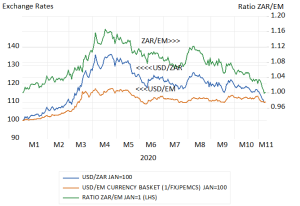

The prospect of an effective vaccine for Covid19 has been particularly good news for investors in SA. The ZAR has recovered all of the ground it had lost to other EM currencies through much of 2020 and is now only about 10% weaker against the dollar this year. In March, when the uncertainty surrounding Covid19 was most pronounced, the ZAR had lost 30% of its USD value of January 2020(see below) The ZAR has gained about 4% on both the EM basket and the USD this month. (see below)

Exchange Rates; The ZAR and the EM basket Vs the US dollar and the ratio ZAR/EM; Higher values indicate dollar strength (Daily Data Jan 1st 2020=100)

Source; Bloomberg and Investec Wealth and Investment

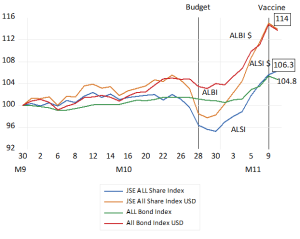

The JSE equity and bond markets consistently also responded very well to the good global news led by the companies that are highly dependent on the SA economy. The JSE All Share Index since October has gained 14% in USD and the JSE All Bond Index has appreciated by a similar 14% in USD. The emerging market index was up by 9.1% over the same period while the US benchmark the S&P 500 gained 5.4% over the same period. The JSE has been a distinct outperformer recently (see below)

The JSE Equity and Bond Indexes Daily Data (October 1st=100)

Source; Bloomberg and Investec Wealth and Investment

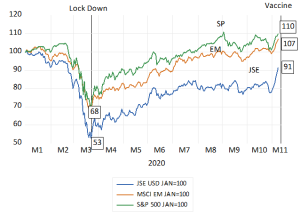

The JSE, The S&P 500 and the MSCI EM Indexes USD Values (Daily Data January 1st 2020=100)

Source; Bloomberg and Investec Wealth and Investment

These developments should not have come as a complete surprise. Such favourable reactions in the SA financial markets to a reduction in global uncertainties, usually accompanied by a weaker USD are predictable. What South Africans lose in the currency and financial markets when the world economy appears less certain, we regain when risk tolerance improves. SA unfortunately is amongst the riskiest of destinations for capital and investors who always demand higher returns as compensation for the risks they estimate. As taxpayers we pay out more interest and our companies have to offer higher prospective returns than almost anywhere else where capital flows freely, as it does to and from Johannesburg.

Recent developments in the markets do provide some relief for our beleaguered economy. The yield on long dated RSA bonds has declined by more than a half a per cent this month. With an unchanged outlook for profits such a reduction in the discount rate applied to expected income could add 10% to the present value of a SA business or roughly 10% its price to earnings ratio. (market reactions confirm this) A further reduction in these very high required returns – now equivalent to about 9% p.a after expected inflation – is much needed to encourage SA businesses to invest more. Essential if our economy is to grow faster.

Yet if the economy were expected to grow sustainably faster the discount rate would come down much further and businesses would be very willing to invest more in SA. And foreign investors would willingly supply us with their savings to do so. And the SA government would be much more confidently expected to raise enough revenue to avoid the danger of a debt trap and avoid a much weaker rand- expectations that are fully reflected in our high bond yields.

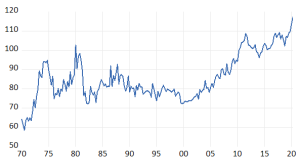

We can hope for the stars to align but should not expect them to do so. We can help ourselves by making the right policy choices. Opportunity presents itself. The terms at which we engage in foreign trade have improved consistently in recent years, by 20% since 2015. Think metal prices over oil prices. These relative price trends are even more favourable than they were in the seventies when the gold price took off. These developments should spur output and investment by business government policy permitting.

There is a further related large opportunity presented by the discovery of a major energy resource off our southern coast. Bringing the gas ashore can accelerate infrastructure and export led growth, funded by foreign capital not domestic taxpayers and led by business not government. It demands the kind of urgency that has brought us a vaccine.

South Africa. Terms of Foreign Trade. Export Prices/Import Prices (2010=100 Quarterly Data 1970-20200)