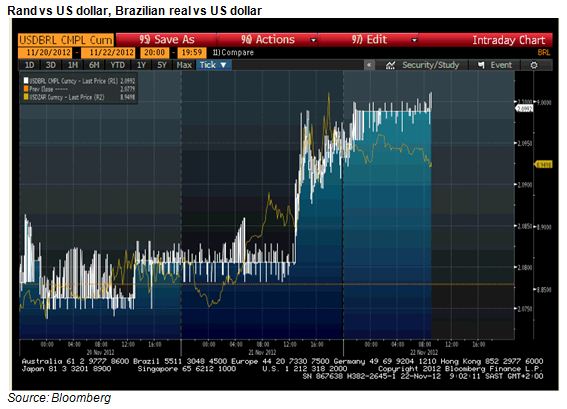

The mystery of the strange behaviour of the rand yesterday (Wednesday) has been solved. Sudden rand weakness had nothing to do with South African events: it weakened suddenly around 11h30 in complete sympathy with a simultaneous decline in the exchange value of the Brazilian real.

As may be seen in the chart below, both currencies weakened significantly at about this time. Hence the rand weakness can be described as a response to emerging market rather than SA specific risk. To deepen the mystery further however, other emerging market currencies, such as the Turkish Lira and the Mexican peso, did not react in anything like the same way. The mystery therefore is to recognise those forces that simultaneously weakened the Brazilian and SA currencies. As for now, this remains something of an unsolved mystery.

The JSE moreover did not react to rand weakness, as might ordinarily have been expected. Retailers, who are particularly vulnerable to rand weakness and the higher import prices that come with it, held up very well and the rand hedges – both of the Industrial and Resource kind – did not outperform.

What Brazil and SA have in common are iron ore exports to China. There was a conference call yesterday organised by one of the institutional brokers on the proposed reduction in Chinese domestic iron ore tax, where it was stated that a more favourable tax treatment of domestic iron ore producers might well reduce the Chinese demand for iron ore imports.

This episode in the currency markets perhaps illustrates once more how important China is to the outlook for commodity prices. Yesterday was not at all a bad day for commodity prices. Iron ore fines were quoted at prices only marginally ahead of the day before and nearly 8% higher, year to date, while the CRB Commodity Price Index was unchanged on the day. Brian Kantor