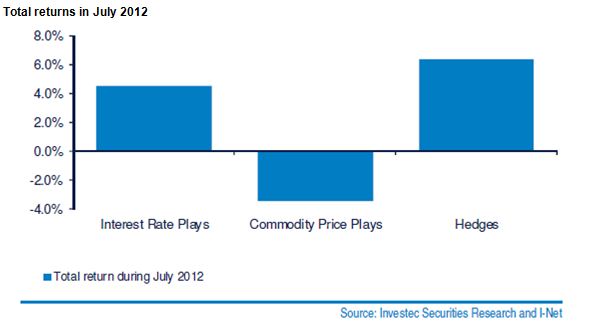

July 2012 proved to be another good month for the Interest rate plays and the Industrial Hedges listed on the JSE Top 40 Index. It was yet another poor month for the Commodity price plays as we show below.

The Industrial hedges are those large cap companies listed on the JSE that are largely exposed to the global economy and whose values are insensitive to both SA interest rates and commodity prices. British American Tobacco, SAB, Naspers and Richemont have proved highly defensive against the risks to the global economy posed by the Eurozone crisis. The cyclical commodity price plays by contrast have been much damaged by these anxieties and share market trends in July proved no exception.

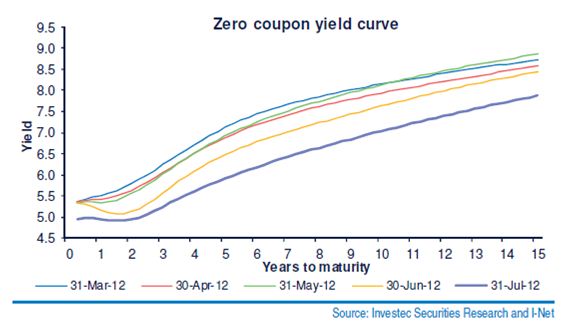

The interest rate sensitive stocks, especially banks, retailers and listed SA property (all of which are highly dependent on the SA economy) have benefitted from the surprising decline in SA interest rates and especially the July cut in the Reserve Bank repo rate. We show below, with the aid of Chris Holdsworth of Investec Securities, just how significantly lower SA interest rates have moved across the yield curve in recent weeks.

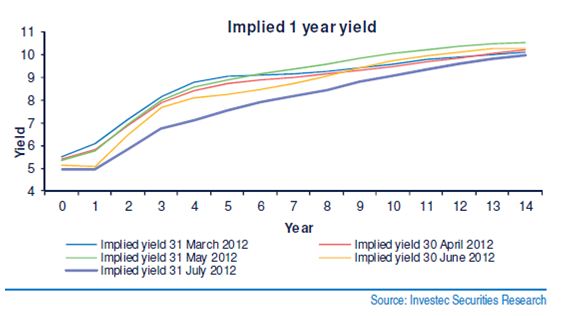

The term structure of interest rates at any point in time makes it possible to infer the short rates expected by the market over the next 15 years. As we show below the rate of interest on RSA bonds with one year to maturity is now expected to remain unchanged over the next year. Then it is expected to increase much more gradually over the next few years and to remain below 7% p.a for another four years. This outlook for interest rates is very encouraging to those companies for whom interest rates are an important influence on their revenues and profits.

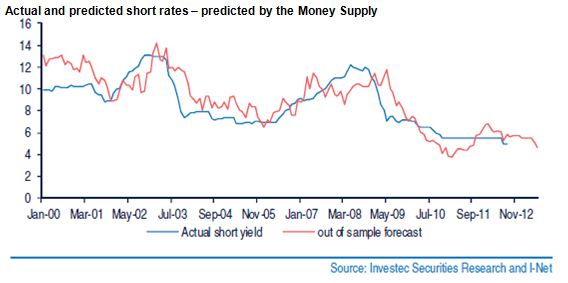

The market in fixed interest securities can change its mind and can be expected to do so again. Holdsworth has developed and successfully tested a theory about the forces that drive the gap between long and short rates in SA. The theory is that money supply growth rates lead interest rate moves by about 12 months. The explanation for this is highly plausible. Given monetary policy practice in SA, the supply of money (defined broadly as M3) and bank credit accommodate the demand for money and credit. Economic activity therefore leads money supply and credit growth and so subsequent moves in interest rates. In other words, economic activity leads and money supply and interest rates follow in due course.

The test of this theory of short term rates is shown below. The money supply has done a good job at predicting short rates and has done better, statistically, than the yield curve itself in forecasting short rates. The Holdsworth prediction, given recent money supply trends, is for still lower short rates to come, of the order of 4.6% p.a in 12 months’ time. The forecast of the three month rate in June 2013, implicit in the Forward Rate Agreements offered by the banks, is currently 4.9% p.a.

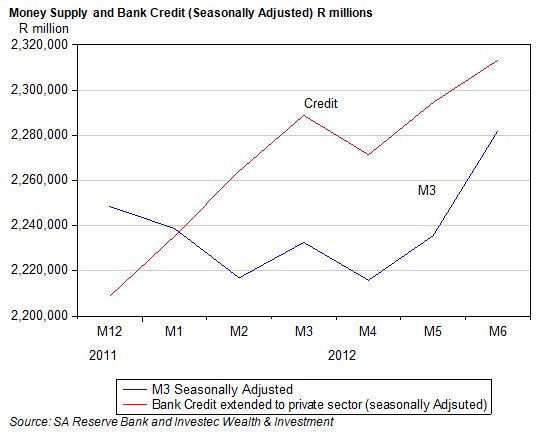

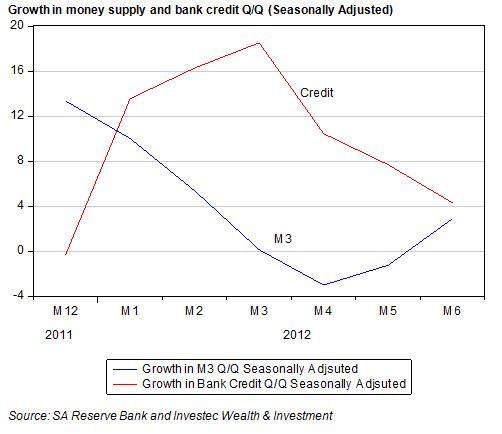

Whether these forecasts will prove accurate or not will depend upon the state of the SA economy over the next 12 months. The stronger the economy the higher will be interest rates and vice versa. All will be revealed by the growth in the balance sheets of the banking system, that is in the money supply broadly defined (M3). These constitute most of the liabilities of the banks and the supply of bank credit. These money and credit aggregates as well as the state of the economy will be closely watched by the Reserve Bank.

However when these aggregates are converted into growth over three months (calculated monthly), the picture looks rather different. Growth in credit supply has slowed sharply while growth in M3 remains anemic with both now at about a 4% p.a. rate of growth. Such growth rates, if maintained, would mean lower rather than higher interest rates to come. These aggregates will bear especially close watching over the months to come. Brian Kantor