We like to think that evidence changes beliefs. The problem with beliefs or rather opinions about economic life is that the economy never stands still to conduct experiments with. The management of Naspers conducted an experiment in September 2019 to reduce the huge gap between the value of the assets on its books, its Net Asset Value (NAV) or sum of its parts, mostly in the form of its enormously valuable shareholding in Tencent a fabulously successful internet company listed in Hong Kong, and the market value of its shares listed on the JSE.

The board and its management have seemingly learned a great deal from the expensive experiment – unexpectedly so surely – because restructuring its shareholding, establishing a subsidiary company in Amsterdam Prosus (PRX) to hold its Tencent shares and other offshore investments went so badly. The value gap, the difference between the NAV and Market Value(MV) of both NPN and PRX rather than narrow had widened significantly after 2019 despite or rather in small part because of the restructuring. By early June 2022 the discount for NPN (NAV- MV)/NAV)*100 was of the order of 62% and 51% for PRX

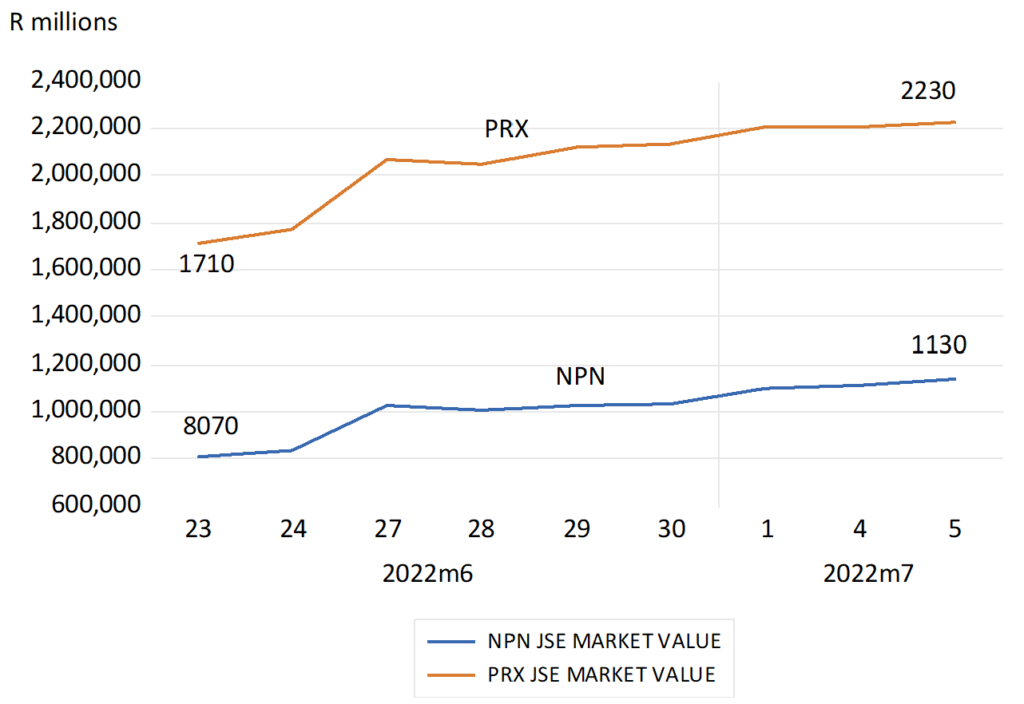

Such new awareness has been received with great appreciation and delight of its shareholders these past few weeks. As a result of its change of mind, in the form of a mea-culpa about past actions and the much more tangible decision to sell as much as 2% a year of its holding in Tencent shares, worth potentially USD 10 billion a year, and to return the cash realized to shareholders buying back its shares. Since the announcement of June 23rd, shareholders in NPN have seen their shares appreciate by 34% adding 323 billion rands to its market value by July 5th while shares in the associate company Prosus (PRX) are up by 26% worth a extra R520 billion rand and the discount has substantially narrowed to the 30% range for PRX and 40% for NPN. A further decision to include success in narrowing the value gap as a key management performance indicator was also helpful. All achieved in days while the JSE has moved sideways.

Daily share price moves and the JSE All Share Index June 23rd – July 5th (June 23rd=100)

Source; Bloomberg and Investec Wealth and Investment

Market Value; Naspers and Prosus, Rand millions

Source; Bloomberg and Investec Wealth and Investment

Naspers and the Value Gap 2010 – 2019 Month end data.

Source; Bloomberg and Investec Wealth and Investment

The Naspers board had been of the view that it was the South African and JSE connections, higher SA risk premiums and a limited shareholding opportunity in SA, where NPN featured so largely, stood in the way of their receiving proper recognition for their vigorous efforts in diversifying their balance sheets. Hence the restructuring. My opinion, long shared with whoever might read or listen to them,[1] was that the difference between the market value of the sum of parts of any investment holding company and its share market value including NPN and PRX could be largely attributed to three factors. And that where a company was domiciled or listed would be of minor consequence.

Firstly that the reported value of unlisted subsidiary companies could be over-estimated to exaggerate NAV. Secondly that the estimated future costs of maintain a head office, including the employment benefits (including share options and issues) expected to be realized to senior management would be present valued to reduce the market value of the holding company shares. Managers can prove very expensive stakeholders.

And thirdly and most importantly would be the investors or potential investors estimate of the present value of the investment programme of the holding company. They might well judge and expect that the future value of the investments and acquisitions to be made by the Holding Company will be worth less, perhaps much less, than they will cost shareholders in cash or returns foregone. And the more investments undertaken the more value destruction and the lower the value of the shares in the holding company priced lower to promise a market related return for shareholders. If such were the market view the less cash invested, the more returned to shareholders by way of dividends, share buy backs or via the unbundling of mature investments, the more value created for shareholders. Naspers/Prosus is helping to prove my theory.

[1] Follow for examples these BD links https://www.businesslive.co.za/bd/companies/2020-09-14-watch-is-nasperss-management-destroying-its-value/