Retail sales help confirm a welcome recovery of spending in June

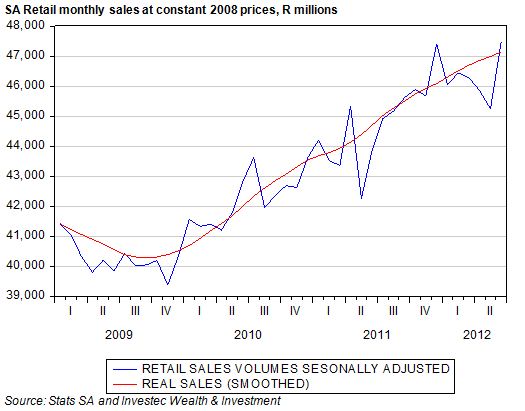

Retail sales volumes reported by Stats SA last week confirm that the SA economy had a rather good month in June. Sales volumes picked up strongly, having grown very little on a seasonally adjusted basis between December 2011 and May 2012. As we show below retail sales volumes(at constant 2008 prices) recovered strongly in late 2009 from their post recession lows, picked up momentum in late 2011, but then fell away rather badly on a seasonally adjusted basis in the first five months of 2012.

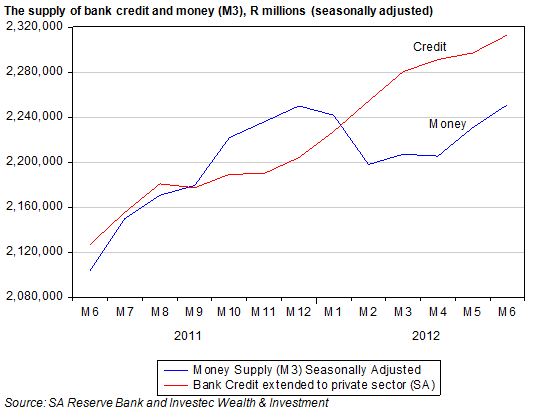

We had learned earlier that June 2012 was also a good month for the banks. This is not a coincidence: economic activity tends to lead rather than follow bank lending. The banks respond to demands for credit to fund intended spending decisions by households and firms. Bank credit extended to the private sector grew strongly in June 2012, as did the deposit liabilities of the banking system (known as M3, the broadly defined supply of money). M3 almost flat-lined between December and May while bank credit grew steadily over the period and also picked up momentum in June.

The data for June 2012 may be regarded as encouraging enough to suggest no further cuts in interest rates are necessary to keep the economy going forward at a satisfactory pace. However June is a long time ago. We are more than half way through August and a month can be a long time in economic life.

Updating the state of the economy to July 2012

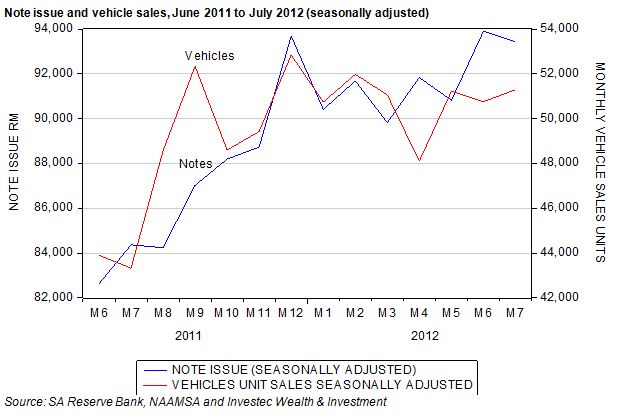

We do however have some useful additional information about developments in July 2012, in the form of vehicle sales and the notes issued by the SA Reserve Bank. These two hard numbers help make up our hard Number Index (HNI) of the immediate state of the SA economy (or, to put it more precisely, combining the vehicle sales with the note issue adjusted for the CPI, equally weighted, gives us the Hard Number Index). As may be seen below, both series show a very similar pattern to that of retail volumes and the money and credit numbers. They show a good recovery in activity in the second half of 2011 that accelerated towards year end. Thereafter activity flat-lined between January and May 2012 as may be seen below. It may also be seen that in July the faster pace was maintained at the higher June levels.

The Hard Number Index (HNI) – an estimate of the state of the SA economy in July

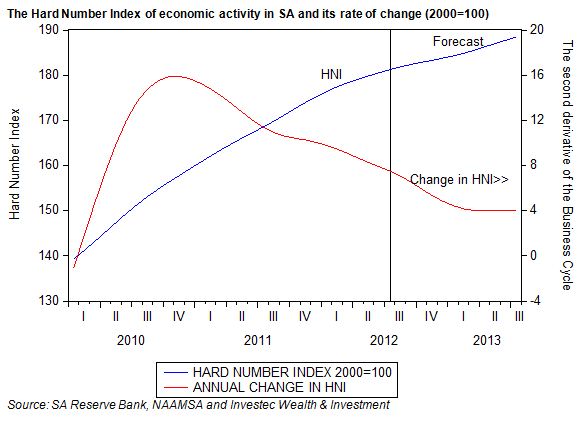

An HNI above 100 indicate growth in economic activity. As may be seen below, economic activity in SA according to the HNI continues to expand but at a slower pace. When these trends are extrapolated further the outlook is for further increases in economic activity and for the rate of increase to slow down further.

Why the HNI is a good leading indicator for the SA economy

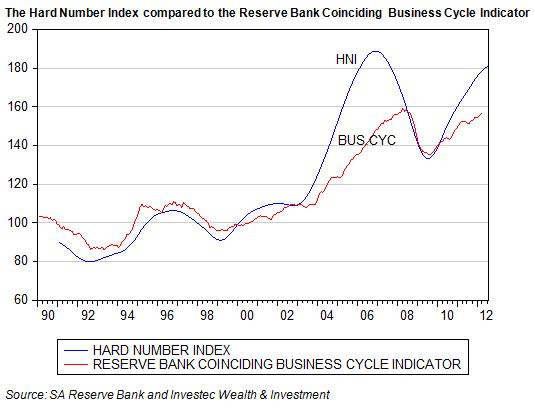

In the figure below we compare our HNI to the Reserve Bank Business Cycle Indicator that is based on a wider number of activity indicators based on sample surveys. Both series indicate very little growth in economic activity before 2003, with numbers that stayed around 100. The measures of economic activity have been consistently well above 100 ever since 2002, indicating that the economy has grown consistently since then, though at a forward pace that accelerated until 2006; slowed down between 2006 or 2007; and then picked up forward momentum in 2010.

The two series have tracked each other very well over the years. They indicate the same time in 2010 when the pace of growth began to accelerate again rather than decelerate. The rate of change of the HNI turned down well before the Coinciding Indicator in 2006 as may also be seen. The advantage of the HNI is that it very up to date – available measured for July 2012 while the Reserve Bank Indicator has only been updated to only.April 2012.

The HNI may therefore be regarded as a very useful and up to date indicator of the SA Business Cycle. There is every indication from it that the SA economy will continue to grow in 2012-2013 but at a decelerating pace that is not likely to threaten any change in current interest rate settings. These have been helpful to date in keeping the economy moving forward, despite a weaker global economy, by encouraging household spending and the extra credit needed to sustain it. Brian Kantor