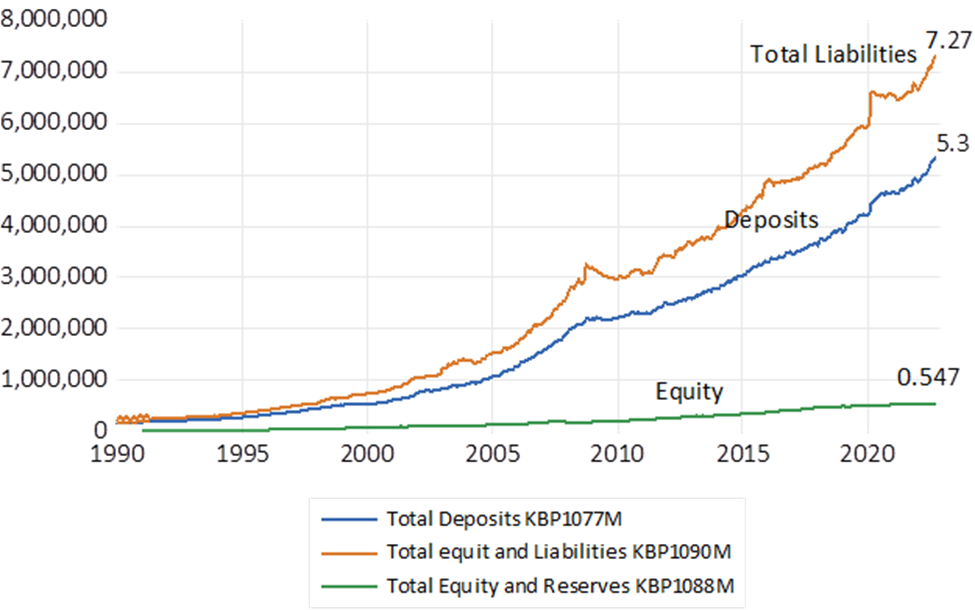

Banks are different to other financial intermediaries. They do more than borrow and lend. They manage the payments system without which any modern economy could not function. The payments system cannot be allowed to fail and banks deserve support should their stability come into question. Which, as was apparent in the US recently, cannot be taken for granted.

Banks maintain the payments system by supplying deposits to their clients and transmitting many of them on demand. They bear the operating costs of doing so – which are considerable. They have to remain viable businesses, so they have to cover their operating costs with transactions fees and more importantly by lending long and borrowing short- realizing net interest income, essential to their profits and survival. Banks, competing with each other, are forced to operate with very limited cash reserves. They hold very limited reserves of equity- that is owner’s capital – and are highly leveraged for the same profit seeking purpose. The dangers come with the territory.

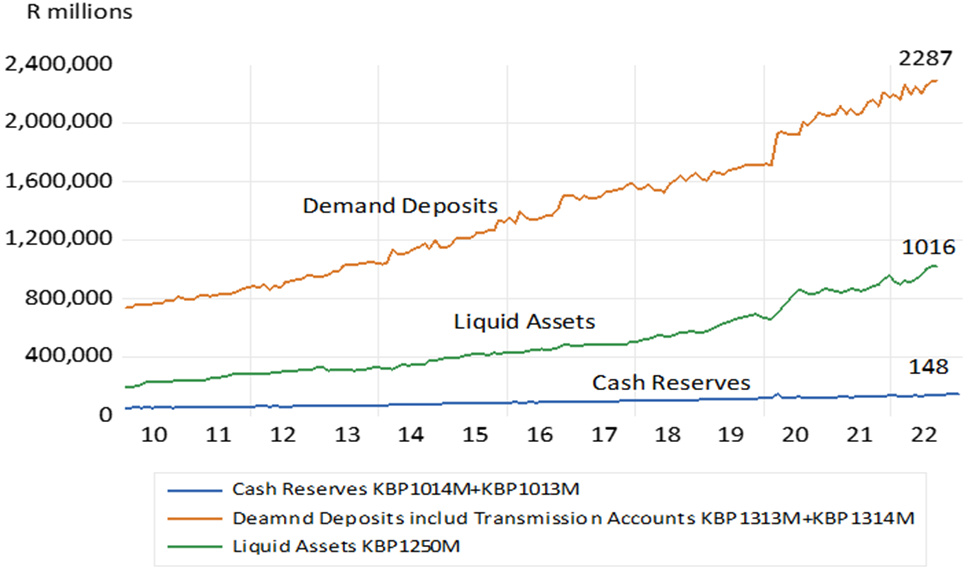

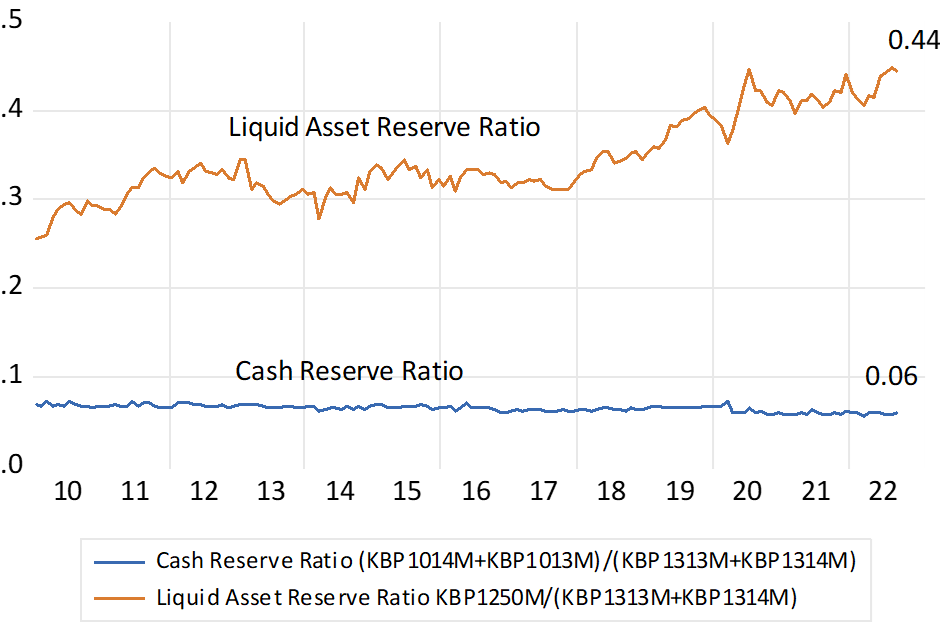

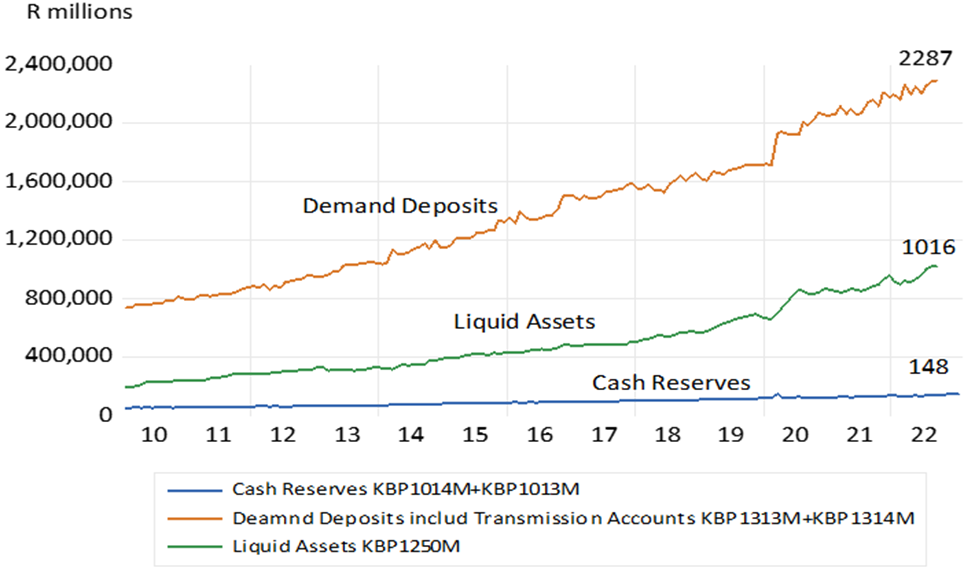

A margin of safety for them is to be found in their holdings of other liquid assets, mostly debt issued by the government, with varying maturities and interest rates, that the central bank will almost always repurchase for cash when asked to do so. In SA the cash to demand deposit ratio is less than three percent and the liquid assets to deposits ratio is now equivalent to about 40%.

SA Bank Deposits withdrawable on demand and Cash and Liquid Asset Reserves. January 2023

Source; SA Reserve Bank and Investec Wealth and Investment

Bankers everywhere must surely be considering attaching a longer notice period to their deposits and to reduce their dependence on transactions accounts – with interest rate incentives to do so. Giving them more time to call for a rescue from the authorities or other banks should their deposits drain away suddenly.

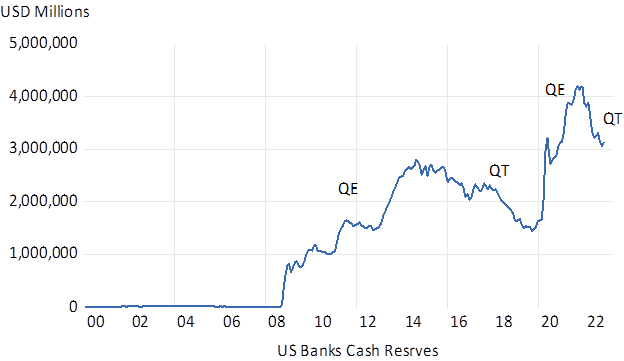

The relationship between the US Fed and its member banks changed in an important way after 2008. To rescue the banking system the Fed injected cash into the financial system on a very large scale through purchases of Government Securities from the banks and their customers in exchange for bank deposits with the Fed. A process of money creation described euphemistically as quantitative easing. (QE) Ever since then US banks have continued to hold large cash reserves despite short phases of quantitative tightening (QT) to reduce the supply of cash as is the case now- or at least before the banks ran into cash withdrawal problems

US Banks Deposits with the Fed

Source; Federal Reserve Bank of St.Louis and Investec Wealth and Investment

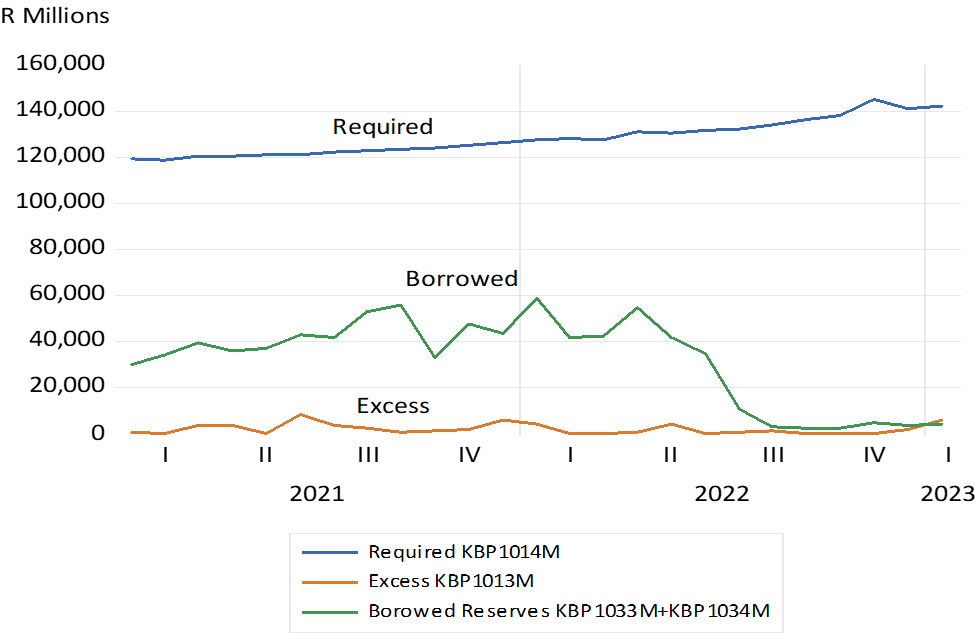

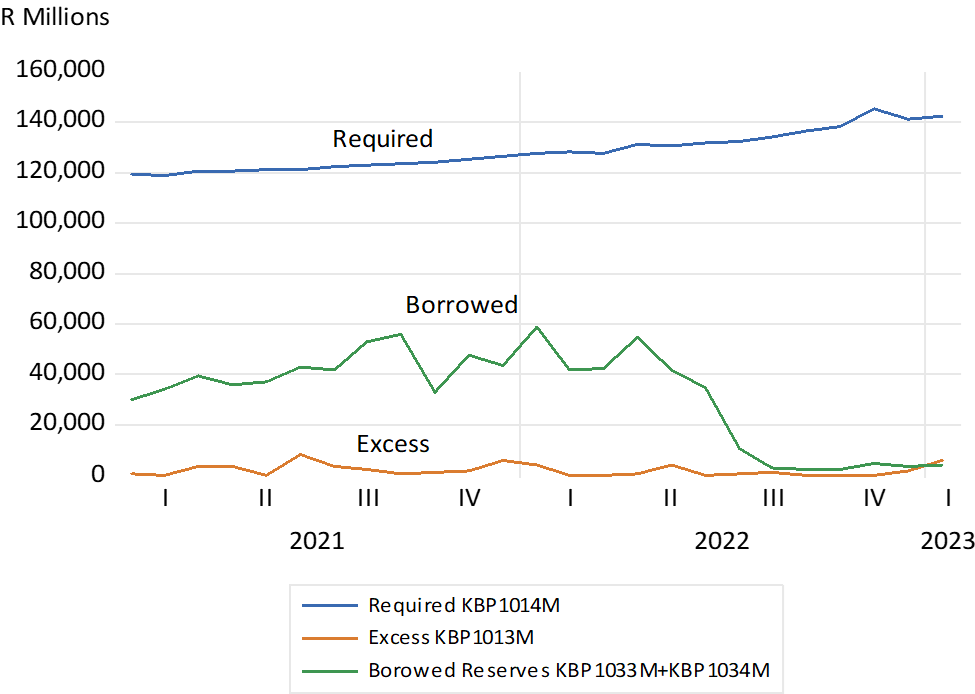

The policy determined interest rate is now the rate the Fed offers the banks on deposit rather than the rate charged them for cash borrowed. The SARB decided it too would no longer attempt to keep banks short of cash. SA banks since 2022 can now hold excess cash reserves and earn interest on them. Reserve Bank lending to the banks has fallen away sharply recently.

SA Banks; Actual, Required and Borrowed Cash Reserves.

Source; SA Reserve Bank and Investec Wealth and Investment

But will central banks be able to exercise good control over the supply of money (mostly bank deposits) and bank credit? The supply of bank deposits and supply of bank credit depends in part on the cash reserves supplied to them by the central bank. More cash supplied by the central bank leads to more bank lending and higher levels of deposits (M3) and vice versa. But this money multiplier (Deposits/Cash Reserves) can now rise or fall depending on how much cash the banks choose to hold, rather than on the extra cash supplied them by a central bank. One bank’s extra lending becomes another bank’s extra deposits. If the banks prefer to hold more cash and lend less, the supply of deposits and the money supply will shrink and vice versa. Therefore, the money supply will tend to grow faster during the booms when demand for bank credit is buoyant, and then grow slower when demands for bank credit is weak- as is now the case in the US – making a recession more likely. Ideally central banks can contain inflation and help smooth the business cycle by controlling the supply of money and credit. The current dispensation for banks with excess cash makes this less likely.