The February 2011 reports on new unit vehicle sales and the Reserve Bank note issue have been released and we are able to update our Hard Number Index (HNI) of the current state of the SA economy. As may be seen below, the economy continued to pick up momentum in February 2011.

The very up to date HNI is proving a reliable leading indicator of both the Coinciding Business Cycle Indicator of the Reserve Bank (updated to November 2010) and the Reserve Bank Leading Indicator of the SA Business cycle (updated to December 2010).

Continue reading Hard Number Index: Maintaining speed

Author: Brian Kantor

Vehicle sales: Why a strong rand is good

It was another big month for unit vehicle sales in February. On a seasonally adjusted basis sales were ahead of the January numbers, which in turn were well up on December.

Year on year growth in unit sales has remained in the plus 20% range. However the quarter to quarter growth rates, which are not dependent on base effects, have surged ahead and are now running well above a 40% per annum rate.

Continue reading Vehicle sales: Why a strong rand is good

Currency markets: Explaining the weak US dollar and the strong rand

Recent trends in the currency markets following the spike in the oil price raise two questions: why has the US dollar weakened and why has the rand strengthened? It should be recognised that the rand has gained not only against the weaker US dollar but also against the crosses, including the Aussie dollar. In the figure below we show the trade weighted value of the rand and the oil price in US dollars based to 1 February 1 2011. The oil price is up about 13% while the trade weighted rand had gained nearly 3% since the oil price spiked in mid month.

The full version of this article can be found in the Daily View here: Currency markets: Explaining the weak US dollar and the strong rand

Money and credit: Sill growing too slowly for GDP and employment growth

The money and credit statistics released by the Reserve Bank yesterday indicate that while the money supply (broadly measured as M3) is maintaining a satisfactory rate of growth of around 7% per annum on a quarter to quarter basis, credit extended by the banks to the private sector has remained largely unchanged over the past quarter. Not coincidentally, the price of the average home in SA is also largely unchanged over the past year.

It will take an increase in mortgage credit to lift house prices, while it will take an improved housing market to encourage the banks to lend more and for property developers to wish to borrow more. The trends in money and credit supply indicate that short term interest rates are still too high rather than too low to assist the economy to realise its potential output growth. And so policy set interest rates are unlikely to increase any time soon.

The lower level of mortgage interest rates and a significantly lower debt service ratio for the average SA household (See below) still have work to do to revive the housing market and construction activity linked to higher house prices. Perhaps the authorities, now so concerned with employment growth in SA and intending to subsidise employment with tax concessions, should be reminded that house building and renovations are highly labour intensive.

For graphs and tables, read the full Daily View here: Money and credit: Sill growing too slowly for GDP and employment growth

Presentation on the SA economy and the markets after the budget

Attached is a presentation on the 2011 National Budget for South Africa: The economy and the markets after the budget

2011-2012 Budget: Getting value for government money

The first impression one has of the Budget proposals is just how strongly government revenues have grown over the past fiscal year, something around 13%. Also, how strongly tax revenues (not tax rates) are expected to increase over the next few years. At around a 10% per annum rate, or in real terms by about 5%, government expenditure is planned to grow at around an 8% rate or around equivalent to a 3% rate in expected inflation adjusted terms.

Read the full story in the Daily View here: 2011-2012 Budget: Getting value for government money

Earnings: Growth is accelerating – perhaps faster than expected

The much anticipated recovery in JSE earnings off a global financial crisis depressed base is now well under way. The results reported by Anglo and BHP Billiton (with a combined ALSI weight of about 24.7%) have contributed meaningfully to the reported growth rates. As we show below, ALSI earnings per share are now 36% higher than a year ago while in real CPI deflated terms the growth is 32% and in US dollars an even more impressive 46% higher than February 2010.

Continue reading Earnings: Growth is accelerating – perhaps faster than expected

SA economy: Moving in step

We have made the point recently that the companies listed on JSE, have become increasingly exposed to the state of the global rather than the SA economy. Hence the close links between JSE earnings (and performance) in US dollars and emerging markets earnings.

The rand: A hopeful portend of better markets to come?

Last week was a better one for the rand. After an extended period of rand weakness that began at the turn of the year, the rand, on a trade weighted basis held its own.

Accordingly the JSE proved to be one of the better emerging equity markets last week (measured in US dollars) though emerging markets again lagged behind the S&P 500 – a trend that has persisted since the beginning of the year. Until the year end the JSE had been an outperforming emerging market during a period when emerging markets had outperformed the S&P 500.

Continue reading The rand: A hopeful portend of better markets to come?

Employment: A call for economic realism, not wishful thinking

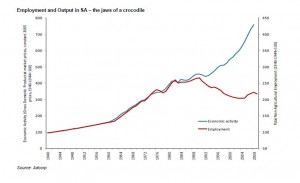

The employment problem in SA has become a major focus of government action. Employment in the formal sector, that is with employers who provide medical and pension benefits and collect PAYE , has lagged well behind GDP growth since the mid 1990s.

Furthermore real remuneration per worker since then has increased significantly over the same period. The two figures below, provided by Adcorp, tell the full story of much better jobs for far fewer workers. The SA economy, or at least the formal part of it, has become much less labour intensive, and much more capital and skilled labour intensive. Decent jobs, but only for the fortunate few, is the SA reality.

The less fortunate or less well endowed with skills get by finding work outside the recorded regulated sector and depend increasingly on welfare grants. Immigrants, of whose large numbers we are uninformed about, without cash grants support from the SA government (i.e. the taxpayer) seem to find work easily enough, though no doubt at highly competitive wages.

Click figures to see full size

Continue reading Employment: A call for economic realism, not wishful thinking

Rand and the economy: Why a strong rand is good for SA business

The notion that the strong rand makes life tough for SA mining enterprises is belied by the earnings now being reported by the mining companies. Anglo Plats just reported headline earnings per share of 1 935c in 2010, up from 289c in 2009, an increase of 570%. The higher US dollar price of platinum metals clearly more than made up for what a stronger rand took away.

Continue reading Rand and the economy: Why a strong rand is good for SA business

The Hard Number Index: Recovery remains well on course

The Reserve Bank announced its note issue for January this morning. This enables us to complete our Hard Number Index (HNI) of the immediate state of the SA economy. Our HNI combines unit vehicle sales with the note issue (adjusted for inflation in equal weights) to provide a very up to date indicator. We compare trends in the HNI with the Reserve Bank coinciding indicator of the state of the business cycle, although this has only been updated to October 2010. Three months can be a very long time in economic life. Continue reading The Hard Number Index: Recovery remains well on course

New vehicle sales: A bright start to the year

The first bit of news about the SA economy in 2011 has been released by NAAMSA in the form of new vehicle sales in January. 45 135 new units were sold in January 2011, up from 39 504 in December 2010. But this does not tell the full story of very robust sales. January and December are usually well below par months for selling new vehicles. Holiday makers are more likely to buying Christmas presents for others than new toys for themselves.

On a seasonally adjusted basis new vehicle sales were up from 45 404 units in December to 45 758 units in January, an increase of 7.4%. This followed a very strong November. If these trends are sustained, sales in 2011 will approximate 585 000 units, up 18% from the 494 340 units sold in 2010. Continue reading New vehicle sales: A bright start to the year

Value for money and value add at the GSB Cape Town

Our readers may not have noticed but the Financial Times ranking of Business Schools around the world was published yesterday. The top schools as estimated by the schools themselves and by the opinions of their alumni were jointly the London Business School and the Wharton School at the University of Pennsylvania. Third was Harvard and joint fourth, Insead and Stanford Business School.

In 60th place up from 89 in 2010 was the GSB at the University of Cape Town. It is the only business school in Africa that is ranked in the FT top 100. Most interestingly the Cape Town GSB ranked first in the Value for Money Category. This has a low three per cent weight in the overall score and so could not have made a great difference to the ranking order. Much more important for the ranking Measure are the categories Weighted Salary with a 20% weight (the average alumnus salary today with adjustment for salary variations between industry sectors. Includes data for the current year and the one or two preceding years where available) and the Salary Percentage Increase with another 20% weight (The percentage increase in average alumnus salary from before the MBA to today as a percentage of the pre-MBA salary). Continue reading Value for money and value add at the GSB Cape Town

In 60th place up from 89 in 2010 was the GSB at the University of Cape Town. It is the only business school in Africa that is ranked in the FT top 100. Most interestingly the Cape Town GSB ranked first in the Value for Money Category. This has a low three per cent weight in the overall score and so could not have made a great difference to the ranking order. Much more important for the ranking Measure are the categories Weighted Salary with a 20% weight (the average alumnus salary today with adjustment for salary variations between industry sectors. Includes data for the current year and the one or two preceding years where available) and the Salary Percentage Increase with another 20% weight (The percentage increase in average alumnus salary from before the MBA to today as a percentage of the pre-MBA salary). Continue reading Value for money and value add at the GSB Cape Town

The rand: What a growing global economy can do

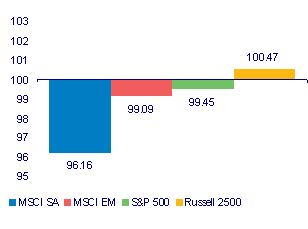

In our recent asset allocation overview we had made the case for overweight equities. However our ranking order, based on our valuation exercises, indicated a preference for developed markets (represented by the S&P 500) over emerging markets generally (represented by the MSCI EM Index) over the JSE All Share Index.

The indexes this year have behaved very much in line with our ranking order. We compare the performance of the respective Indexes this year in USD below. As may be seen the S&P was the out performer and the JSE the distinct underperformer in January 2011.

Continue reading the full Daily View here: Daily View, 1 February 2011 – The rand: What a growing global economy can do

Lessons from the Global Financial Crisis

The worldwide financial markets and the global economy have suffered from a financial crisis on a scale not experienced since the 1930s. But the crisis now appears to be over. Credit spreads have returned to more normal levels, activity in credit markets has recovered strongly, and the volatility of day-to-day movements in share prices has declined. Moreover, the recovery of the global economy, of which the U.S. is such an important part, now appears strong enough to suggest that the recession of 2008-9 may turn out to have been a mild one of short duration. The IMF is forecasting global growth of 4% in 2011 after recording a marginal decline of about 1% in 2009, and thus the global financial crisis does not appear to have led to an economic crisis.

Click to read the full article: Lessons from the Global Financial Crisis (Or Why Capital Structure Is Too Important to Be Left to Regulation)

76JEBQJN5MTY

The global forces that drive SA’s Financial markets from day to day

Turbulence on the Nile – ripples elsewhere

The likely fall of an Egyptian Pharaoh, after a very long reign, added uncertainty to global markets last week. Exposure to equities was reduced and share markets retreated with most of the weakness experienced on the Friday. A weaker rand made the JSE an underperforming Emerging Market in USD. The weak rand furthermore did not spare the Resource stocks that are regarded as riskier than most. (See below)

Global Equity markets Weekly USD returns; January 23rd= 100

JSE Weekly Rand returns; January 23rd= 100

Earnings: The trend is your friend – but which trend?

Continue reading today’s Daily View here: Daily View 26 January 2011

The building cycle: When a plan comes together

There are increasing signs that the global economic recovery is building momentum, and is very strong in many instances. We saw this last week with Chinese GDP numbers for the fourth quarter, which grew at an annualised 12.7%. But even in the developed world the signs are looking promising, with good business activity survey numbers out of Japan and Germany, and a promising set of jobless claims numbers out of the US last week.

Continue reading the Daily View here: Daily View 24 January 2011