The money market has raised the probability of an early increase in short term interest rates (in three months’ time) following the meeting of the Reserve Bank’s Monetary Policy Committee (MPC) on Thursday that maintained the repo rate at 5.5%. The short term three month Forward Rate Agreement curve (FRA) of the banks moved higher by between 10 and 30bps across the range of forward rates beyond the next three months late last week.

Interest rates expected over the longer term, beyond four years, have remained unaffected. The zero coupon yield curve implies that the one year government bond rate, currently around 6% per annum, will rise consistently to a level of about 9% in four years’ time and then stabilise at this level.

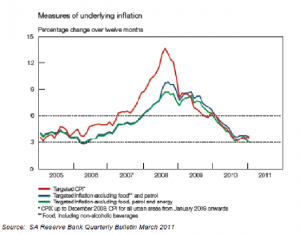

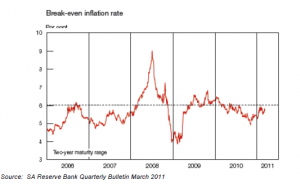

These expectations remain consistent with inflation compensation priced into the bond market in the form of the yield gap between conventional RSA bond yields and their inflation linked alternatives. This gap remains consistently above 6% regardless of the rate of inflation.

Our own interpretation of the MPC statement and the press conference is that the Governor and the MPC would be extremely reluctant to take any interest rate action before the economy has regained its potential growth, which it is still some way from attaining. However further increases in fuel and food prices and the headline inflation rate might force them in this direction for fear of second round effects on inflation itself. In other words, more inflation expected would lead in turn to still more inflation.

We have found comprehensive evidence that inflation in SA does to a small degree influence inflation expected, as measured for the Reserve Bank by surveys conducted by the Stellenbosch Bureau of Economic Research for business, trade unions and financial institutions. However, the reverse has not been true, although the Reserve Bank seems to believe otherwise.

Moreover it is clearly concerned to preserve its inflation fighting credentials even if this should mean having to raise rates. This is so even when it is clear that the inflation it is attacking is not under its control and when higher interest rates might lead to slower growth and a wider gap between actual and potential output and employment. The striking feature of inflation expectations in SA is just how stable they have been and how they remain above the inflation target band of 3% to 6%.

As we indicated in our first reactions to the MPC statement, the outlook for interest rates in SA will depend primarily (and unfortunately) on the rand price of oil and the continued upward direction of administered prices and not on the state of the economy that might be intolerant of higher interest rates. There should be a better way of running monetary policy in SA with more sensitivity to the state of the domestic economy and with the media and the financial markets well able to understand that a shock to the inflation rate does not imply permanently higher inflation. Keeping interest rates on hold in such circumstances when demand pressures are subdued does not mean being soft on inflation. This better way is indicated by the inflation targeting mandate itself, which does not demand adherence to inflation targets regardless of the causes of inflation and the consequences of higher interest rates for the economy, as is indicated explicitly and clearly in Paragraph 4 of the Mandate.

The rand has however weakened in recent days despite an earlier expected increase in interest rates. This again confirms that the influence of movements in interest rates on the value of the rand is not easily predicted. As we show below the rand lost about 4% of its trade weighted value last week.

Perhaps the market is being influenced to a degree by the unknown outcomes of the municipal elections in SA on Wednesday, which have become a test of the national government and its competence to govern. A small additional protest vote would probably be welcome as an incentive for the government to improve its delivery. An unexpectedly large vote for the opposition might be regarded as a serious longer term threat to the powers that be, and would perhaps have unpredictable outcomes for the ruling party, its leadership and its policies. As we know markets do not appreciate uncertainty.

To view the graphs and tables referred to in the article, see Daily Ideas in todays Daily View: Daily View 16 May: After the MPC: Interest rate expectations and the rand