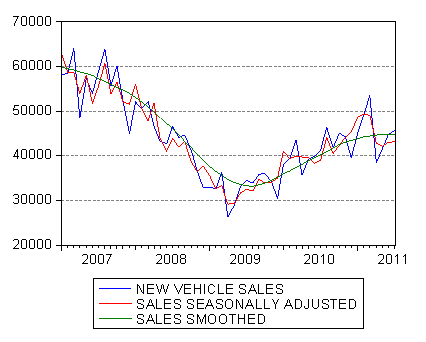

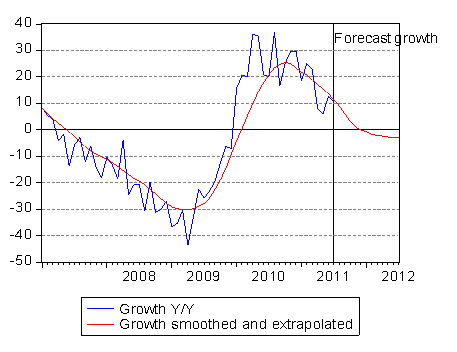

New vehicle sales in South Africa in July rose from 44 880 in June to 45 703 units sold. On a seasonally adjusted basis this represents a marginal increase of about 70 units. As we also show below, the new vehicle cycle has clearly peaked and if present trends continue the level of new vehicle sales will remain more or less at current levels and growth will turn marginally negative (off its higher 2011 base) by early 2012.

In 2010 SA Households increased their spending on durable consumer goods by 24% off a very depressed base. This growth in the first quarter of 2011 was maintained at a very robust 21.5% annual rate helped by particularly buoyant sales of new vehicles in March 2011. The impetus provided to the SA economy by increased sales of new vehicles and perhaps also sales of other durable consumer goods, is losing momentum.

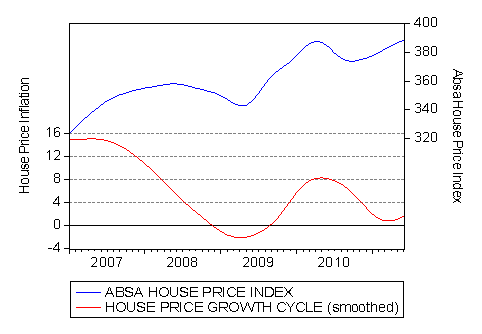

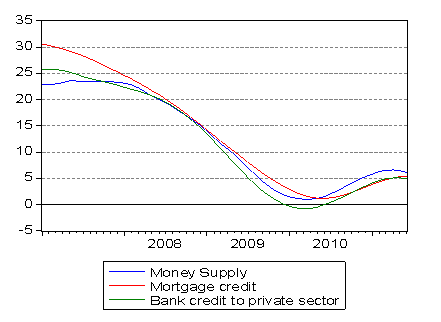

Such lack of momentum is also revealed by very tepid growth in the supply of bank credit and money to June 2011, a trend confirmed by the results reported by the retail banks this week. The revenue line of the SA banks is growing very slowly because house prices and so demands for additional mortgage loans have increased at a very modest rate and growth in the supply of money and credit may be slowing down rather than picking up.

These trends in vehicle sales, house prices and credit and money supply suggest that the SA economy will operate below its potential for some time to come. The potential stimulus to growth from the global economy and exports now also seems less likely to provide additional strength to incomes and employment. The MPC after its July meeting told us that it had not even considered lowering interest rates only raising them- a temptation that was strongly resisted as we were also told. Given these updates on the SA economy it should have considered lowering interest rates