The prospect of being hanged is said to concentrate the mind. Clearly the European leaders were concentrated very hard over the weekend to find a clear way out of the European debt and banking crisis. Also on hand were the leaders of the IMF and ECB. Full details of the plan to revive the credit of European governments and the banks threatened by the possibility of default will be released on Wednesday. But so far so good as far as the equity and bond markets are concerned. Investors understandably have great difficulty in valuing assets given a small probability of a catastrophic event (particularly when nothing like it has ever occurred), such as the failure of the euro experiment and all the financial commitments and contracts associated with the Euro. The markets before and after a fateful weekend in Brussels appear to have reduced the likelihood of catastrophe.

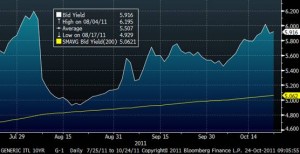

As we show below, some of the upward pressure on the yields of Spanish and Italian bonds has been relieved. When the market is convinced that 6% in euros from the Italian government is a good deal the crisis will be over and the Italians and Spanish governments can then come up with credible long term plans to further reduce their costs of finance.

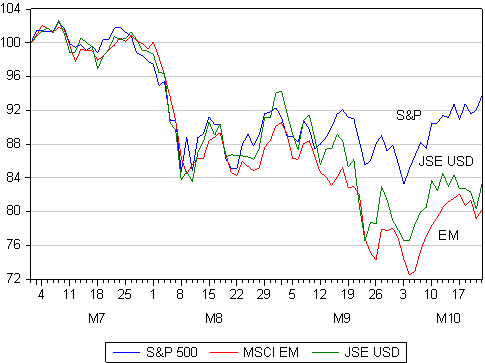

The equity markets are well off their recent lows, with the S&P 500 leading the pack and up 10.6% off its recent low of 3 October. The JSE in US dollars (despite a weaker rand), has gained 7.8% since 3 October and the MSCI EM is up 8.8% from its low of 4 October.

The very much revised plans (from July 2011) to avoid disaster appear to have a few essential elements. Firstly a much larger write down of Greek debt (from a 30% write down to something more than 50%) appears to be in the wings. The banks suffering these losses therefore will need significant infusions of fresh capital. Clearly European governments – especially governments with fiscal strength – will be an important source for additional capital. However shareholders and sovereign wealth funds will also be called upon; though to what degree and will have to be revealed.

The market in all other vulnerable European government debt will be encouraged by the utilisation of the European Stability Fund. How best to leverage this fund of €440bn has been the subject of particularly intense debate between the French and the Germans. The French have been calling for what in broad terms would amount to unconstrained support (by European taxpayers in one way or another including interventions by the ECB) for all euro denominated European government debt. The Germans, while emotionally strongly committed to the symbolism of the euro have been reluctant to sign a blank cheque.

According to the Online addition of the Wall Street Journal this morning (24 October 2011):

Options for the fund, the European Financial Stability Facility, were narrowed to two after a meeting of euro-zone finance ministers Friday. One is an insurance plan that foresees the fund’s setting aside a pool of money that could be used to offset part of any losses suffered by purchasers of the debt of weak countries, such as Italy. That could entice buyers and keep Italy financed.

The other would be to create a special, separate fund. That fund would raise money from private investors and others, like sovereign-wealth funds, to buy debt of weak countries. The EFSF would also participate in the fund—but would suffer the first losses. Officials said the two options could be combined.

Meanwhile, in other parts of the world …

The markets woke up today on their good side following a strong close in New York. However not all the good news may have emanated from Brussels. It seems very clear now that the US economy grew satisfactorily in the third quarter with the initial growth estimate, to be released, expected to be at about a 3% rate. The US third quarter earnings updates are by now well in hand and the results appear highly satisfactory, with earnings per share estimates for calendar 2011 in the process of being revised upwards again to above $100 per share. According to the FT, reported third quarter earnings from US companies have been ‘remarkably upbeat’. The FT, quoting S&P Capital expects a “blended average of actual and forecast earnings for the S&P 500 to rise 14.6 per cent for the quarter from a year ago…That figure is up from 12.4 per cent a week ago but below the mid July estimate of 16.94 per cent..”

The outlook for the Chinese economy also appeared to have improved over the weekend with official statements indicating no need for additional stimulus or any change in the policy tack. Should the market decide that a solution for the European debt and banking crisis has been found (even as the outlook for minimal European growth remains largely unchanged) the focus of market concerns will revert to the outlook for Chinese and Emerging market growth, helped or hindered (as the case may be) by the outlook for US growth. Brian Kantor