The equity markets in New York appeared to gain some late afternoon relief yesterday from the Institute of Supply Management (ISM) survey of the state of nonmanufacturing activity (the NMI) in August. The survey is an influential and comprehensive one covering the very large proportion of economic activity in the US that is service rather than manufacturing based.

To quote the report:

“The NMI registered 53.3 percent in August, 0.6 percentage point higher than the 52.7 percent registered in July, and indicating continued growth at a slightly faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased 0.5 percentage point to 55.6 percent, reflecting growth for the 25th consecutive month, but at a slower rate than in July. The New Orders Index increased by 1.1 percentage points to 52.8 percent. The Employment Index decreased 0.9 percentage point to 51.6 percent, indicating growth in employment for the 12th consecutive month, but at a slower rate than in July. The Prices Index increased 7.6 percentage points to 64.2 percent, indicating that prices increased at a faster rate in August when compared to July. According to the NMI, 10 non-manufacturing industries reported growth in August. Respondents’ comments remain mixed. There is a degree of uncertainty concerning business conditions for the balance of the year.”

Thus it may be presumed that the US economy is still growing but at a modest pace. ISM numbers above 50 indicate positive growth rates. In other words the US economy is not in recession which will have come as something of a relief to the increasingly bearish mood. The employment numbers and hiring intentions indicated in the survey however remain a continued source of economic weakness and uncertainty. The employment sub-index registered 51.6 – therefore also indicating growth but was down from the 52.5 level recorded for July 2011.

Clearly very weak employment growth is the Achilles heel of the US economy and presumably of the re-election ambitions of President Obama. He will address the combined houses of Congress on Friday – on his plans for the economy – but by all accounts expectations are not high about any immediate policy breakthroughs. What could do a great deal for business confidence in the US would be clear directions from the President and his administration that the long term fiscal and debt issues facing the US are being addressed in a serious and realistic way. The concern is that the focus of policy will be on additional short term stimulus measures unlikely to find approval in the House.

The European debt crisis continues to add uncertainty and volatility to the markets with the Spanish government (with the active support of its main opposition) leading the austerity stakes (including support for a constitutional amendment to entrench fiscal conservatism) and the Italian government trailing behind by a day or two – though seemingly able to push through its own austerity programme through the Italian Senate today.

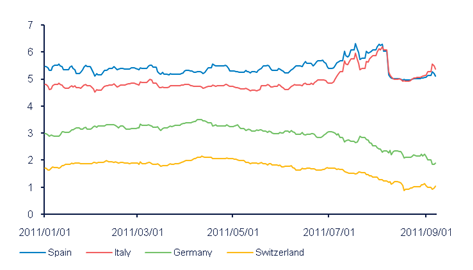

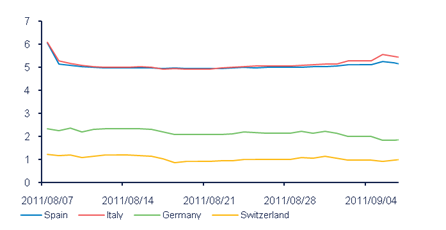

The reactions in the bond market are shown below. As may be seen Spanish 10 year bond yields have now fallen below Italian yields, having traded well above them this year. Such are the rewards for fiscal realism. As may also be seen these yields have been kept under control with ECB support this month. That the key governments under market stress seem able and willing even to bite the austerity bullet will help the ECB to maintain its support. Perhaps it will also encourage Germany to support a Eurozone bond market and the euro in Parliament: the German Constitutional Court has just ruled that this is the responsibility of the Bundestag Budget Committee – so rejecting claims that such support would be unconstitutional.