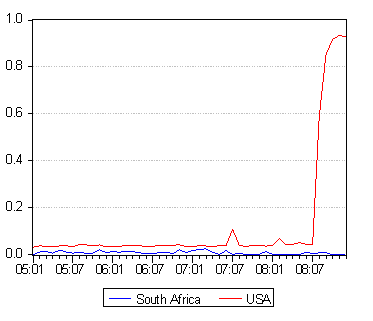

Investors will be well aware of the extremely wide daily moves on the JSE and other equity markets, such as the benchmark S&P. We show such daily moves below. It may be seen how volatile the markets became during the height of the credit market crisis in September 2008 and have become only partially less volatile since then.

Daily percentage moves in the S&P 500 and the JSE

Source: I-Net Bridge and Investec Securities

The average moves can only tell part of the story, especially when the movements higher are cancelled by falls in the market. It is the movements about this average that tell us about the extremely volatile conditions with which investors have had to cope recently. Movements about the average are captured by the statistic known as the standard deviation (SD) of a series about its average.

Measuring volatility

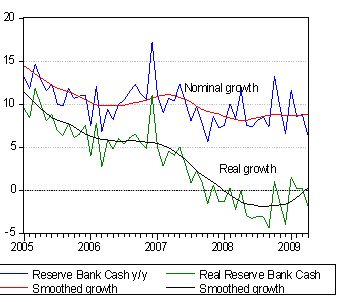

Between June 2005 and June 2008 the SD of the S&P 500 Index was less than one per cent per day on average, (0.08011 per day) to be exact. The SD of the JSE ALSI moved on average by 1.1% per day over the same period. Since then the SD of daily moves on the S&P 500 have more than doubled to 2.5% per day on average while the SD of the average daily move on the JSE have almost doubled to 2.1%.

In the figure below we show the volatility of the S&P, the JSE and the MSCI Emerging Market Index since 2005. We measure volatility as the 30-day moving average of the Standard Deviation of the Index. As may be seen the volatility on the different markets are highly correlated indicating just how well integrated global financial markets are. There are no places to hide in equity markets.

It should also be noticed that volatility has receded sharply from the extreme levels of September 2008. Volatility picked up again in January 2009 only to recede again in March. While now significantly lower than it was, volatility is still well above what might be regarded as normal levels, as may be seen below.

Global equity market volatilities

Source: I-Net Bridge and Investec Securities

Risks and returns – economic theory vindicated

Clearly the more volatile the markets the more risks faced by investors for which they will seek compensation in the form of higher returns. And so as we show below, as the risks increased dramatically so the markets fell away equally dramatically. The recent recovery in the ALSI and all the other equity markets – from their lows of early March – have clearly been associated with less risk. We show below the relationship between the JSE ALSI and the 30-day moving average of the standard deviation of its daily returns. The reduction in volatility has been very helpful for the market. Indeed, without the company of consistently lower volatility it is difficult to predict further consistent advances in the equity markets.

The JSE and its volatility

Source: I-Net Bridge and Investec Securities

Implicit and actual volatility compared

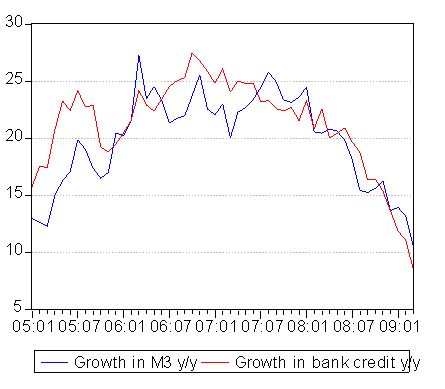

Another method for measuring volatility is to calculate the volatilities implied in the prices of options bought and sold on the equity market. In Chicago such an index known as the Vix is actively traded – so that volatility itself can be bought and sold. A similar measure of implied volatility is calculated for the JSE and published as the Savi. These measures may be regarded as forward looking measures of expected volatility, and can be compared to the actual volatility registered by the standard deviation of recent daily moves in the Index. As we show below these two measures of expected volatility that influence today’s share prices are also highly correlated, providing further evidence of the integration of global equity markets.

Implied equity market volatility – the Vix and the Savi

Source: I-Net Bridge and Investec Securities

In this case past performance of volatility does seem to be a very good guide to expected volatility. The 30-day moving average of the SD of the daily moves on the S&P 500 and the JSE Alsi tell very much the same story about volatility as we show below.

Volatility compared – SD of daily returns Vs the Savi

Source: I-Net Bridge and Investec Securities

Explaining volatility

Clearly returns and risk as measured by actual or implied volatility will move in consistently opposite directions as economic theory would predict. Higher returns after all are the expected rewards for bearing higher expected risks.

The cause of the surge in volatility in mid 2008 is obvious enough. The credit crisis made it near impossible to estimate with any degree of confidence the outlook for real economic growth and so for the earnings of listed companies. The economic outlook had obviously deteriorated but by just how much was impossible to say. Furthermore the credit market crisis itself did more than collateral damage to companies via the state of demand for their products. It made it much more difficult for them to raise finance and when finance was available it had become much more expensive. Thus risks of default and al it cold mean for the value of debt and equity capital increased markedly.

The issue of how to value the future income to be generated by a listed company became subject to most unusual difficulty. The difficulty the market has in estimating value shows up in sharp daily and even sharp intraday moves in share prices. Economic news in such circumstances becomes especially difficult to interpret and consensus about what it all means becomes especially difficult to reach. Hence much reason for changing opinions about the outlook for economies and firms that are reflected in volatile share prices.

Why volatility has receded

Volatility has receded in recent months because, while the outlook for the global economy has not improved greatly, there is much more confidence in economic forecasts. The downside seems now to have a bound to it compared with a few months ago when the downside seemed so difficult to estimate. The recovery in the credit markets has contributed greatly to this. Capital markets have not frozen. The appetite for corporate paper, offering perhaps only temporarily high yields, has been recovered. Companies are raising both debt and equity capital in a very much a normal way. Default risks have receded.

One senses that there is further scope for improvements in both the confidence with which the economic outlook can be forecast. Even if the news about the economy does not show any marked improvement, a stronger sense of what the future holds will reduce fear of the future and the volatilities associated with such fears. It will be much more helpful for equity investors when the forecasts themselves can predict economic recovery with a degree of confidence. If economic recovery comes more firmly into sight, default risks implicit in the still large interest rate spreads paid by corporate borrowers over governments, will recede further to the advantage of their bottom lines. With economic recovery confidence in the survival prospects of the will improve further to the advantage of the equity investor.

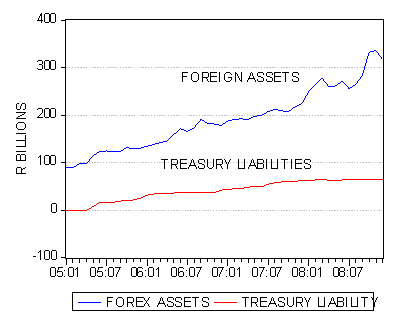

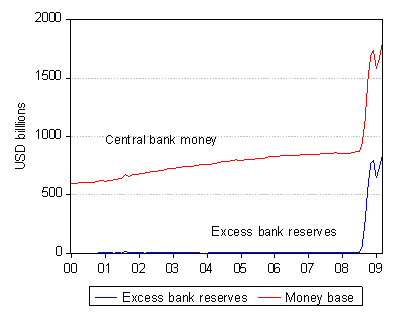

The interest rate outlook has become very clouded

One of the uncertainties to be resolved with any sustained economic recovery will be the future of government interest rates themselves. Short term interest rates will rise as economies recover and long term government bond rates will take their cue as always from the outlook for inflation. The outlook for inflation has become particularly difficult to estimate. Central banks in the US and Europe are pumping cash into their banking and credit systems to help encourage lending and spending. The cash in large measure is being hoarded rather than lent or spent. And so deflation rather than inflation remains the immediate threat to the US economy.

The path from deflation to inflation will be a difficult journey

But at some point with recovery, inflation will become the danger to be addressed by the Fed. The issue of whether the Fed can get its timing right to prevent actual inflation from rising is a live one. Good timing – from fighting deflation to fighting inflation – will be made all the more difficult by the surge in US government borrowing that will continue for years putting pressure on long term interest rates. Such pressure, when it occurs, will add temptation in the form of monetising the debt as a temporary alternative to the sting of higher interest rates.

Interest rate volatility

We show below just how much more volatile US long term government bond yields government have become. These volatilities also measured by the 30 day moving average of the SD of daily interest rate moves increased greatly in the midst of the credit crisis. They increased even as government interest rates fell which was result of the greatly increased demand for default free safe havens. But these volatilities remain highly elevated and such risks will not only influence the government debt markets, they will also make it harder for the equity markets to perform well. It is of interest to note that US bond yields have been a lot more volatile than long dated RSA yields

The volatility of long term government bond yields. USA and RSA

Source: I-Net Bridge and Investec Securities

Interest rates and the equity markets

In our view the uncertainty about the inflation outlook in the US and elsewhere and the direction of interest rates has already entered the equity markets, to its disadvantage. To be equity market bulls now would require optimism about the outlook for economic recovery and optimism in the ability of the Fed to negotiate successfully the fork in the road when it points to inflation rather than deflation. Furthermore the bond market will have to share this confidence in the excellence of Fed timing. This confidence would show up in lower volatility of interest rates. We will be watching trends in the volatility of equity markets and debt markets very closely as a guide to the direction of the equity markets.

Source; Federal Reserve Bank of St Louis and Investec Securities

Source; Federal Reserve Bank of St Louis and Investec Securities