A shorter version was published in Business Day on 1. november.

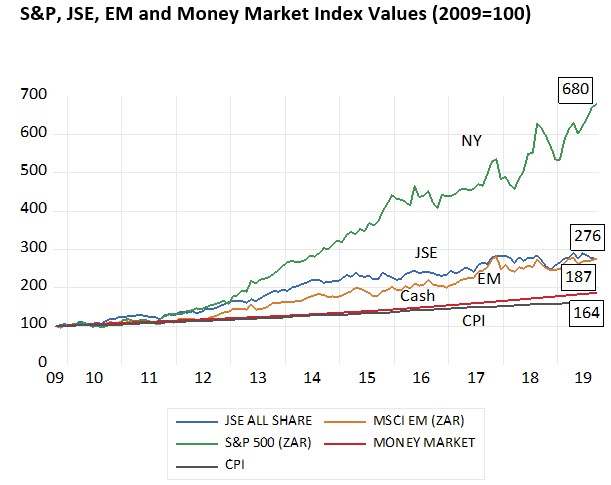

It is ten years since the Global Financial Crisis (GFC). R100 invested on October 2009 in the 500 companies that make up the most important equity index, the New York S&P 500 Index, would now be worth as R680, with dividends reinvested in the index. This is the result of extraordinarily good 12 month returns over the ten years that averaged over 18% p.a. in ZAR and 13.4% p.a in USD.

Most other equity markets have not performed anything like as well. R100 invested in the JSE All Share Index or in the MSCI EM, again with dividends reinvested, would now be worth about R276. This is equivalent to an average annual return of about 12% from the JSE over the ten years.

Ten years ago the SA bond market could have guaranteed the rand investor 9% p.a for ten years. Realized equity returns of 12% p.a therefore did not fully reward investors running equity market risks – assuming a required equity risk premium of 4% per annum.

The strong outperformance of the S&P 500 began in 2013 and has continued strongly since. It reflects very different fundamentals. The S&P 500 delivered growth in index earnings per share in USD of 11.7% p.a. over the ten years. By contrast the JSE delivered growth in index dollar earnings per share of only 1.46% p.a and 5.5% p.a in rands, over the ten years. Barely ahead of inflation.

Source; Bloomberg Investec Wealth and Investec Wealth and Investment

Back in September 2009, US Treasury Bonds offered a guaranteed 3.4% p.a for ten years. A good yield by the standards of today. This meant, at that especially fraught time, investors would have required an average return of about 7.5% p.a. to justify a full weight in equities, assuming the same required extra equity risk premium of 4% p.a. Actual realized returns on the S&P therefore exceeded required returns by about a very substantial 6% p.a.

Time has proved that the risks of financial failure in the US were greatly exaggerated. The lower entry price for bearing equity risk ten years ago, reflected by Index values of the time, proved unusually attractive.

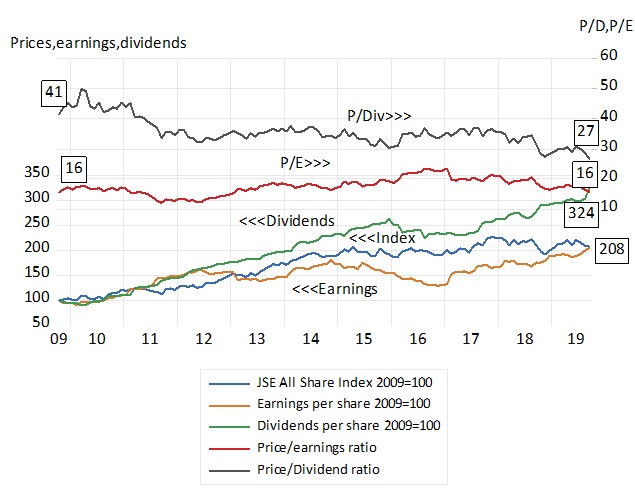

Dividends per JSE Index share by contrast with earnings have grown from the equivalent of R100 in 2009 to R324 in September 2019 while earnings per share have no more than doubled. The ratio of the JSE index to its dividends was 41 times in 2009- it is now only 27 times. The ratio of the Index to its trailing earnings per share was 16 times in 2009 – and is the same 16 times today. There has been no derating or rerating for the JSE. See figure below

The JSE over the past ten years. Values, earnings and dividends (2009=100) Price to earnings and dividend ratios.

Source; Bloomberg Investec Wealth and Investec Wealth and Investment

The equivalent required risk adjusted return of the highly diversified S&P 500 Index today is a mere 5.8% p.a. on average. With long RSA bond yields now offering close to 9% p.a. the required risk adjusted return from the average company listed on the JSE is now at least 13% p.a.

It has become increasingly difficult given slow growth and low inflation for a SA based company to add value for shareholders by earning returns on its capital expenditure of over 14% p.a. . And SA business has responded accordingly by saving and investing less and paying out dividends at a much faster rate. This is not good news for business or the economy. JSE listed companies would be much more valuable if they could justify investing more and paying out less- as US companies have done.

They need encouragement from faster growth in their revenues and earnings and lower interest rates. Lower short-term interest rates are in the power of the Reserve Bank and if reduced could help stimulate extra spending by households. SA business and its share market also need the encouragement of lower required long-term returns. That is from the lower long-term interest rates that would come with less inflation expected. Less inflation expected (and consequently lower interest rates) means a growing belief that SA will not fall into a debt trap and print money to escape it- that could be highly inflationary. So far and after the MTBPS last week not obviously so good. The jury remains very much out on the ability of the SA government to manage its debts successfully and the cost of capital for SA business has become even still more elevated.