In our recent asset allocation overview we had made the case for overweight equities. However our ranking order, based on our valuation exercises, indicated a preference for developed markets (represented by the S&P 500) over emerging markets generally (represented by the MSCI EM Index) over the JSE All Share Index.

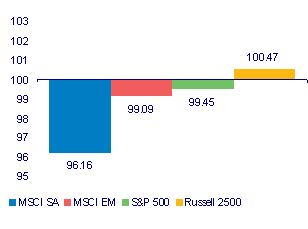

The indexes this year have behaved very much in line with our ranking order. We compare the performance of the respective Indexes this year in USD below. As may be seen the S&P was the out performer and the JSE the distinct underperformer in January 2011.

Continue reading the full Daily View here: Daily View, 1 February 2011 – The rand: What a growing global economy can do