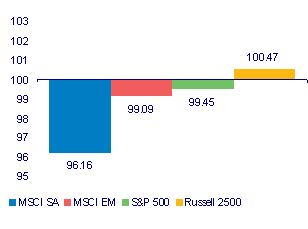

The likely fall of an Egyptian Pharaoh, after a very long reign, added uncertainty to global markets last week. Exposure to equities was reduced and share markets retreated with most of the weakness experienced on the Friday. A weaker rand made the JSE an underperforming Emerging Market in USD. The weak rand furthermore did not spare the Resource stocks that are regarded as riskier than most. (See below)

Global Equity markets Weekly USD returns; January 23rd= 100

JSE Weekly Rand returns; January 23rd= 100

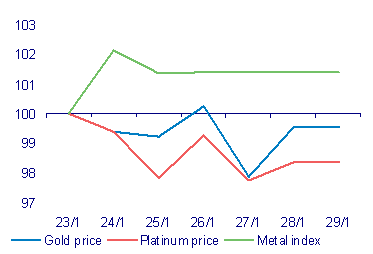

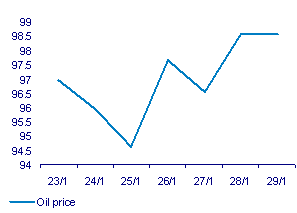

Underlying metal prices ended the week barely changed with industrial metals holding up better than the precious metals though consistently with troubles in the Middle East the Oil Price had added a few per cent by the week end. Sasol surprisingly perhaps did not benefit from a weaker rand and a higher Oil Price in USD starting the week at R365.60 and ending it at R349. A weaker equity market took Sasol down with it despite favourable firm specifics.

Metal Prices; January 23rd=100

Oil Price; USD January 23rd=100

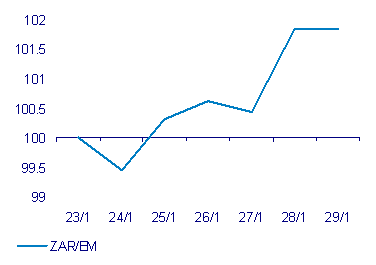

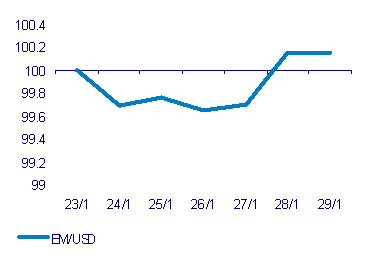

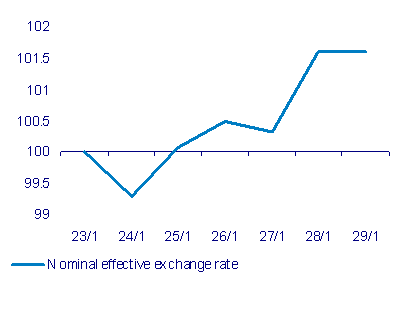

The rand however was under marginally more pressure than the average Emerging Market Currency- continuing a trend that had begun two weeks before. By our own calculations the rand lost about 2% of its exchange value against the average EM currency that was barely unchanged against the USD by week end. (See below) The ZAR also lost slightly less than 2% of its trade weighted basis last week.

ZAR Vs EM Basket; January 23rd=100

EM VS USD; January 23rd=100

ZAR; Trade weighted exchange value January 23rd=100

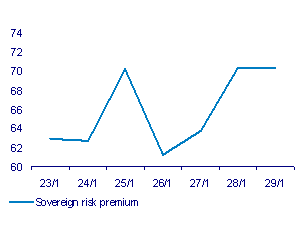

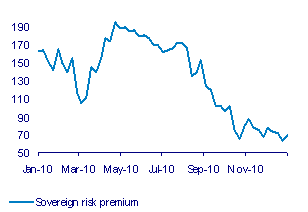

While the market in rand bonds has weakened in response to foreign selling SA sovereign debt has retained its exceptional standing in global debt markets. The SA sovereign risk premium measured as the difference in SA government USD denominated debt and its US Treasury counterparts had risen only marginally by last week end. (See below)

RSA Sovereign Risk Premium; January 23rd- January 28th 2011

RSA Sovereign Risk Premium; January 2010 – January 2011

The SA authorities, judged by comments from the Minister of Finance on the week end, would seem to prefer a weaker to a stronger rand. The increase in the petrol price this week will remind them that low inflation and weaker rand are entirely inconsistent objectives.

We would argue that a strong rand is to be preferred- it brings low inflation, low interest rates and strength in consumer spending essential if the SA economy is to realise its growth potential.

The rand is however beyond the direct control of the SA authorities as they have recognised. We think it will continue to take its cue mostly from the state of the global economy as reflected in Emerging Equity Markets and Commodity markets. It was a marginally down week for emerging equities, equities generally and the ZAR. It was a better week for commodities. The events in the Middle East do contribute to global risks but their influence so far on the outlook for the global economy has been muted and we would suggest will remain so.