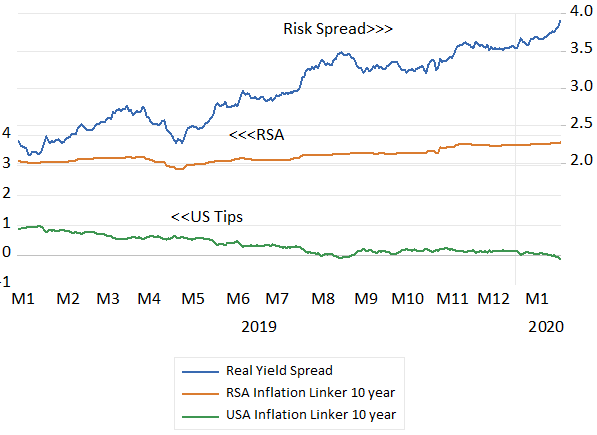

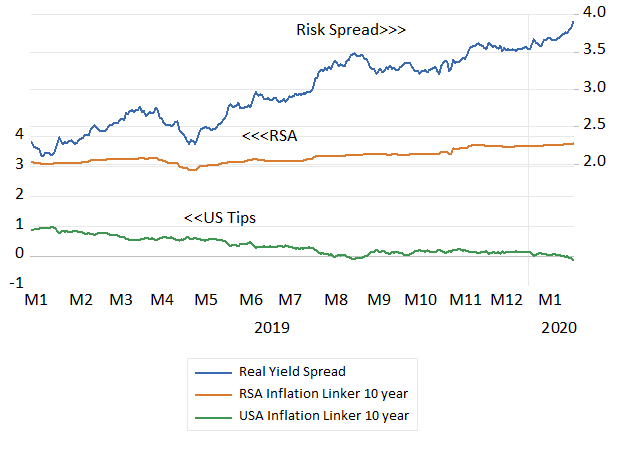

The RSA is currently offering its bond holders a real 3.8% a year for 10 year money. It is the lowest risk investment that can be made in rands over the next 10 years. One made without the risk of inflation reducing the purchasing power of your interest income and without risk of default. If you wished to invest in a US Treasury inflation protected security (a ten year TIPS) you would have to (pay) Uncle Sam 13.3 cents per $100 invested for the opportunity.

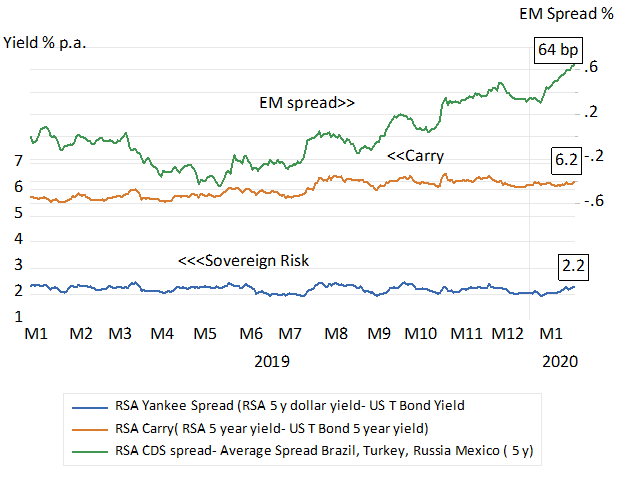

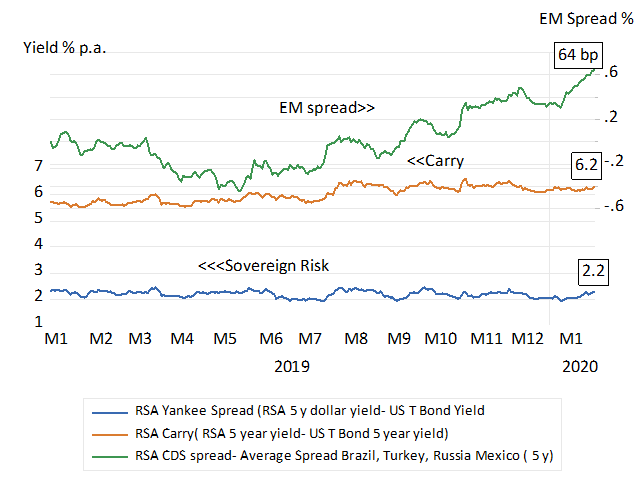

Thus investors willing to accept RSA risk are currently being compensated with an extra 4% real rand income each year for the next ten years. This real risk spread was a mere 2.3 % p.a. a year ago. Other possible measures of RSA risk are as unflattering. The RSA borrowing dollars for five years has to pay an extra 2.2% p.a more than the US Treasury for five year money making RSA debt already well into junk status where it has languished for some time not withstanding its fragile investment grade status with Moody’s. Our rating compared to other EM borrowers has deteriorated and the ZAR is expected to weaken at a faster rate (See figures below)

The real risk spread for SA assets

Source; Bloomberg and Investec Wealth and Investment

Measures of SA risk

Source; Bloomberg and Investec Wealth and Investment

It all makes for very expensive national debt that taxpayers have to fund and higher costs of capital for SA business. These higher real rates also raise the returns that SA businesses have to hurdle to justify capital expenditure. Ever fewer such opportunities are seen to be on offer. And so the best many SA economy facing businesses can now do for their share owners is to opt out of the race in ways that are not good for growth. That is to use the cash they generate to buy back shares or pay dividends rather than attempt to grow their businesses.

The cause of this deteriorating credit rating and the higher discount rates applied to SA earnings is obvious enough. The RSA appears increasingly unlikely to manage its public finances with any degree of competence. The 2020-21 Budget has to cover an extra R50b to hold the fiscal line drawn as recently as last October. It is the result of less revenue than expected as growth has slowed and rapidly growing government expenditure on failed state-owned enterprises. A growing interest rate bill on ever more government debt is a further growing strain on the Budget .

There are however alternatives to raising taxes or borrowing more. That is to raid the SA pension and retirement funds. That is to compel them to hold more RSA debt of one kind or another on less favourable terms than have currently to be provided. Such forms of EWC have one major advantage for the politicians imposing them. Their full consequences will not become obvious for many years. That is in the form of lower than otherwise returns for pension funds and depleted pension payments. Including the bill ultimately to be presented to taxpayers for underfunded defined benefits owed to public sector employees- and largely incalculable today.

Swapping most of the debts and interest payments of SOE’s for equity without guaranteed returns has however one major potential upside. It could mean the effective transfer of ownership and rights of ownership from government to the private sector. This would bring greater efficiency and the avoidance of further losses for SA taxpayers and consumers of essential services. Such a step would bring down real interest rates and encourage private sector investment.

It would moreover indicate something much more fundamental to investors in SA. That is when accompanied by credible controls on the size of the government payroll it would clearly signal something all important for investors. And that is the primary purpose of the SA government is not to provide a growing flow of real benefits for those employed by government. This is the essential question that the Budget, we must just hope, will answer in the affirmative.