Graham Barr and Brian Kantor

16th May 2023

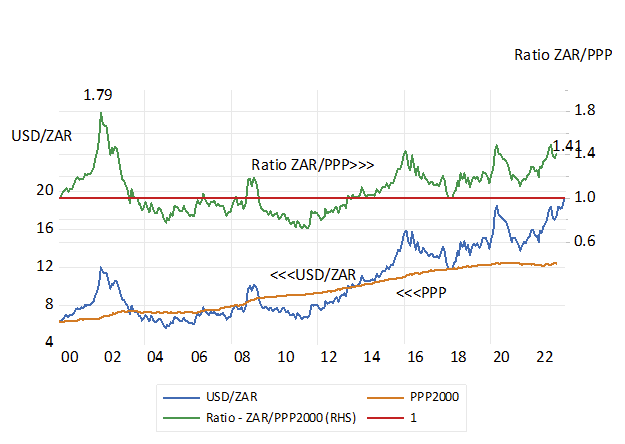

In early 1980 the Rand reached a peak of 1.32 US$ to the Rand; yes, the Rand then bought more than one dollar! This was the time of a very high gold price of $820 per oz. when Russia invaded Afghanistan and WW3 looked like a real possibility. It was but 35 dollars an ounce in 1970. Things have not been as rosy on the exchange rate front since. The exchange rate is currently around 19.2 Rand to the $. This means that in purely nominal terms the Rand is currently 1/25th (against the dollar) of what it was in those heady days of 1980! If the ZAR merely adjusted for differences in SA and US inflation since 2000 the dollar would now cost less than R13. In a relative sense- the ratio of the market to the Purchasing Power Parity was only wider in 2002 when the ZAR was nearly 80% undervalued. At current exchange rates it is about 50% undervalued. Or in other words the rand buys roughly 50% less in NYC than it does in SA as SA visitors will testify. The great deals will now be realised by tourists to SA –until the rand sticker prices in the stores and on the menus are marked higher. See figure 1

Figure1. The USD/ZAR and its PPP equivalent.1 Monthly data to April 2023.

Source; Federal Reserve Bank of St.Louis, Stats SA and Investec Wealth and Investment

In the seventies as the gold price took off- more in USD than ZAR, SA was the largest gold producer in the world and gold mining was hugely lucrative for shareholders in the gold mines and for the SA government who collected much extra revenue from taxes, and royalties paid by the gold mines. Platinum mining was only then getting going and subsequently got a huge boost from the widespread use of catalytic converters in the exhausts of motor vehicles. Coal exports got going after the construction of the huge export terminal at Richard’s Bay, and the rich Sishen iron ore deposit was still to be exploited.

South Africa is now merely the eighth largest producer of gold in the world, producing but a sixth of the gold delivered in 1970. And gold production is now a relatively small part of the South African economy that in the seventies accounted for 60% of all exports from SA and about 16% of GDP. The link between the gold price and the exchange rate

is now correspondingly weak and has done little to save us from facing the second weakest Rand on record and ever higher long-term interest rates.

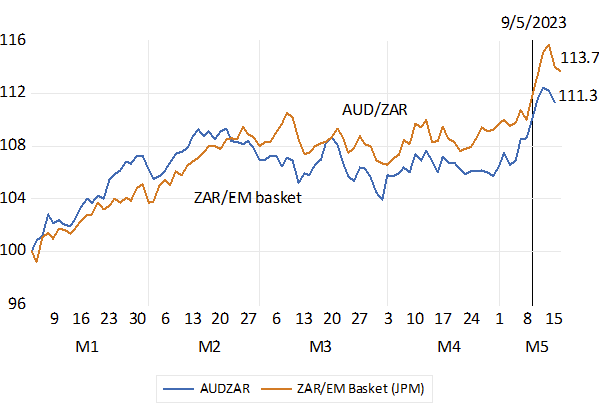

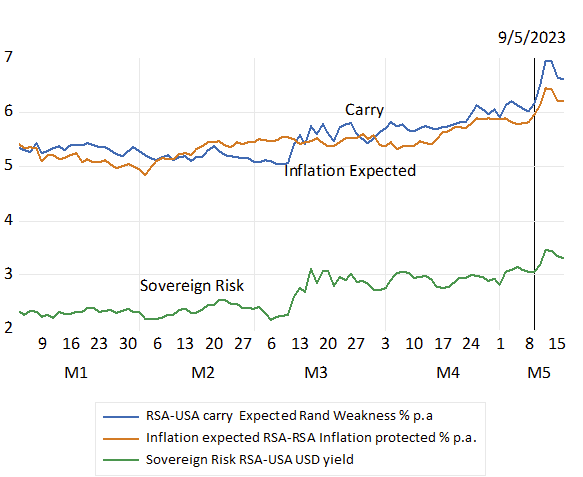

The strength of the Rand is still much influenced by the state of the commodity-price cycle, as South Africa remains a commodity-based and exporting economy. It is also determined in large part by perceptions of South Africa’s economic future and the associated safety of investing in SA. Foreign and local investors require a return that compensates for the perceived risk of investing in SA- including the risk of rand weakness. These perceived risks influence flows of capital to and from SA and can strongly influence the foreign exchange value of the ZAR, as they have this year. As an emerging market, South African risk generally follows the average emerging market risk, but SA specific risk has recently risen dramatically in the face of income destroying load shedding and more recently for reputation destroying toenadering with the reviled Russians. This year the rand has weakened by about 13% vs the Aussie dollar and 11% Vs the EM basket. Much of the relative weakness occurred in January and February in response to load shedding. With additional exchange and bond market weakness (higher yield spreads) on the 10th May in response to the Russian revelations. (see figures 2,3 and 4)

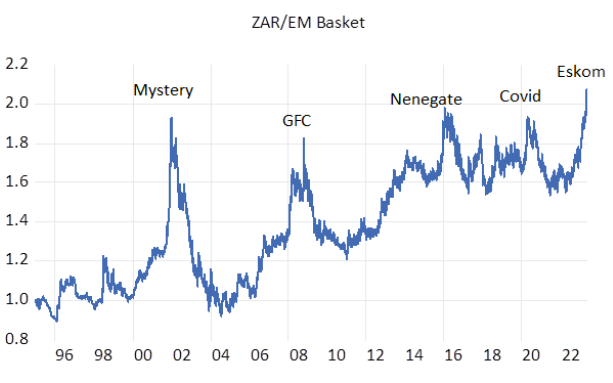

The ratio of the USD/ZAR exchange rate to the USD/Emerging Market (EM) average provides a useful indicator of SA risk. This ratio indicates that SA is again in economic crisis territory. The hope is that this time is not different- and the USD/EM ratio recovers to something like normal, as it has done after all the other crises that have damaged the ZAR and the SA economy. Relative to an average EM currency the ZAR has never been weaker than it is now. The outlook for the SA economy, judged by this ratio, has never been as bleak as it is now.

Fig.2: Identifying SA specific risks- comparing the behaviour of the USD/ZAR exchange rate to that of a basket of EM currencies. Daily Data 2000=1

Higher ratios indicate relative rand weakness

Source; Bloomberg and Investec Wealth and Investment.

Fig.3; Relative performance in 2023 ; ZAR VS AUD and EM Index; Daily 2023 to 15th May 2023. Higher numbers indicate relative rand weakness.

Fig.4; Rand Weakness, Inflation expected and the RSA Sovereign Risk Premium. 5 year yield spreads. Daily Data 2023 to May 16th 2023.

Source; Bloomberg Investec Wealth and Investment

In response to this exchange rate shock – for reasons specific to SA – the SA rate of inflation is very likely to trend higher, independently of by how much the Reserve Bank raises short-term interest rates to further reduce spending pressures on prices. Yet raising short-term rates is almost certainly negative for growth in incomes and employment of which the SA economy is already so sorely lacking, given load shedding and a general loss of confidence in the competence of the SA government. The forces that have given us this latest exchange rate shock are completely out of the Reserve Bank’s control. The

Governor needs to recognise this and do little additional harm to the economy and its growth prospects- by not reacting to the exchange rate shock.

It seems evident that the surging rand prices for our mineral exports may not help the Rand this time. A working Transnet to ship the metals and goods out the country would help – as even more important would be a consistent supply of electricity. But it is hard to be optimistic about such immediate responses and investors shared this pessimism earlier in the year and well before our damaging Russian connection came to light to add further to relative rand weakness.

Unfortunately, we do seem saddled for now with a weak Rand and a near-term uptick in inflation. Yet the weaker rand is not an unmitigated disaster. Exporters and firms competing with more expensive imports will benefit from higher rand prices for their production. Their extra rand costs of production will lag higher rand revenues until local inflation catches up with the inflation of the rand prices, they will be able to charge on foreign and domestic markets. The window of extra profitability will be supportive of extra output, incomes and employment. And of the rand values of the exporters and global plays (e.g. Richemont or Naspers) listed on the JSE. Sectors of the JSE that face abroad can provide a very good hedge against rand weakness that occurs for SA specific reasons, as they are predictably doing.

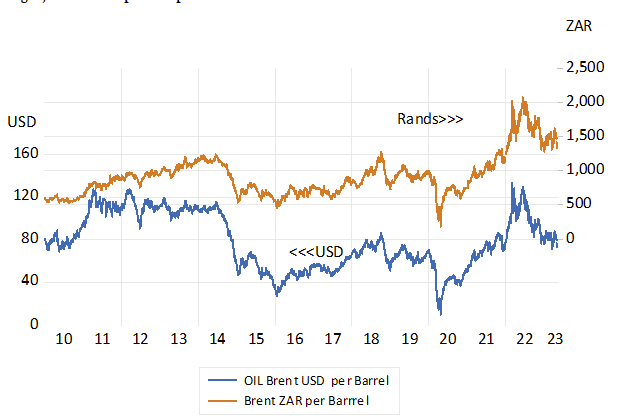

The rand cost of petrol and diesel will play an important role in influencing the inflation rate in the months to come. A saving grace for the inflation outlook is that the dollar price of oil and gas has fallen away- by more than the ZAR has weakened against the USD. (see figure 5)

Fig.5; Brent Oil price – per barrel in USD and ZAR

Source; Bloomberg and Investec Wealth and Investment

The biggest danger to the local economy is that the Reserve Bank will raise interest rates further (the money market already expects increases of over 100b.p. in the next few months) The most recent attempt to support the ZAR raising interest rates by 50 b.p. at the last Monetary Policy has been a conspicuous failure. It has not helped, could not support the rand in the circumstances, but has further depressed spending and the growth outlook. And helped push long term interest rates and the cost of capital higher.

The best approach to rand shocks – that have nothing to do with monetary policy settings- is surely to ignore them – and let the inflation work itself out without higher interest rates. One has long hoped that SA had learned the lesson to not interfere with the currency market. Interest rates can have little impact on the ZAR in current circumstances. The best support for the rand will come from faster economic growth that raises incomes and tax revenues for the state.

Long term interest rates in SA are now punishingly higher than they were last week and the rand is now expected to weaken at an even more accelerated rate than was the case a week ago. This is because SA remains at greater risk – given the even more depressed outlook for growth – of not easily balancing its fiscal books. The expectation of even slower growth to follow still higher borrowing costs, as is widely expected, has added to these risks.

The only way out of the mess SA has got itself into is to surprise investors by delivering surprisingly faster growth- even an extra one percent higher GDP would be helpful. The Reserve Bank has a crucial role to play in this by ignoring the exchange rate shock. Eliminating load shedding and delivering more exports are even more important to improve the growth outlook and reduce SA risks.