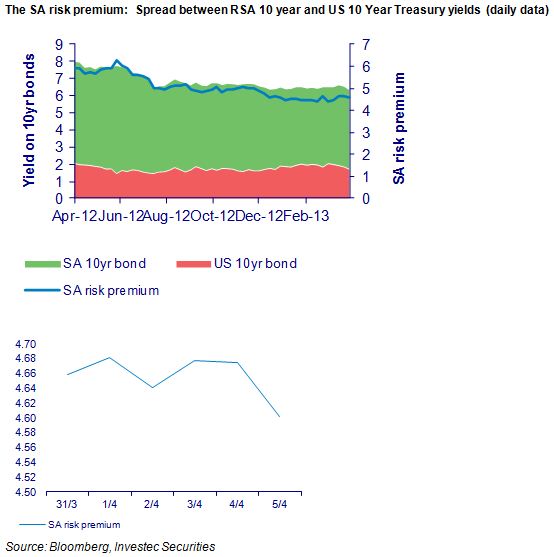

There were some interesting developments on the SA interest rate front late last week. Long term rates in SA declined by more than they did in the US. Thus the spread between the rand yields on long dated RSAs over US Treasury Bonds narrowed.

This spread is equivalent to the rate at which the rand is expected to depreciate against the US dollar over the next 10 years or so. It is notable that as the rand weakened over the past 12 months the spread actually narrowed, indicating less (rather than more) rand weakness to come in the years ahead. This spread, which we describe as the SA risk premium, was over 6% this time last year; last week it had fallen to 4.58% (see below).

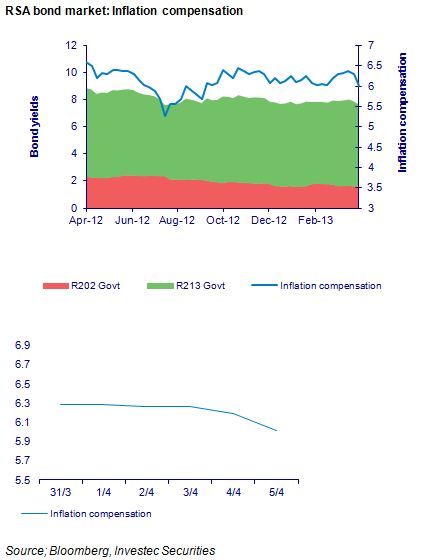

The gap between long dated vanilla RSA bonds and their inflation linked equivalents remains stubbornly around the 6% plus range, though this compensation for bearing inflation risk (implicit in long dated fixed interest) also narrowed marginally.

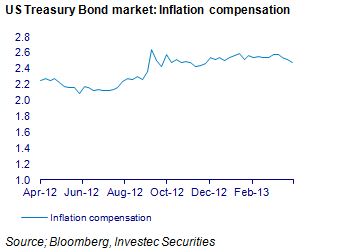

Inflation expected in the US, calculated similarly as the difference in yields on vanilla bonds and inflation linkers of similar duration, is of the order of 2.5%. This spread has widened marginally over the past 12 months (see below).

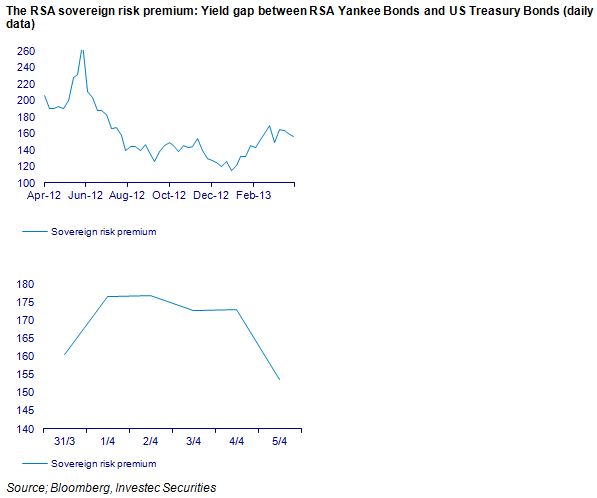

The spread between RSA US dollar-denominated (Yankee) bonds and US Treasuries also narrowed last week to about 150bps. The spread was below 120bps in December 2012.

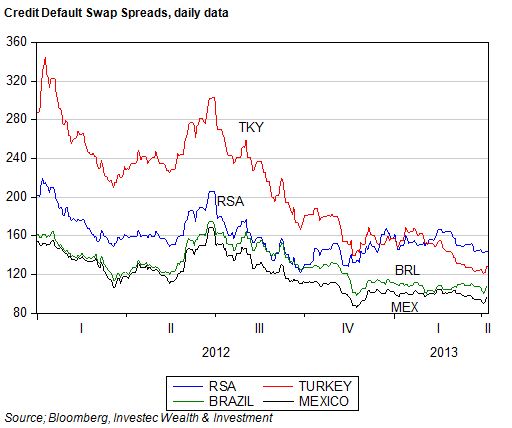

RSA US dollar bonds have not performed as well as most of their emerging market peers over the past 12 months. Turkey now enjoys a superior credit rating to SA. Mexican and Brazilian bonds have been in particular favour with global investors as we show below.

A fair wind from Japan

The force dominating developments on the global interest rate front last week was the carry trade in the yen. Despite the markedly weaker yen – in response to aggressive money creation in Japan – interest rates in Japan remain below yields everywhere else. Thus borrowing yen to buy higher yielding securities everywhere else, including in SA, must have seemed like a good idea late last week. It has certainly proved to have been a good trade this week and may well be judged to offer further advantages in the weeks ahead. The rand and bond yields in SA will benefit from any such further yen carry trade – as should the interest rate plays on the JSE. Brian Kantor