When will inflation in the US (9.1% in June) peak? My answer is about now. And the surveys of inflation and the state of the financial markets support this proposition. If month to month increases in the US CPI revert to something like the 20 year average, inflation in the US will be trending well below 7% by year end and fall back to 2% p.a. by late 2023. Bloomberg surveys conducted in July indicate in inflation in Europe- now over 8% p.a. to recede to 2% by year end. Inflation in SA, still to peak at over 7%, is expected decline to 5% by late 2023.

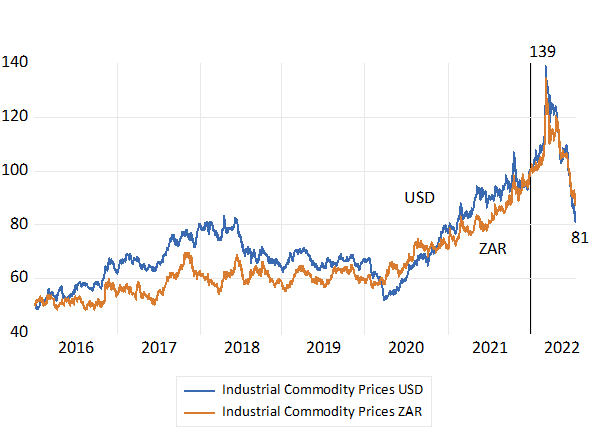

The supply side disruptions that ramped up oil, grains, shipping costs and metal prices (unfortunately for the South African economy) have abated. They are all well off their recent peaks. Industrial Commodity and Metal prices are 50% lower than their peak values of January 2022. These prices may remain at high levels, but they are no longer rising to force inflation higher.

Industrial Commodity Price Index. January 2022=100. Daily Data

Source; Bloomberg and Investec Wealth and Investment

Prices have their supply and demand causes as they have had in our post Covid, post Russian invasion world. They also have their intended effects. They have helped repress demand for goods, more than for services, in the developed world and South Africa. Inflation is properly defined as a continuous increase in the CPI. It takes more than essentially temporary supply side shocks for inflation to proceed at persistently higher levels. Inflation can only be sustained with continued stimulation of demand. Without additional demand, the higher prices perhaps planned in advance by suppliers with price setting powers, cannot be sustained. Without support from the demand side of the economy, from further injections of demand, stimulated by central banks and governments, the market-place will not t absorb higher prices. In the absence of supportive demand, prices will, perhaps only gradually, adjust lower in response to help sustain sales revenues and bottom lines.

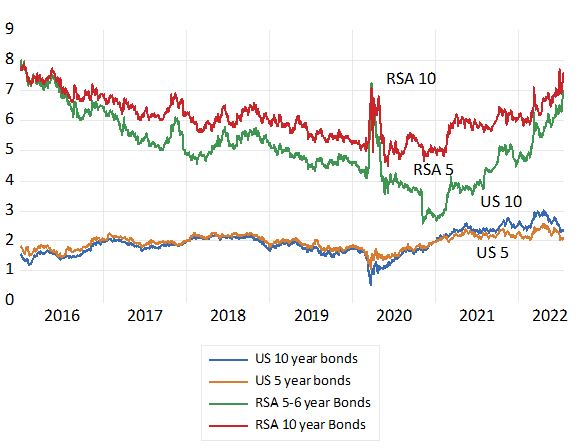

Prices are not what firms would like them to be, higher usually, but are conditioned by what their customers will bear. Expecting more inflation and setting higher prices accordingly regardless of the stae of demand cannot be a self-fulfilling prophecy. It is not consistent with economic rationality. The clear evidence from the recent surveys and the bond markets is that economic actors are not naively extrapolating recent inflation into the distant future. They are wisely seeing beyond current inflation to the longer-term demand and supply forces that will act on prices- including the role expected to be played by fiscal and monetary policy. As with the surveys, inflation expected, as priced in the market for US Treasury Bonds, so called break-even rates, have receded in the past week-despite higher realized inflation.

The US bond market expects inflation to average 2.1% p.a. over the next five years and 2.3% p.a. over the next ten years- very close to the 2% p.a. Fed target for inflation. The SA bond market is now offering still higher rewards for bearing inflation risk- despite the inflation-fighting zeal of our Reserve Bank. The money and bond markets in the US are priced for a reversal of the direction of interest rates next year, with the peak in short rates having been brought sharply forward to January 2023 at 3.25%. The SA money market predicts much higher interest rates for a much more extended period. One hopes wrongly given the absence of demand side pressures on prices and the state of the economy.

Inflation expectations revealed in the Treasury and RSA bond markets. Daily data.

Source; Bloomberg and Investec Wealth and Investment

The best reason to expect inflation to subside in the US, Europe and South Africa is that the demands for goods and many services are already well depressed, thanks to higher prices. Spending is no longer being supported by additional income subsidies or by rapid growth in the money supply and bank credit. The money supply in the US (M2) has ground to a halt. The essential question is still to be answered. Is the US and Europe heading for recession aided and abetted by central banks intent on raising interest rates too aggressively and indeed unnecessarily fighting the last war? Central banks should know better than to lead their economies into recession while inflation is moving in the right direction and their economies head in the wrong direction.