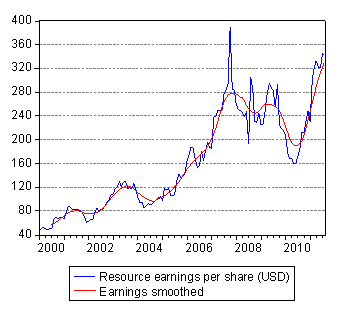

In the midst of market turbulence it may prove helpful to focus on earnings rather than prices. Index weighted earnings per share reported by the Resource companies listed on the JSE over the past 12 months have risen very sharply.

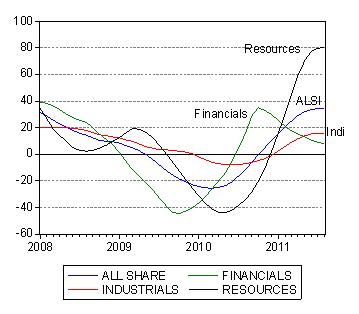

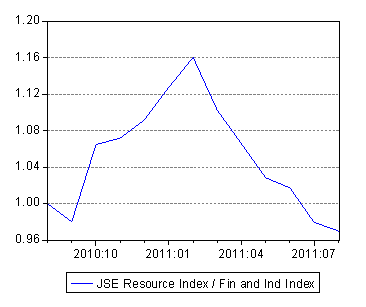

These earnings per share in rands have grown by about 80% over the past 12 months (given rand stability the growth rates in rands have been very similar to growth recorded in US dollars). Resource companies have significantly outperformed other sectors of the JSE on the earnings front. Yet when valuations are considered, JSE Resources have proved distinct underperformers since the beginning of the year. JSE resources, when compared to the Financial and Industrial Index, are about 20% weaker than in early 2011.

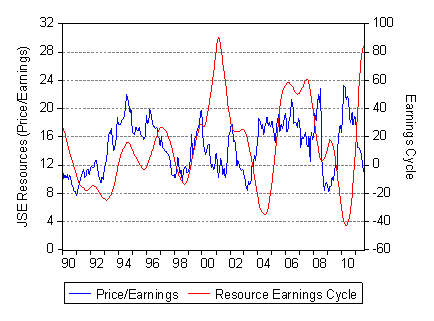

Clearly the share market must be expecting a very sharp decline in resources earnings from current levels to have derated the sector as much as it has. As we show below, the peaks in the resource earnings cycle have often been associated with declines in the price to earnings ratios established for the sector. This relationship – a peak in the price to earnings multiple and a trough in the earnings cycle – appears particularly obvious over the past 12 months. The earnings cycle is approaching a very high peak while the price to earnings multiple has headed sharply in the other direction.

The valuations therefore seem to be predicting the impact of a global recession on underlying metal and mineral prices and therefore in turn on resource earnings.

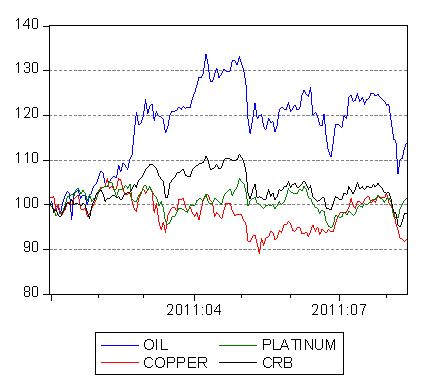

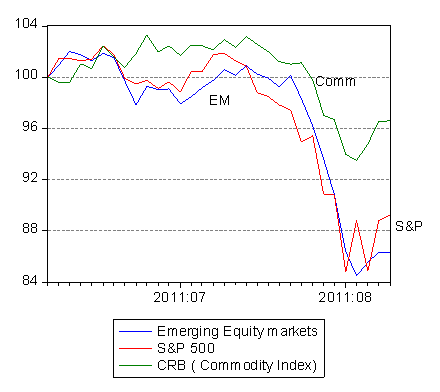

Commodity prices have however have held up over the past and in recent turbulent weeks rather better than equity valuations, as we show below. Recession fears – especially for the global economy – may be overdone. If so commodity prices may remain resilient and current resource valuations will then prove very undemanding.