The European central bankers and finance ministers invited Timothy Geithner, the Secretary of the US Treasury to their weekend meeting in Poland, but did not take that kindly to the sense of urgency he tried to convey. Jean Claude Trichet, head of the ECB, was ungracious enough to indicate that the outlook for European governments’ fiscal deficits at a 4.5% average was significantly better than that of the US. This average however conceals a wide standard deviation about the average which is the European problem and especially the problem of European banks. The Europeans in turn urged the US to adopt its tax on financial transactions proposals that seem like an invisible way to raise revenue – but only if all financial regimes cooperate (something the Americans and British seem unwilling to do).

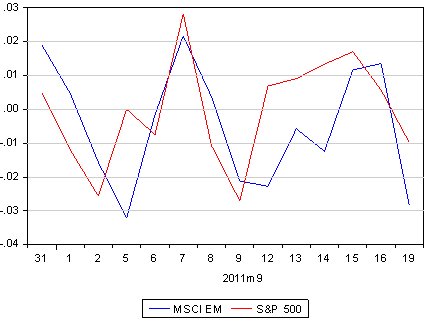

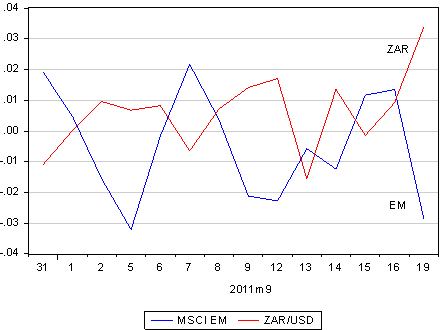

The markets did not at all like the news flow from across the Vistula River. Increased risk aversion drove equity markets lower. Emerging market equities were especially vulnerable and took the rand predictably lower with them.

As we show below the benchmark MSCI EM Index lost 3% by the close and the rand/US dollar was a little more than 3% weaker as investors hedged their EM bets in the market for rands.

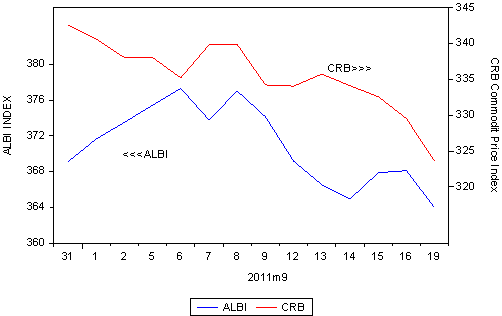

Neither SA rand denominated bonds nor commodity markets escaped the downward draft. Rand denominated bonds are no longer acting as the safe haven they were earlier in the month. Commodity markets, despite yesterday’s declines, can still be regarded as holding up very well relative to the equity markets, helped presumably by superior growth still emanating from the emerging economies.

The shining light yesterday was predictably the higher rand price of gold and the still higher rand price of gold shares listed on the JSE. The gold shares even outperformed the gold price on the day.

The European financial leadership does not appear to take the threats to European banks nearly as seriously as investors in them do. The European banks, represented by the Eurostoxx bank index, has lost over 50% of its value since March. This Index lost about 5% yesterday. The numbers bandied about in IMF and other circles indicate that the Euro banks are undercapitalised by about EUR220bn. European governments do not, as yet, seem willing to assist such an infusion of capital into their banks that would not at all be beyond their financial capacity. Unless Greece does manage to step back from the default brink, such a capital raising exercise will indeed be as urgent as Geithner has been arguing. The Greek drama is surely now very close to its final scenes (one way or the other), in the form of a recue or hopefully orderly bankruptcy proceedings.

What Geithner knows very well, but apparently failed to convince the Europeans accordingly, is that the solution to Europe’s financial crisis is very similar to that of the US crisis – that is pump cash into the banking system without limits to provide liquidity – and also to pump capital into the banks without delay so that they can resume business more or less as usual. The solution to Europe’s and the US’s long term fiscal imbalances will take longer and require much more fundamental reforms that politicians will have to wrestle with.

I just got back from the RailVolution corenefnce in San Francisco. Transit Oriented Development (TOD) was the focus of the corenefnce. I am happy to know the high speed rail in California was approved by voters and look forward to urging my community in California to pay attention to the benefits of TOD.