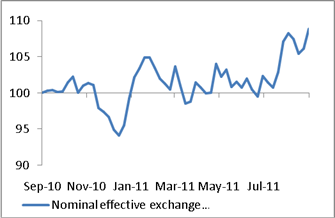

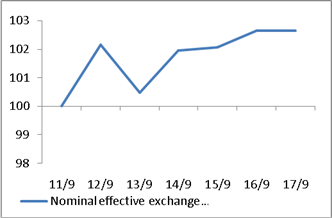

The rand came under moderate pressure last week – it lost about 2.5% on a trade weighted basis. Compared to a year before, the rand is now about 9% weaker than a trade weighted basket of the currencies of its trading partners.

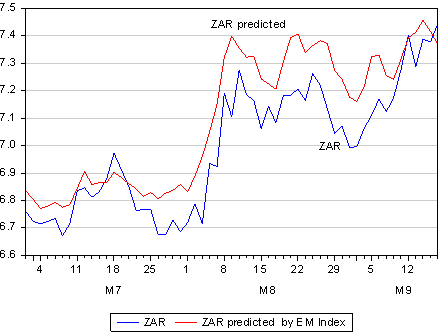

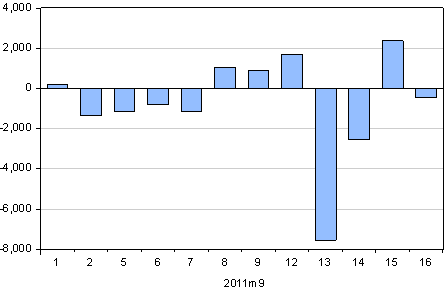

The rand/US dollar exchange rate has continued to follow very closely the direction given by emerging equity markets, represented by the MSCI EM equity Index. This we show below where the influence of the EM equity index on the rand can be seen very clearly. However, as may also be seen, the rand/US dollar has moved from being somewhat overvalued – relative to emerging equity markets – to marginally overvalued by this criteria. On Friday emerging equity markets moved higher and the rand/US dollar unusually moved marginally lower, indicating perhaps additional forces at work. As we had previously pointed out, foreign holders of RSA rand denominated bonds had sharply reduced their exposures to the rand earlier last week; though they had returned to the market as net buyers on Thursday and were only marginally net sellers on Friday.

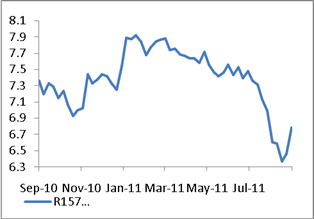

Longer term interest rates in SA have reversed a declining trend. The four year R157 recently touched a 6.3% yield then moved higher early last week on these net foreign bond sales but then yields declined later in the week.

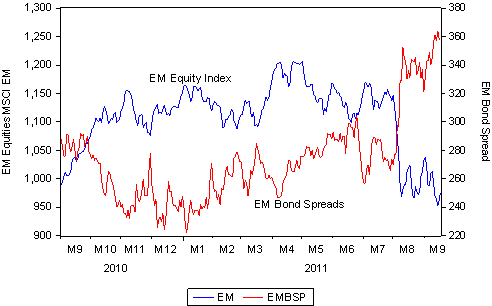

It is also of interest to note that emerging market US dollar bond spreads over US Treasuries also widened sharply in recent weeks as global risk appetite diminished in the wake of the European bond crisis. These wider spreads are also consistent with both weaker EM equity markets and a weaker rand (which acts as a proxy for emerging market currencies that are less easily traded and hedged).

The rand continues to be well explained by global economic and financial forces. It remains a play largely on global risk aversion that is well represented by emerging market bond spreads and emerging market equity valuations. These two series remain highly correlated on a day to day basis. As we show below, when risks rise equities fall and vice versa. The rand can be expected to recover its strength should global investors recover some of their appetite for risk. South African specific risks or even expected movements in short term interest rates do not appear to have added much (if anything) to an explanation of the recent direction of the rand.