March 31st 2024

Over the past 20 years institutional fund allocators have fallen in love with high-fee paying, internally valued, and illiquid private investment strategies known as Private Equity (PE). The PE industry has evolved from a small cottage industry to a very important asset class. The PE partnerships that manage the process have gone the other way. Converting from small private partnerships to highly valued public companies. With their revenue and earnings and market value propelled by the ever-increasing inflow of assets they have captured from institutions. Supporting strategies that promise to ignore the “hated” and unavoidable volatility associated with owning listed stocks. Their founders are the new Titans of Wall Street.

These PE managers typically invest alongside their pension fund and endowment partners in the series of multiple separate funds (partnerships) they initiate and raise capital for. The largest the Blackstone Group Inc. has over $1 tr of assets under its management (AUM) and a stock-market value of $155b. Other prominent names in the category include KKR, the Carlyle Group, Apollo, Ares, Blackrock and Brookfield.

For privately owned operating companies sourcing capital from these private equity funds has clearly become an increasingly viable alternative to an initial public offering of their shares. The number of publicly listed companies traded on US exchanges has fallen dramatically from a peak in 1996 of 8,000 plus. Now only 3700 companies are listed in the US. Astonishingly there are now about five times as many private equity-backed firms in the US as there are publicly held companies according to the Wells-Fargo Bank.

Staying or going private works because the private co-owners and managers of their business operations are very likely to focus narrowly on realising a cost of capital beating return on the capital at risk, including their own capital. The controllers of the private equity funds are aware of the advantages of appropriately incentivised owner-managers. They design their contracts with the private companies they oversee accordingly. And the private companies that the funds invest in will also be encouraged to raise debt to improve returns on less equity capital.

Regular fund valuations and annual returns on the funds however are conveniently based on internal calculations of net asset value. Reporting smoother annual returns, so calculated, than provided by listed equity plays well in the annual performance reports provided to trustees of pension funds and endowments. Moreover, if returns on equity generally exceed the costs of finance over the long run, as expected, the case for leveraging returns on equity capital with more debt is a powerful one. And lenders also like smoother, predictable returns, especially when secured by the pre-commitments to subscribe funds when called. The longer the call for capital by the funds can be delayed, the higher will be the returns on the lesser equity capital invested.

A further advantage is that their private companies supplied with capital will be given time –five to up to ten years – to prove their business case – before the funds have to be liquidated. Perhaps via an initial public offering of shares (IPO) public market conditions permitting. Or a sale of assets to another PE fund. Perhaps even rolled over to a new fund raised by the same fund manager. The performance fees paid to the private equity firms themselves (perhaps 20% of the capital gain) will be realised on the final liquidation of a fund. Management fees of typically 1-1.5% p.a. on AUM will also be collected. These performance fees account for a large proportion of the fund manager’s revenue.

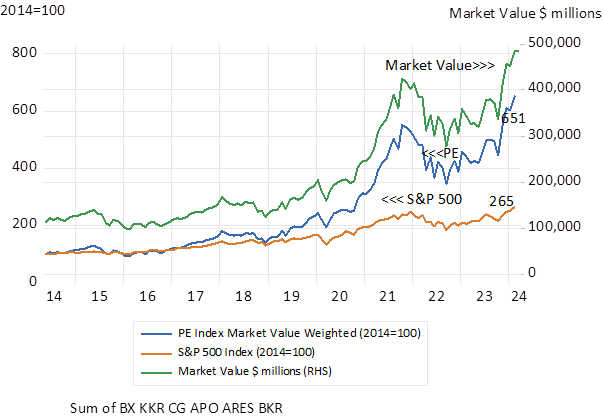

Yet paradoxically it would have been an even better idea to have become a General rather than a Limited partner in these burgeoning private equity funds. That is owning the shares of the listed private equity managers as an alternative to subscribing to one of their funds. The shares of six of the largest listed PE managers – yes volatile and market-related – have SIGNIFICANTLY outpaced the excellent performance of the S&P 500 Index itself. And PARADOXICALLY outperformed most of the funds they have managed. Taking more risk in PE investments has had its reward. (see below)

Listed Private Equity Companies; Market Cap weighted value of six large listed PE managers. (2014=100) Month End Data.

Source; Bloomberg, Investec Wealth and Investment International