The recent willingness of communities in South Africa to defend the property of others, their shopping malls, is of deep significance. At great danger to themselves they established a line that the looters and vandals feared to cross. They did so because what they were protecting was of great value to them. What was at stake was convenient access to the great variety of goods and services, necessities, and luxuries the shopping malls and their retail tenants supply them.

They were defending the market based economic system of which the last step in a supply chain is the well-stocked shop around the corner from which they benefit in a practical and important way, as they well understand.

hey are unlikely to be able to explain that the market delivers via a highly complicated well informed supply chain that reaches across the globe. One that is held together through the discipline of required returns on their owner’s capital put to risk in all the different enterprises that link producers and their customers. Or appreciate that the feed-back loops that keep the system going are not designed or directed by any leader issuing orders. That the process evolves continuously in response to the essential knowledge of how it works best that is highly diffused among many millions of decision makers. Who are required to respond to the preferences of their customers that are signalled when they make their selections at the malls. That it is indeed in large measure a consumer led system.

These are the abstractions used to make the case for free markets and privately held property. Abstractions that are not easily grasped and compete with the other, more easily grasped, abstraction of a centrally planned economy. One led by a presumably all-knowing and equality minded, selfless and highly competent bureaucracy.

But the market system delivers the goods in abundance as SA the communities know very well – and they do not need to know more than the practice. They should be aware that the alternative to the market-consumer led system, whenever tried, has failed to deliver, other than to its powerful elites, who maintain their power and very unequal living standards by their ability to brutally repress any opposition that might dare to challenge their interests.

While the mob was attacking our system, Cubans were also protesting politely on their streets. Protesting for more economic freedom, more access to the goods and services and higher incomes that they know a market system could provide them with. It was most unusual protest in Cuba because it will be severely punished as the protestors must expect to be. The well-heeled Cuban establishment has one of the most effective surveillance systems to keep their citizens in line.

The market system however does depend critically on the provision of law and order- to protect property and wealth. Without it the incentive to save and invest and to take risks with savings, that is capital, falls away and economic progress is stunted.

The priority for the SA government, is to not only restore order but to provide every confidence that it will be able to provide protection against disorder in the future. This is the essential reform agenda. South Africans and their ability to take full advantage of what the malls could offer them needs not so much more law and order, but rather more order itself. The economy could do with much less law, of fewer rules and regulations, and obstructions of freedoms to engage and contract freely and usefully with each other.

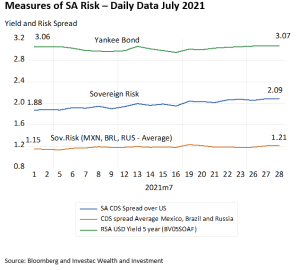

The signals from the financial markets indicate that the global investors have not changed their view of the SA economy this month. That all is by no means lost. The cost of insuring RSA dollar denominated debt this month has increased by 20 b.p. while the yield on a five-year RSA dollar bond is barely changed.

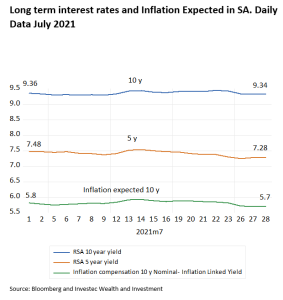

Long term interest rates in SA are largely unchanged as are inflation expectations.

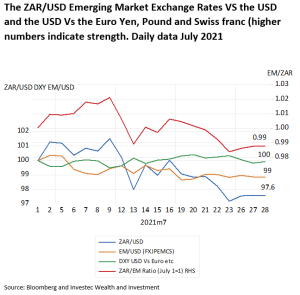

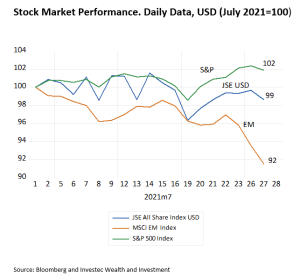

The rand weakened against the dollar this month by 2.4% but so have most other EM exchange rates- on average by about a per cent. And EM equity markets have underperformed the JSE this month- in USD- by about 6%

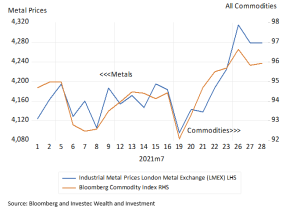

What remains very helpful to the SA are high metal prices. They have had a welcome pick-up since July 19th

The investor opinion of SA remains un-flattering yet one of wait to see. Correctly so.