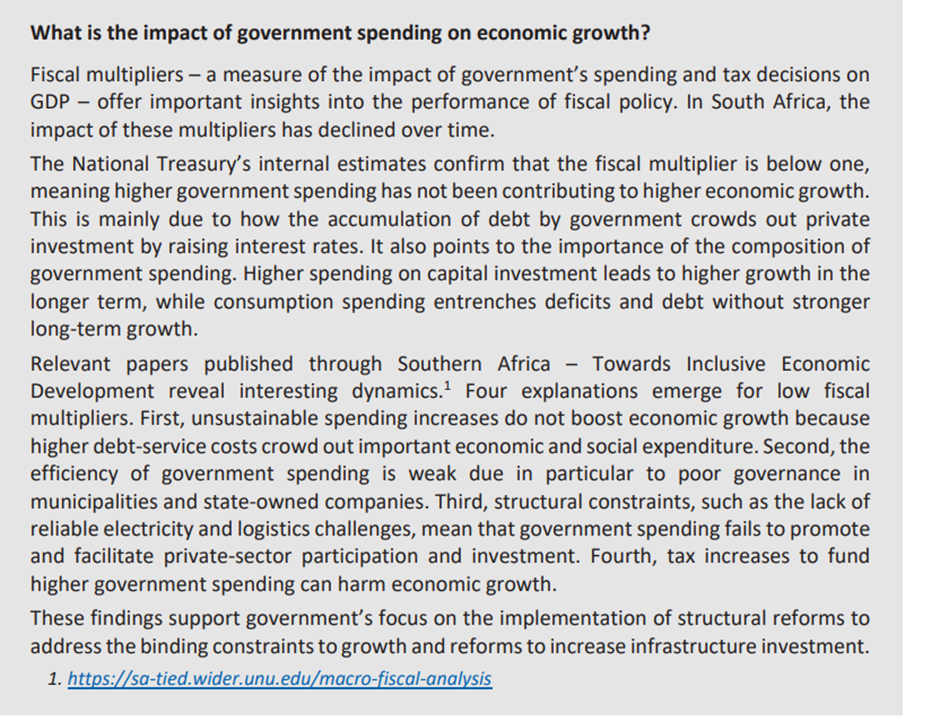

The thoughts that have moved the Treasury are well illustrated by the following extract from the Budget Review. They are enough to warm the cockles of a heart sympathetic to a market led economy. Even more warming were the intention and practice to pass the incentives to add and maintain the infrastructure to the private sector.

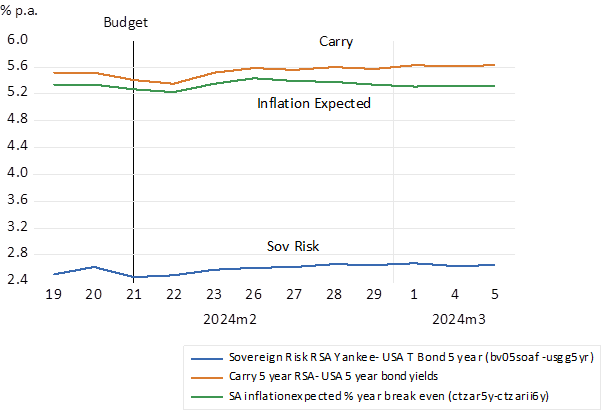

Are the plans credible? The market remains unconvinced

One could perhaps argue and judge that these austere budget plans are too ambitious and hence not credible. The Budget proposals have however not received any positive reactions in the currency or bond markets. Long term interest rates have not declined nor has the risk spreads between RSA and US Treasury Bond Yields declined. They remain at highly elevated levels. So far not so good for the SA economy.

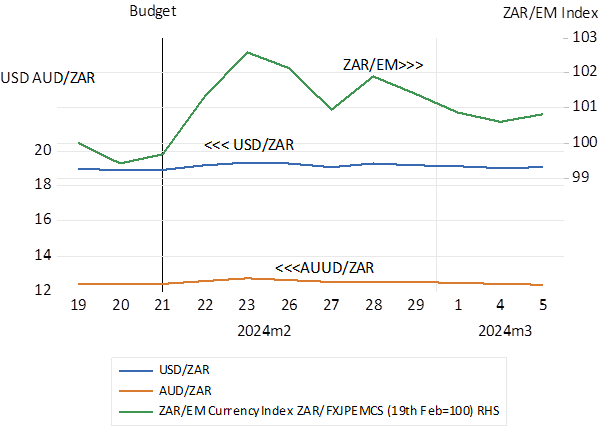

The rand has weakened marginally against the EM currency basket since the Budget. A minor degree of extra SA specific risk rather than the strong dollar is to be held responsible. (see below)

Taking of reducing the inflation targets has not been well received- for good reasons.

Perhaps the post budget suggestion by the Treasury that they would welcome a reduction in the inflation target has muddied the waters. How would lower inflation be realised without a stronger rand? A rand that could, with a more favourable view of fiscal policy, be expected to depreciate at less than the current 5.5% p.a. rate – which clearly adds to prices charged and inflation expected. Absent a stronger rand, a lower target for inflation would imply even more restrictive and growth and tax revenue defeating than current monetary policy settings. It is not something to be welcomed by investors.

The Treasury would be well advised to wait for the approval of their policy intentions as and when registered in the bond and money markets, in the form of lower interest rates and a stronger rand – before they explicitly aim at lower inflation. The Treasury may well be getting ahead of itself.