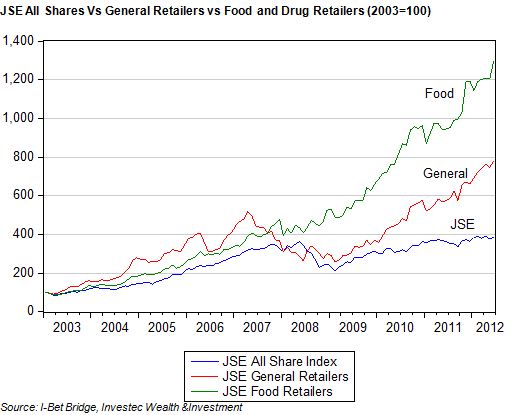

JSE listed retailers listed in the General Retailer or Food and Drug Retailer sub-indexes continue to enjoy great approval from investors. They have outperformed the All Share Index since 2003 by very large margins with the Food and Drug Retailers performing especially well with this Index rising by an extraordinary 1200% over the period 1 January 2003 to 22 June 2012 compared to a still very satisfactory 400% improvement for the All Share Index.

The General Retail Index did twice as well as the All Share. Over the period January 2003- June 2012 the JSE ALSI provided an average return, including dividends, calculated monthly of 15.2% p.a., compared to 25.3% from the General Retailers and 28.7% realised by the Food and Drug Retail Index.

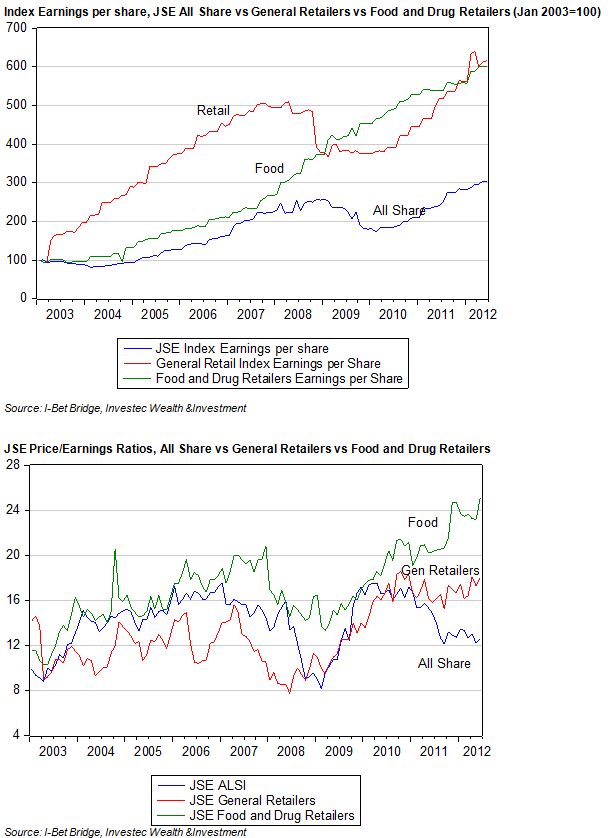

The sector has re-rated: prices have risen further than earnings

The outperformance by retailers was almost as impressive on the earnings front. Retail Index earnings per share have grown twice as fast as All Share Earnings, growing six times compared to the three fold increase recorded by the market as a whole (including the contribution made by retailers. The General Retailers, having seen earnings decline in the recession of 2009, have now caught up with Food and Drug Index earnings per share. Impressively the Food and Drug Retailers were able to sustain impressive growth in their earnings despite the recession.

Over the past twelve months to 22 June the General and Food Retailers, co-incidentally, both provided their shareholders with as much as a 34% return. Clearly investors continue to be surprised by the sustained excellent economic performance of the retailers. Returns of this order of magnitude are far in excess of the risk adjusted returns required to satisfy investors and therefore must represent further unexpectedly good performance over the past twelve months. But having been surprised, investors have come to expect more from their retailers, as revealed by more demanding valuations.

The Food retailers are trading at over 25 times trailing earnings and the General Retailers 18 times compared with the market as a whole that is priced at a much less demanding 12.5 times reported earnings.

Identifying the performance drivers

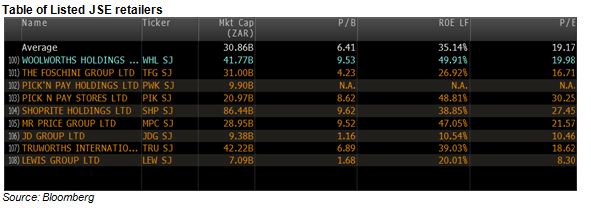

As we indicated in our previous report on retailers on the JSE, these companies, in growing their earnings, have realised extraordinarily good (internal) returns on shareholders capital they have invested in recent years. The accounting returns on equity capital for the latest reporting period have ranged from 20% to 49% as indicated in the table below.

Given these exceptionally good returns on capital and given what have become demanding market valuations, we thought it helpful to compare the listed retailers using three metrics. In our previous report we compared Shoprite to Pick n Pay and Woolworths. In this report we extend the comparison to Truworths (TRU), The Foschini Group (TFG) and Mr Price (MPC).

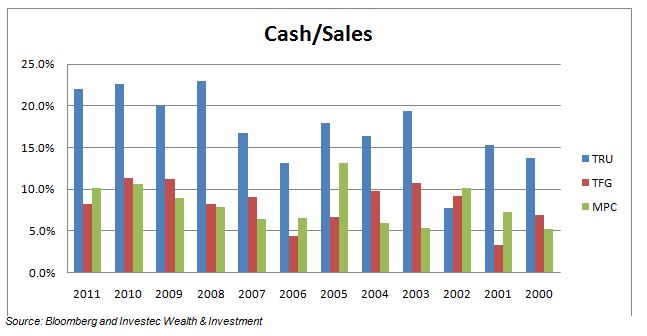

Firstly we compare the ability of the different retailers to realise cash from sales revenue. In the figure below we compare cash to sales ratios of three retailers. All three have proven ability to turn sales into cash on the balance sheet but TRU is a clear leader in this regard as may be seen.

But realising cash is not all that will determine the value of the company. It is what is done with the cash that will matter to shareholders. Investing the cash will add more value than paying it out in dividends or share buy backs, provided the returns on capital exceed their opportunity costs. Clearly the retailers meet this proviso by large margins.

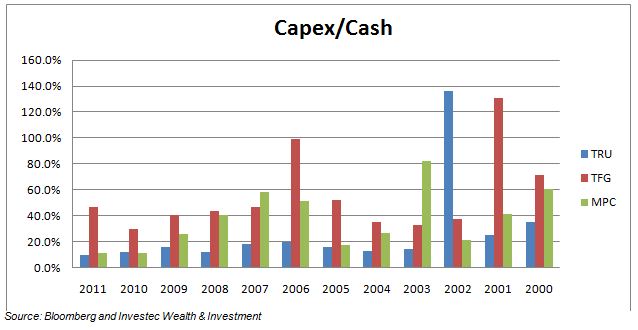

We show the ratio of capex to cash flows below. By this criterion TRU ranks behind MPC and more so TFG. TFG appears as the most willing to turn cash into fixed and perhaps also working assets. But all three retailers typically invest only at best to half the cash they generate.

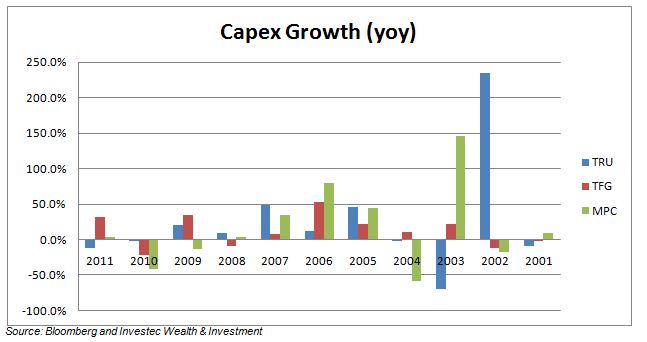

This reluctance, or rather perhaps the inability, to find value adding investment opportunities is demonstrated by rather tepid and variable growth in capital expenditure itself as we show below. As may be seen the rate of capital expenditure appears to have slowed down in recent years.

Conclusion

It seems fair to conclude that these listed retailers have done done much better at the operating level than they have at identifying and implementing growth enhancing investment activity. If they are to surprise the market in the future as they have done in the past, they would need to do both. Brian Kantor