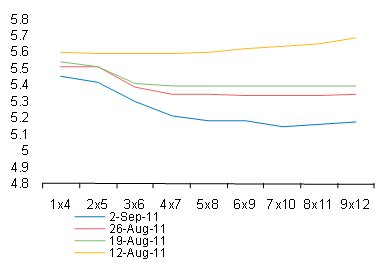

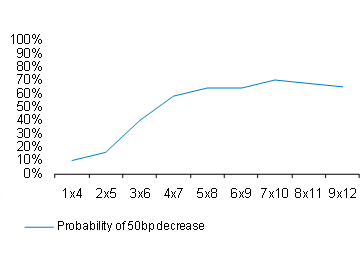

The money market is now pricing in a significant probability of a 50bps cut in the repo rate by early next year. The three month interest rates offered by the SA banks on forward rate agreements have been declining sharply since mid August and they declined further last week indicating a more than 50% chance of a 50bps cut within six months.

It seems clear that the focus of the Reserve Bank is now firmly on the state of the SA and the global economy rather than on any short term blips in the inflation rate, over which the Bank has little influence. Without a series of unexpectedly good news about the global economy (and the SA economy, especially about demands for credit), these lower interest rates (now factored into and expected by the financial markets) will become a very necessary reality.