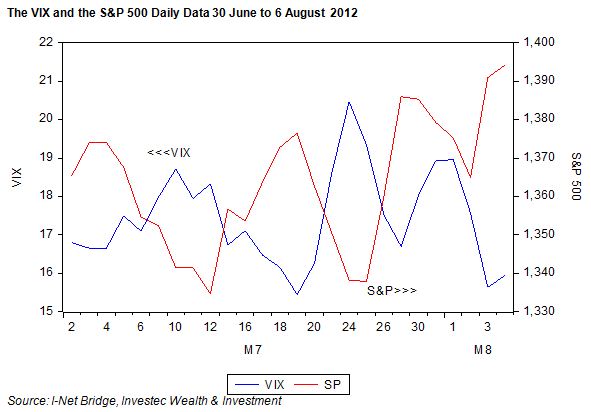

The Volatility Index (VIX), which is traded on the Chicago Board Options Exchange and that reflects the implied volatility of an option on the S&P 500, has been trading at very low levels recently. It has been in the mid teens, or at levels that were common before the Global Financial Crisis triggered by the collapse of Lehman Brothers.

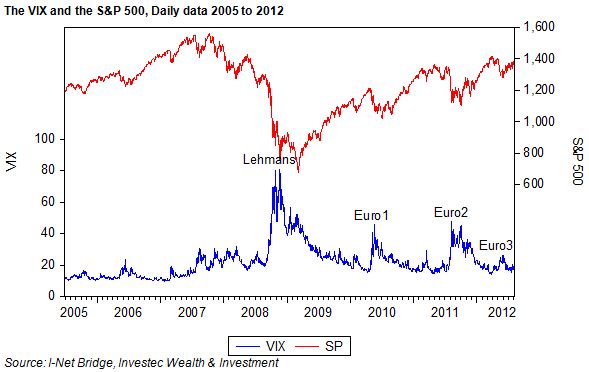

As we show below the VIX rose to as much as 80 in late 2008. We also show how the Euro Crises drove the VIX markedly higher, though never to Lehman type levels of anxiety.

What is noticeable is just how little affected the share markets and the options traders were by the latest flurries in the share dovecote caused by weakness in Spanish and Italian debt. Judged by the behaviour of the VIX this year, the markets have not been nearly as noisy as the commentators.

We also show that where the VIX goes, so goes the S&P 500 in the opposite direction. When risks go up (as reflected by actual or implied volatility of share prices) returns (that is share prices) go down and vice versa. The correlation between daily percentage moves in the VIX and the S&P is (-0.80), which is very close to a one to opposite one relationship.

This may (hopefully) mean that we have entered a much more sanguine market place and if sustained, this degree of detachment will remain helpful to shares and what are regarded as riskier bonds. The safe haven bonds, by the same token, will not then attract the same anxious attention to the point where favoured governments have been paid by investors to take their money for up to two years rather than the other way round.

The attention of the market place may turn much more closely to the outlook for earnings and interest rates rather than the the very hard to estimate (small) probability of catastrophic financial events. These probabilities can alter meaningfully from day to day, so adding to share and bond price volatility of the kind observed post Lehman and post the Euro crises

Hi Bill, the SPX is quite flat since a few days, so it’s quite normal for hisiartcol volatility to go down. VIX measures the premium of out-of-the-money options treated on the CBOE hence it can’t go down that quick.Something else: i’ve been thinking about these ratios i discussed with you last week. Besides the issue that SPX:VIX amounts to divide a price by a yield, i’ve considered SPX:CPCE instead. CPCE is the “equity” put/call ratio thus it considers all the equity options treated during a given day and constitute some sort of “instantaneous volatility” which is a bit higher than the one obtained by VIX. Especially, one may look at CPC:VIX and CPCE:VIX which should display flat areas where instantaneous and implicit volatilities match each other separated by transition zones where both measure of volatility diverge.Could these divergences be explained by saying that people in CBOE concentrate on in-the-money options thus anticipate minor changes in the near future ? What is your sentiment on this issue ? Best,–Laurent