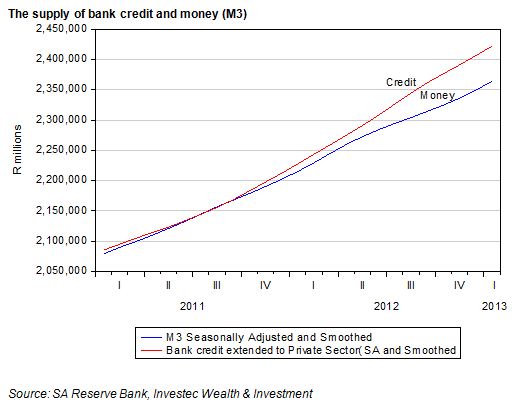

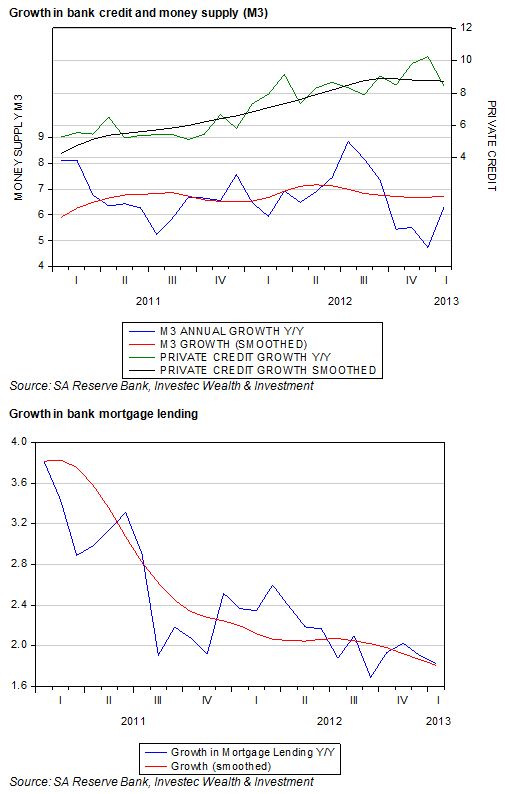

Money supply and credit numbers for January 2013 show that while the supply of money (broadly defined as M3) continues to increase, the pace of growth remains subdued at about the 6.5% to 7 % year on year rate. The asset side of the bank’s balance sheet, represented by credit granted to the private sector, has been growing at a slightly faster rate, closer to a 9%.

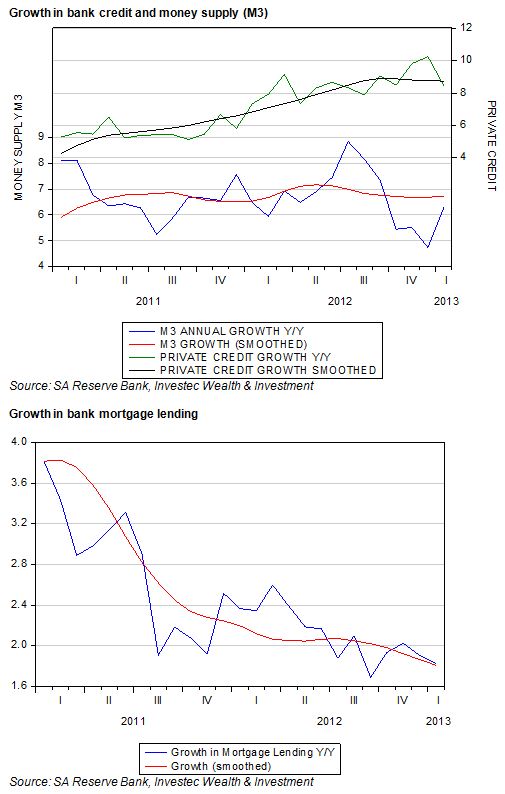

There would however appear little evidence of any pickup in growth in bank lending or in the broadly defined money supply. Mortgage lending, which is usually a large component of credit supplied by the banks, about 50% of all bank credit provided to the private sector, continues to grow very slowly. Clearly house price gains and thus growth in mortgage lending are increasing very slowly, with the rate of growth slowing down.

These money supply and credit trends, as well as the very subdued trend in house prices, make the case for lower interest rates. Until such time as these trends move strongly in a higher direction, short term interest rates in SA will remain on hold – though given these money and credit trends the economy could well have done with lower interest rates. Brian Kantor