What explains the recent ascent of the gold price to record levels? Is this a sign of extreme anxiety about the state of the world – the end of the world as we know it – or perhaps something else, more easily explained by economic fundamentals?

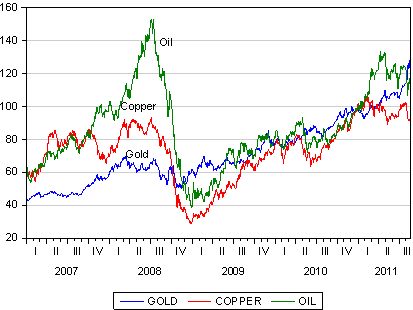

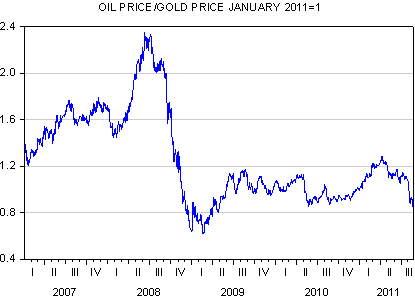

The performance of gold since 2007 has been impressive indeed. The price of gold has risen almost uninterruptedly since early 2007, by about four times since then, with rather low volatility from day to day. Good returns with low risk are a very attractive combination very likely to attract investor interest. More impressive still is that the price of gold was hardly affected by the global financial crisis of 2008-09 when other commodities and metals (and also equities) fell away so dramatically.

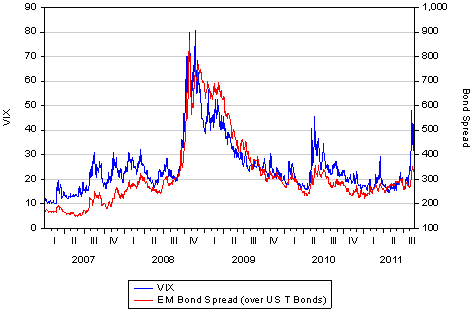

The times have become more uncertain, as is revealed by the indicators of risk and volatility in the form of the volatility priced into options on the S&P 500 (The VIX) as well as the risk spread offered by emerging market (EM) government bonds over the yield on US Treasuries. But as we show below, while these risks have increased significantly lately driving down equity and EM bond prices, they are a far cry from the risks priced into markets at the height of the financial crisis. This is especially true of the emerging market bond spreads which are far below those crisis levels. There may well be a crisis of confidence in global financial markets but, so far at least, it is one far lower on the financial Richter scale than was the crisis of 2008.

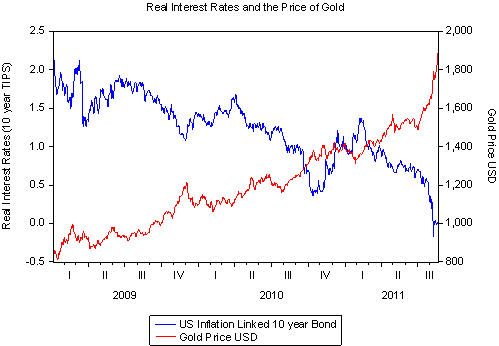

How then to explain the much higher price of gold and its more or less continuous ascent? The cost of holding gold is interest income foregone. Perhaps more relevant as an opportunity cost of holding gold is real, after inflation interest rates foregone. As we show below the price of gold has gone up as real interest rates have fallen. The relationship between the falling real yield on a US 10 year inflation linked bond (TIPS) and the US dollar price of gold over recent years an almost perfectly negative one: the correlation statistic is (-0.90).

Gold has gone up as real interest rates have fallen, in a highly consistent way, with the yield on a 10 year Tips now a negative one. Investors are paying up for the right to an inflation linked yield.

Holding cash at even a zero (not negative) yield would seem to offer a superior return. However holding cash is usually in the form of deposits in a bank, which (so some fear) may not to be able to pay the cash back at full face value. This anxiety about the future of banks and uncertainty about future inflation (which may flare up again), may be part of the explanation for negative real interest rates and so the higher price of gold.

However the lack of demand for capital to invest, combined with abundant supplies of savings emanating from China in particular, is a further part of the explanation for very cheap capital and so very low costs of owning gold. These low costs of ownership apply also to other commodities and for that matter equities that pay more or less inflation linked dividends. That gold and other commodities should have so dramatically outperformed equities recently is perhaps the bigger mystery than the price of gold.

Hi,

The last graph is a repetition of the one above it… Do you maybe have the gold price/real interest rate graph you mention?

Great piece!

Thanks,

Sam

Hi Sam,

Thank you for pointing that out. I have replaced the figure with the one that was meant to be there.

– Hakon Kavli (administrating Kantor’s blog)