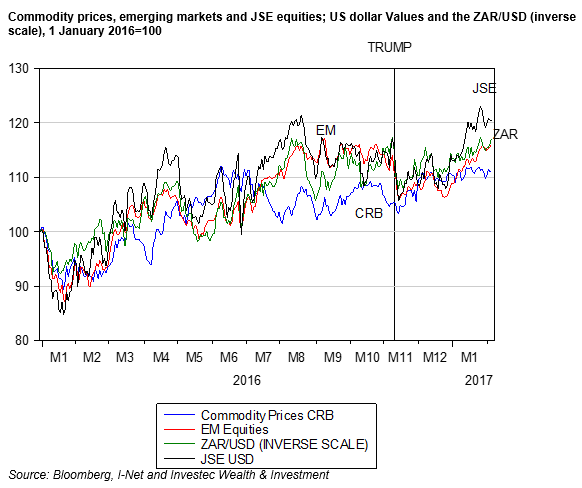

We can recall the days when the BRICS, Brazil, Russia, India, China and, a later inclusion, South Africa, were the darlings of the commentators. Their growth prospects were fueled by the super-cycle of commodity prices and improved equity markets – until the global financial crisis of 2008 intervened.

Commodity prices and emerging market (EM) equities recovered strongly after the crisis, but then in 2011 fell away continuously, until mid-2016. This took down the exchange value of EM currencies, including the rand, with them and forced inflation and interest rates higher, so adding further to the BRIC misery.

The economic and political reports out of Brazil in recent days are particularly discouraging. Its current constitutional crisis and likely upcoming elections will make it more difficult to enact the economic reforms that could permanently improve the economic prospects for the country. The trajectory of its social security expenditures and lack of revenue from payroll taxes will take the social security funding deficit, currently 2.4% of GDP, to 14% by 2022, according to the IMF. But these fiscal problems are compounded by a recession that shows little sign of ending.

The disappointments of the BRICS moreover forced attention on the “Fragile Five” of Turkey, Brazil, India, South Africa and Indonesia. These are economies with twin deficits – fiscal and current account of the balance of deficits, that makes them especially vulnerable to capital flight. Some investors have found consolation in this slow growth. Slow growth has seen these current account deficit decline markedly. In the case of South Africa the current account deficit – the sum of exports less exports, plus the net flow of dividends and interest payments abroad – has declined markedly from near 7% of GDP in 2013 to less than 2% in Q4, 2016, and is likely to have fallen further since.

These trends have made the SA economy and its fragile peers appear less dependent on inflows of foreign capital, thus making the spread between the yield on its bonds and safe-haven bonds attractive enough to attract inflows of capital and provide support for the local currencies. In mid-2016 the declining trend in EM exchange rates and commodity prices (not co-incidentally) was reversed, as was the outlook for inflation.

These reactions however neglect the more important vulnerability of the SA and the Brazilian economies to persistently slow growth. That is the danger slow growth presents for social stability. The capital account inflows no more cause the current account deficits, than the other way round. The force driving both sides of an equation is an equality is the state of the domestic economy and its savings propensities. In the case of SA, Brazil or Turkey, should the growth rate pick up, so will the current account deficit and the rate at which capital flows in. If the capital proves expensive or unavailable, the exchange rate will weaken, inflation will rise, the prospective growth will not materialise and the current account deficit will remain a small one.

Were Brazil or South Africa to adopt a mix of policies that reduces risks and improves prospective returns on capital, the long-term growth outlook will improve and their economies will grow faster. And they will have no difficulty in attracting the capital to fund the growth. Growth could lead and capital will follow in a world of abundant capital.

South Africa and Brazil have more in common than slow growth and fiscal challenges. They have similar degrees of political difficulty in adopting growth-enhancing reforms. The best they can now do, absent a credible growth agenda, would be to aggressively lower short term interest rates. This would improve the short term growth outlook and help attract capital and, if anything, help rather than harm the exchange rate. It remains for me a source of deep frustration that the SARB remains so reluctant to take the opportunity to improve growth rates, without any predictable impact on inflation. 26 May 2017