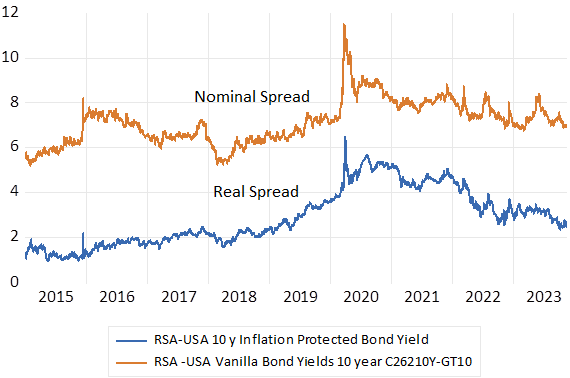

South Africans this week benefitted from a powerful demonstration of our integration into global capital markets. On Tuesday November 14th, the interest yield on the key ten-year US Treasury Bond fell by about 20 b.p. from 4.63% to 4.44% p.a. By the end of the day, the 10 year RSA bond yield had declined by the same 20 b.p. from 11.66% to 11.45% p.a. The yield on a RSA dollar denominated five year bond fell from 7.52 to 7.19 per cent p.a. leaving the yield spread with the US TB, an objective measure of SA sovereign risk, slightly compressed at 2.76% p.a. The dollar weakened across the board. And with higher bond values the share markets almost everywhere responded very agreeably for investors and pension plans. The JSE gained nearly two per cent on the Tuesday (5% in USD) and again by a further near 2% on the Wednesday.

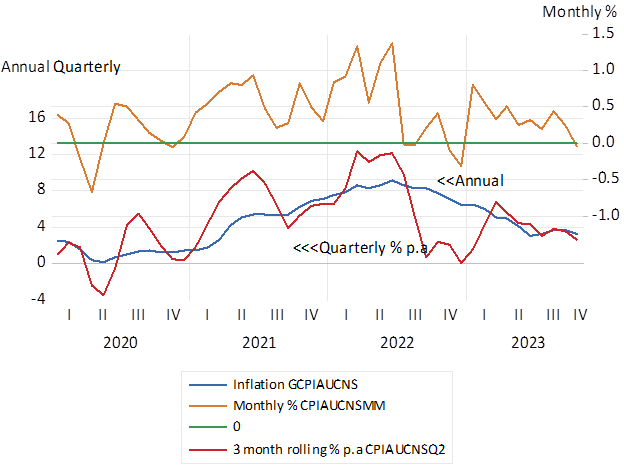

All this on the news that inflation in the US had fallen to by a little more than had been expected after the CPI remained unchanged in the month. The chances of further increases in short term interest rates therefore fell away as they have in SA. And long rates moved in sympathy. Should the US economy slow down sharply as slowing retail spending as strongly suggested in a print released on Thursday, declines in US short rates will follow in short order adding to dollar weakness and rand strength. Or at least as investors, if not yet the Fed, thinks.

US Inflation; Annual, Quarterly and Monthly

Source; Federal Reserve Bank of St.Louis and Investec Wealth and Investment

All it might be thought as much ado about relatively little- a mere blip on the CPI. If you could predict nominal US GDP and interest rates over the next ten years you would be able to predict share and bond values with a high degree of accuracy- if the past is anything to go by. Predictions that will not be much affected by the failure of the Fed to manage inflation during the Covid lockdowns. Or by what has been its near panic and confusing rhetoric in dialing back inflation. That so roiled the equity and bond markets in 2021- and 2022, a strong bull market in most of 2023 has yet to fully recover from.

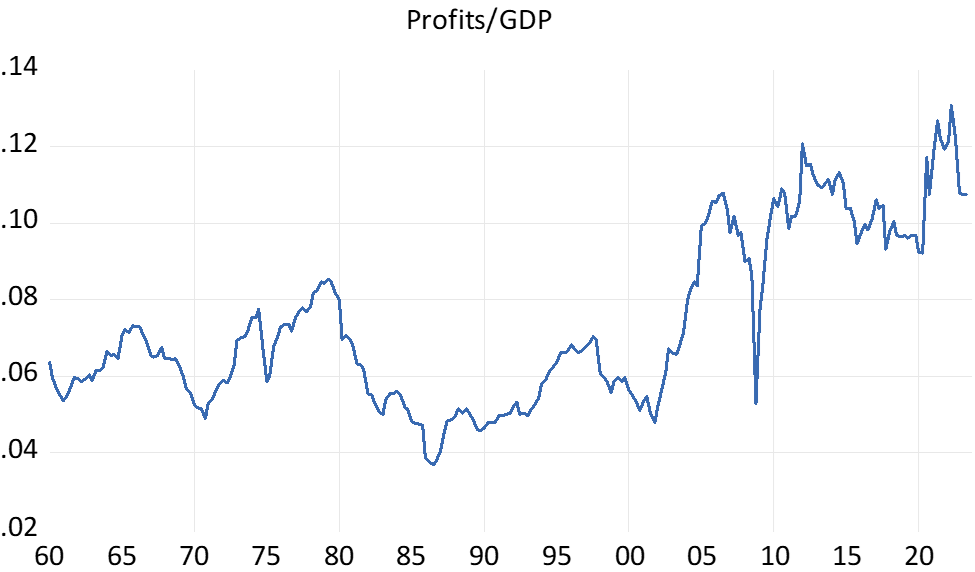

Perhaps the most intriguing feature of recent trends in the US GDP has been the growing share of Corporate Profits after taxes in GDP. The ratio of these profits to GDP- have nearly doubled since the early nineties. A profit ratio that investors must hope managers, with the aid of R&D, in which they invest so heavily, can defend to add to share values.

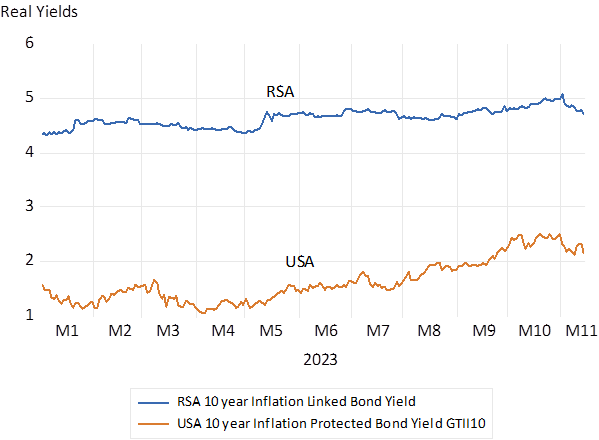

Another question about the long run value of US corporations and their rivals elsewhere will be about the cost of capital by which their expected profits will be discounted. A puzzle is why have long term interest rates in the US have increased as much as they have this year? It is not more inflation expected that have driven up yields. They have remained well contained below 3% p.a. despite higher rates of inflation. Quantitative tightening – the sale by the Fed and other central banks of vast amounts of government bonds bought after the GFC and during Covid, is surely part of the explanation.

But it is not only vanilla bond yields that have risen this year. Real yields- the inflation protected bond yields – have risen dramatically this year. From near zero earlier in 2023 to their current over 2% p.a. Clearly capital has become not only more productive of profits in the US – it has also become more expensive in a real sense, to counter productivity and profit gains when valuing companies. Will it remain so? That is the trillion-dollar question.

US Share of after tax corporate profits in GDP.

Source; Federal Reserve Bank of St.Louis, Investec Wealth and Investment

The gap between real interest rates in SA where a very low risk ten-year inflation linker offers over 4% p.a. – making for very expensive capital for SA corporations, and the US – has narrowed sharply. Surprisingly perhaps, real interest rates in SA have not followed global trends. Making for at lease relatively lower costs of capital for SA based corporations, good news, which we can hope will lead to more investment.

Inflation Protected Real Bond Yields RSA and USA – 10 year bonds

Source; Bloomberg and Investec Wealth and Investment

Risk Spreads – RSA-USA 10 year Bond Yields

Source; Bloomberg and Investec Wealth and Investment