The volume of retail sales in August 2011, reported yesterday, was over 7% ahead of August a year before. This would seem to represent quite robust real growth in the top lines of SA retailers. However a year is a long time in economic life and especially in the retail business for making sales comparisons. Even a week and especially a week around Easter or more so Christmas when sales are highly concentrated may prove to be a very anxious and long period to wait for reports from the tills.

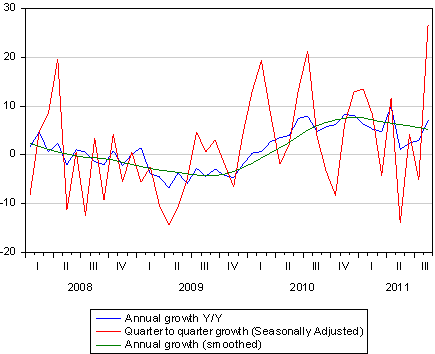

In the figure below we show annual and smoothed annual growth in retail sales volumes. As may be seen, these trends appear to be pointing lower. However when we seasonally adjust sales on a moving three month period these quarterly growth rates spiked significantly higher in August – providing a much more encouraging signal about sales growth.

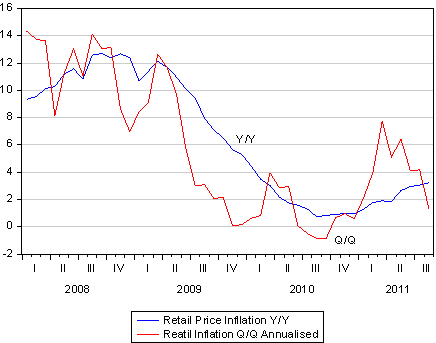

This growth in sales may well have been assisted by a low rate of retail inflation. Retail prices are 3.25% higher than a year before while on a seasonally adjusted basis retail prices have risen by only 1.33% over the past three months. The annual rate of retail price inflation has ticked up while the quarter to quarter rate has slowed down.

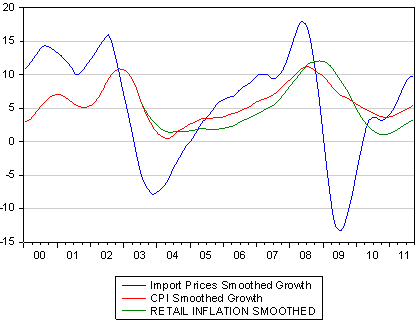

We show below that retail prices have been rising at a significantly slower rate than prices in general, the inflation of which has been much augmented by higher administered prices, that are taxes on consumers by another name. In a real sense these price trends have made retailers more competitive for the household budgets strained by higher charges for electricity and petrol.

However as we also show prices in general, including at retail level, follow the trends in the prices of imported goods. Imported goods represent the cutting edge of competition in SA and so the prices of imports lead prices lower and higher as the exchange rate strengthens or weakens. The state of global supply and demand is also reflected in the US dollar prices paid for imported goods. Lately the rand has weakened as have commodity prices on expectations of slower global growth.

The net effect has been a rising trend in the prices of imported goods that may not reverse until the rand recovers some of its lost ground. The outlook for inflation in SA has deteriorated accordingly but it is not an inflation rate that the SA Reserve Bank or higher interest rates can have any influence over. The case for higher interest rates can only be made when the upward pressure on prices emanates from excess domestic spending rather than temporarily higher prices driven by a weaker rand.

Despite a satisfactory state of demand at retail level, the SA economy deserves encouragement rather than discouragement from monetary policy settings. It would appear that the Reserve Bank remains of this mind, despite the usual genuflection to the inflationary dangers of inflationary expectations (for which there is simply no SA evidence).

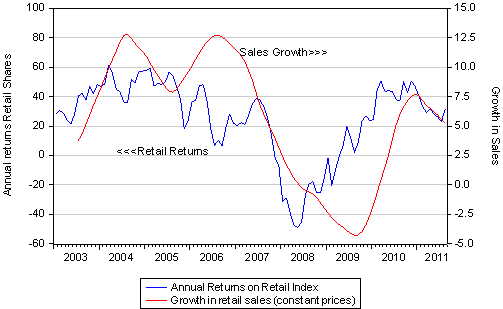

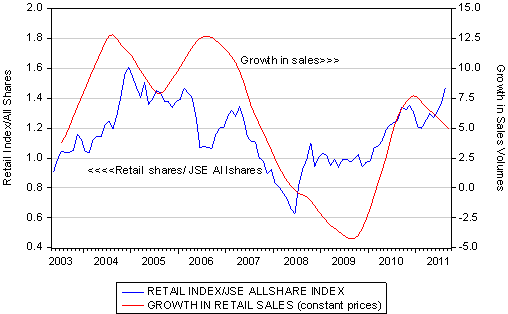

A further source of encouragement for the view that retail sales are growing consistently well is the performance of the SA retailers on the JSE. As we show below the returns on the JSE General Retail Index have provided a very good leading indicator of retail sales volumes. Returns have picked up recently, as may be seen below. As may also be seen, such positive signals of retail sales volumes and the earnings to follow are provided by the outperformance of retail shares. Retailers have been doing significantly better than the JSE as a whole. Thus the prices attached to the shares of retailers (especially relative to share prices in general) may tell us more about the state of retailing in South Africa, and in a much more up to date way, than the retail sales statistics themselves.