The group of countries that will make up the enlarged BRICS, Argentina, Egypt, Ethiopia, Iran, Suadi Arabia and the UAE have little in common other than a deep suspicion of the motives of the US and its close allies. A state of mind also shared by left wing opinion everywhere including in the US itself. If the unlikely combination of kingdoms, autocracies and genuine democracies is to become more than a another talking shop with an anti-West bias, then it should take an important lesson from the economic development of the US and Europe.

What has been of great benefit to the US and to Europe, since it established a common European market and Euro are their highly significant common currency areas. The same money is used everywhere in the US and Europe as a medium of exchange and a unit of account. Thus unpredictable rates of exchange when buying or selling goods and services across frontiers are avoided, as are the direct costs of converting one currency into another- usually converting US dollars -into the domestic money.

Trade and financial flows between the states of the US and now of Europe is greatly encouraged by what is a fixed exchange rate regime within a common market, also free of protective of domestic industry tariffs or discrimination against foreign suppliers, by regulation. As it does incidentally when transactions of one kind or another take place within any country. The important trade between Gauteng and the Western Cape for example is facilitated by prices set in the rand common to both.

In the nineteenth century when which international trade and finance first flourished and economies came to benefit from wider markets for their goods and labour, and the ability to realise productivity and income enhancing economies of scale, currencies were mostly linked by fixed rates of exchange. The link was the ability to convert the different monies, if necessary, into gold at a fixed rate. And the issuers of different monies made sure to maintain convertibility by protecting their balance of payments through adjusting domestic interest rates. If gold generally flowed out interest rates could be raised to conserve and attract gold reserves and vice versa. Provided the commitment to currency convertibility was fully credible, the extra interest received would balance the payments by attracting or retaining capital.

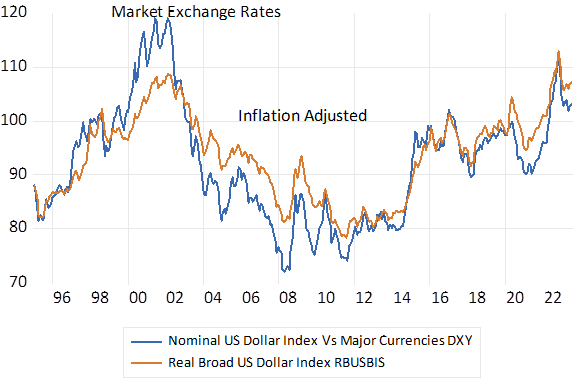

A modified fixed exchange rate system was re-established after the second world war with the US dollar as the reserve currency- but dollars that could be converted into gold at the request of other central banks. This commitment was abandoned unilaterally by the US in 1971 and market determined exchange rates, with the still dominant US dollar, became the norm. Highly variable rather than predictably fixed exchange rates have become the unsatisfactory order of the day. The rates of exchange of other currencies with the dollar, both in money of the day terms and when adjusted for differences in inflation of different currencies have varied very significantly – and unpredictably- damaging volumes of international trade and real investments.

US Dollar Exchange Rate Index. Market Determined and Inflation Adjusted

Source; Bloomberg, Federal Reserve Bank of St.Louis and Investec Wealth and Investment

It has not been a case of exchange rate moves levelling the playing field for traders in goods and services- so maintaining purchasing power parity in the face of differences in inflation rates across trading partners. Rather the exchange rates have adjusted to equilibrate independent flows of capital – large and reversible flows – in search of better risk adjusted rates of return- to which inflation then responds. Weaker exchange rates lead to more inflation and vice versa. Without stable exchange rates, controlling inflation in the face of capital withdrawals and a suddenly weaker exchange rate with the US dollar can become a severe interest rate burden on the domestic economy – as South Africa demonstrates.

The enlarged BRICS could establish fixed exchange rates between each other to promote trade and investment. They might usefully adopt a Chinese standard- that is offer convertibility of their own currencies into Renminbi at fixed rates. And rely on the Bank of China to manage the float of the crucial rate of exchange of Renminbi into US dollars, as it now does.