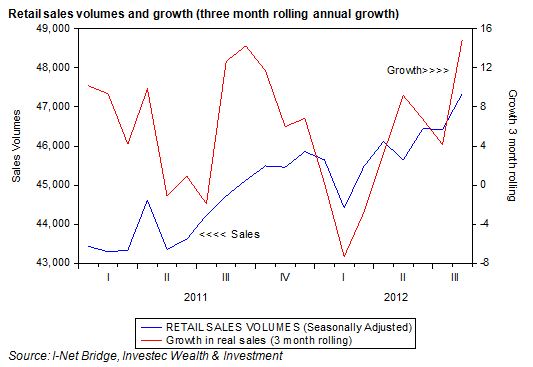

Retail sales volumes in August 2012 were up nearly 2% in August when measured on a seasonally adjusted basis, or 6.5% ahead of their December 2011 volumes. (See below)

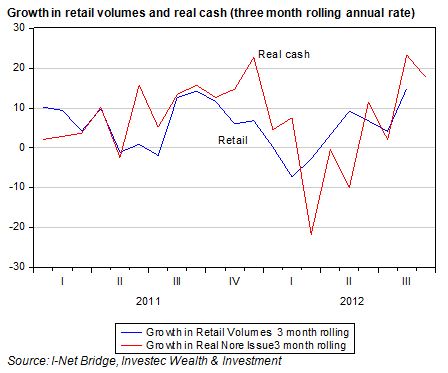

Apparently the buoyancy of sales took economists somewhat by surprise. However observers of the note issue and unit vehicle sales (updated to September 2012 month end) that make up our Hard Number Indicator of the state of the SA economy, should have been less surprised. The retail volumes follow the pattern established by both vehicle sales and the real note issue. That is, growth in volumes, seasonally adjusted, when calculated on a three month rolling basis, picked up strongly towards year end 2011, then fell back sharply in early 2012, whereafter growth accelerated again. (See below)

As we have suggested, and has been confirmed by the strength in retail sales volumes, the SA economy has had more life in it than has generally been appreciated.

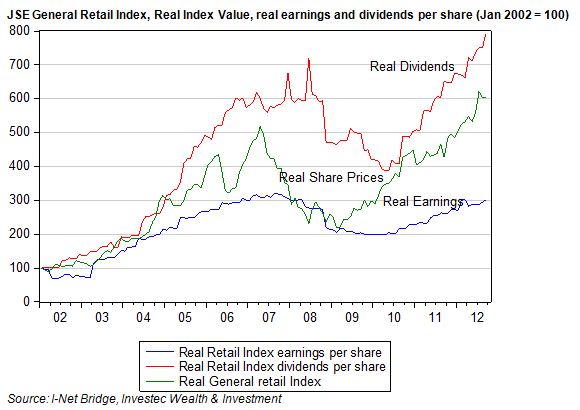

The stock market was perhaps less surprised by the strength in retail sales, given the recent strength of the General Retail and Food and Drug Indexes on the JSE. The value of the JSE General Retail Index, in real CPI adjusted terms, has increased by 35% between January 2011 and 17 October 2012 with much of this strength coming in 2012. Real sales volumes grew by 10% between January 2011 and August 2012.

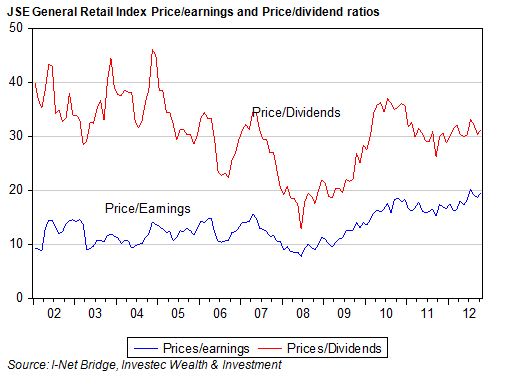

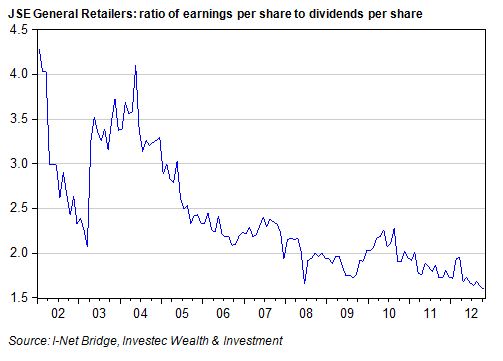

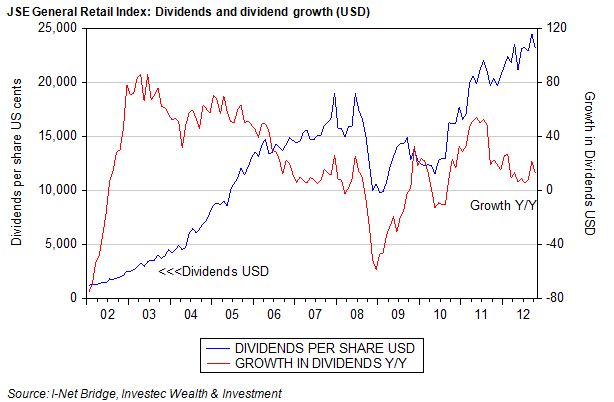

The valuations of retail companies have clearly improved significantly faster than those of real sales. They have also outpaced real retail earnings per share, leading to elevated ratios of share prices to earnings of the retail counters, as has been well documented. However what has not been as well recognised is the extraordinary growth in real dividends distributed by the retail companies. Dividends per retail index share have grown much more rapidly than earnings per share. Dividends in fact have not only grown faster than earnings – 2.64 times as rapidly since 2002 – they have also outpaced the increase in the retail Index as we show below.

Thus, while the price to earnings multiple attached to the general retailers in SA has increased significantly since 2002 (from 9.32 in early 2002 to the current 19.6 times) the price to dividend ratio has in fact fallen since 2002, from R40 paid for a rand of dividends in January 2002 to a mere 31.3 times today.

Retail companies listed on the JSE have benefitted from strong growth in sales and stronger growth in bottom line earnings as operating margins have improved. But they have also been able to generate strong growth in free cash flow – that is cash generated after increases in investments in working and fixed capital. The strength of their balance sheets, or perhaps an inability to find sufficient opportunities to deploy cash inside their businesses, has encouraged the retailers to pay out cash to their shareholders in the form of share buybacks and a reduction in earnings cover. The ratio of earnings to dividends per share has declined dramatically over the years, a decline that appears to be accelerating.

These dividends per retail share (in US dollars) have grown at an average compound rate of about 27.1% p.a since 2003 and have clearly had great appeal for foreign investors who have come to hold an increasing proportion of the shares in issue while SA fund managers have (regrettably) reduced their stakes. The Index in US dollars (excluding dividends) has increased at an average compound rate of 24.9% p.a over the same period.

Dividend yield and growth in dividends that SA retailers have been able to generate have had particular appeal in a world of very low interest rates. The exceptional returns provided by SA retailers in recent years are therefore not at all surprising in the circumstances. Their valuations – seen as a dividend rather than an earnings plays – make every sense. Brian Kantor

What is underpinning the growth in retail in South Africa though? Surely it has to do with retailers such as Shopright achieving significant growth in Africa. Low interest rates in South Africa , huge increases in unsecured lending and higher public sector wages could be fueling this growth too.