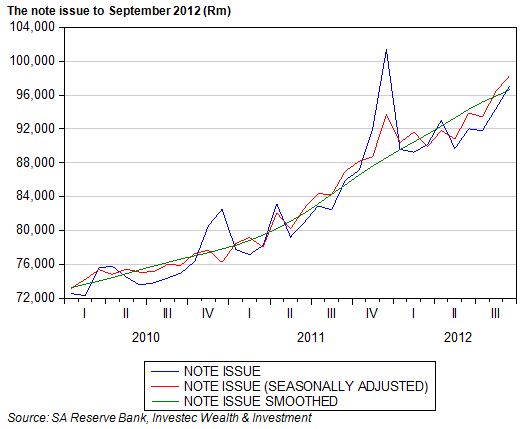

We regard the note issue as a very reliable indicator of spending intentions in SA. It has a particular advantage in that it is updated every month with the release of the Reserve Bank balance sheet, usually within the first week of the next month. The Reserve Bank has now published its balance sheet for September and as we show below, the note issue, on a seasonally adjusted basis, grew strongly towards year end 2011, then moved largely sideways until May 2012 and since then has grown quite strongly. The note issue, seasonally adjusted in September 2012, maintained this strong upward momentum in September and is now well ahead of its level in December 2011.

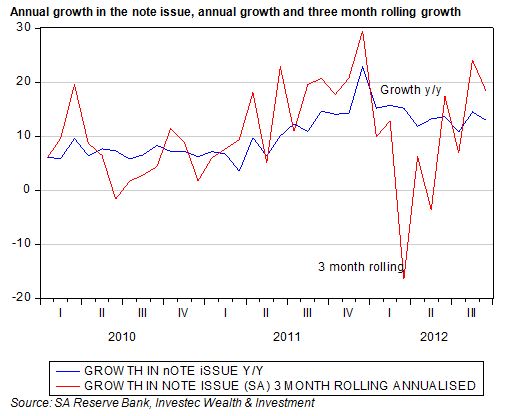

The strong recovery in the note issue is well demonstrated by the growth measured on a three month rolling basis. This three month growth in the seasonally adjusted note issue, when annualised, turned negative in May 2012, picked up to 17% in June, grew by 24% in August and 18% in September 2012.

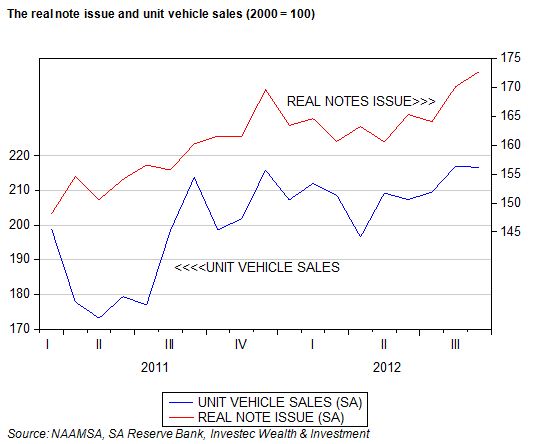

When adjusted for consumer prices, the recovery in the real note issue is equally impressive, with the three month growth rate recording about 20% in 2012. These trends in the real cash supply are matched very closely by trends in unit vehicle sales. They too were up strongly in late 2012, moved sideways until May and then also recovered strongly (see below).

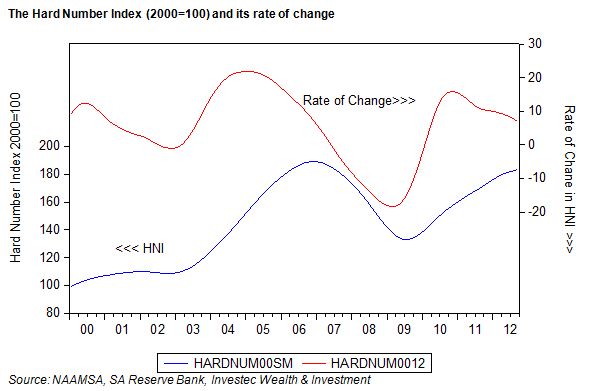

These two series (both up to date hard numbers), rather than based on sample surveys make up our own economic activity indicator that we call our Hard Number Index (HNI). As we show below, supported by the uptick in vehicle volumes and the real note issue, the HNI has continued to move ahead – indicating continued growth in SA economic activity at a more or less stable rate. Numbers above 100 for the HNI indicate the economy is growing and its rate of change, also shown, indicates whether the economy is picking up or losing forward momentum. It would appear that the speed of the economy has slowed down from its peak but has in September almost maintained the speed reached in August 2012. Given the fears of a marked slowdown in activity this outcome should be regarded as highly satisfactory.

It would appear that the SA economy, on the demand side, has shown more strength than is perhaps widely appreciated. Spending appears to have picked up, rather than slowed down, between May and September 2012. These trends have also been confirmed by retail sales and broader money supply trends that we have reported upon. Given the disruptions on the supply side of the economy, this strength in demand is likely to also show up in a wider trade deficit. This might enhance the case for rand weakness – but the underlying strength of demand should also encourage investment and inward capital flows. Brian Kantor