How are governments and their central banks responding to the damage from the lock downs forced upon their economies and their citizens? They are doing all they can to minimize the damage to incomes sacrificed during the lock downs. There is no reluctance to spend- the issue is not about how much but rather how best to spend. Restraints on fiscal deficits and money creation have been abandoned – and rightly so in the circumstances.

When so much central bank lending is to the government, even via the secondary market replacing other lenders, the distinction between monetary and fiscal policy falls away. The British government made this clear when it exercised its right to a large overdraft on the Bank of England. The Bank could not and would not say no to such a demand for funding, giving the state of the Kingdom. The US Fed has added over 2 trillion dollars of cash to the US banking system over the week to April 10th. That is increased its balance sheet by 50% over a very busy week. The federal government has budgeted for trillions of dollars of extra spending- including spending to cover possible losses on the Fed’s loan book.

Issuing money is usually the cheapest way for any government and its taxpayers to fund such emergency spending. Though when interest rates on long term government debt is close to zero – more so if interest rates are negative – as in the developed world- issuing debt is almost as cheap as issuing money. Though where would interest rates settle without the huge loans provided to governments and banks by their central banks?

This is not the case in South Africa and many other emerging economies. Issuing long term debt at around 10% p.a. is an expensive exercise. Issuing three-month Treasury Bills at 5% p.a is also expensive. For central banks to create money for their governments and tax-payers is a much cheaper option. Is there not the same good reason for them to support government credit in the same exceptional circumstances as vigorously as is being done in the developed world to universal investor approval?

There is every reason for the SA government to rely heavily on its central bank at a time like this. With the same proviso as applies in the developed world. That is when the economy is again running close to its potential the stimulus should be withdrawn to avoid inflation. That test however will come later. There is an immediate challenge to be met now. And spending and lending without usual restraint is rising to the challenge.

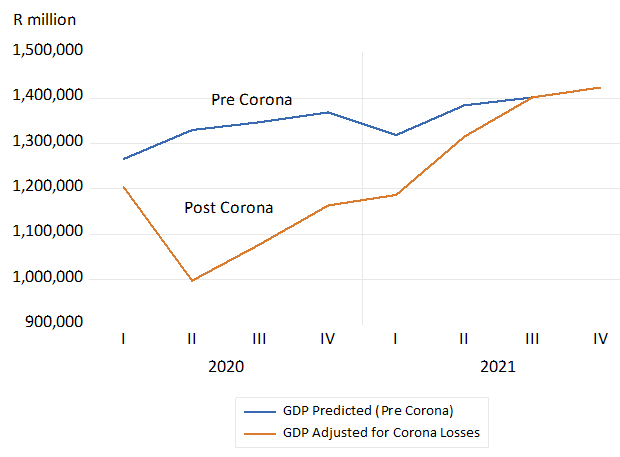

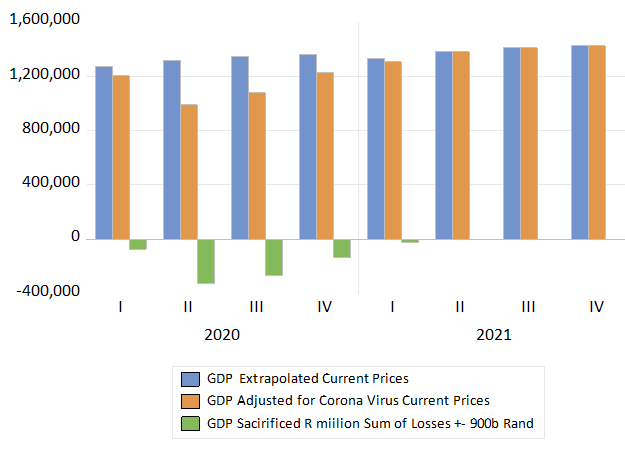

How much economic output and income will be sacrificed over the period of the lock-down and the gradual recovery after that? A broad- brush comparison between what might have been without Corona and what may yet happen to the SA economy can be made. The loss in output as a result of the shut downs – the difference in what might have been produced and earned had GDP performed as normal in 2020 and 2021, and what now – post Corona- is likely to be produced has been estimated as follows.

We first estimate economic output and incomes (GDP at current prices measured quarterly) had the economy continued on its recent path unaffected by Corona. To do this we use standard time series forecasting method. That is to extrapolate what might have transpired had GDP in money of the day continued to grow at its very pedestrian recent pace of about 4- 5 per cent per annum. GDP inflation in recent years has been of the order of four per cent per annum meaning indicating very little real growth was being realized as is well known. We then make a judgment about how much of this potential output will be lost due to the shutdowns. We estimate a GDP loss ratio for the quarters between Q1 2020 and Q4 2021 to calculate this difference between pre and post Corona GDP.

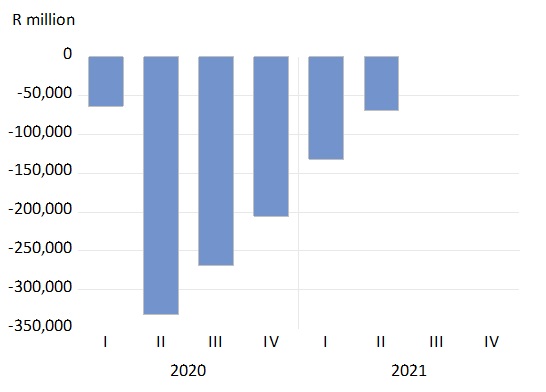

The cumulative difference – the lost output and incomes over the next two years we estimate as of the order of R1,071,486 millions – that is approximately R1 trillion of lost output will be sacrificed to contain the spread of the virus. This one trillion is equivalent to approximately 24% of what might have been the GDP in 2020. (See figures below)

GDP and GDP after Corona (Quarterly Data Current Prices)

Source; SA Reserve Bank and Investec Wealth and Investment

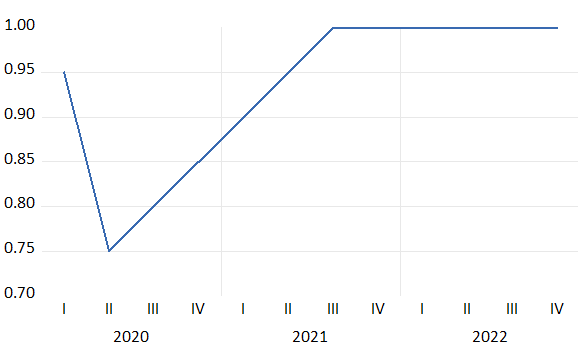

The loss ratio – the percentage of the economy that remains after the shutdown is the crucial judgment to be made. We have assumed that the economy operated at 95% of its pre-Corona potential in Q1 2020. Then as the impact of the lock down intensifies through much of Q2, the economy it is estimated will utilize only 75% of capacity in Q2. This, it is assumed, will be followed by somewhat less damage in Q3 when the economy is assumed to be operating at 80% of potential capacity as the lockdown is gradually relieved. Conditions are then expected to continue to improve by the equivalent of 5% each quarter. That is until the economy gets back to where it might have been without the lock downs assumed to be in the second quarter of 2021.

This almost V shaped recovery might well be too optimistic an estimate. The losses in 2020 may well be greater and the recovery slower than estimated. But the output gap – the difference between what could have been produced and what will be produced, for want of demand as well as ability to supply, will be a very large one.

Loss of Output Ratio – GDP Adjusted/GDP Estimate (pre-Corona)

Source; SA Reserve Bank and Investec Wealth and Investment

Estimated Loss in GDP per Quarter (R millions) Sum of losses 2020-2021 = R107146m

Source; SA Reserve Bank and Investec Wealth and Investment

The pace of recovery will depend in part on how much the government spends and how much the Reserve Bank supports the government and private sector with extra cash. The more support provided to the economy in one way and another by the government and the Reserve Bank, the more demand will be exercised and the smaller will be the eventual loss of output. Any reduction in economic damage of the large likely order estimated is a clear gain to the economy. Any additional utilization of what would otherwise be wasted capacity- human and material- comes without real economic cost. That extra demand can bring forth extra supplies would be pure gain to the economy, especially if funded with central bank money.

It is not clear that the Reserve Bank sees the SA predicament in this same urgent way. In the way central banks in the developed world are seeing and acting. It has the opportunity to create more of its own money without any cost – to help borrowers –not only the banks and the government but also private businesses directly through its lending. Unlike its peers in the developed world it also has scope to significantly lower short-term interest rates. All the way close to zero would make sense. It should not be hesitating to act boldly. Any inflation that may come along later with a recovery in the economy will have to be dealt with in its own good time.

Post-Script on Growth Rates They will not mean what they usually do post the crisis.

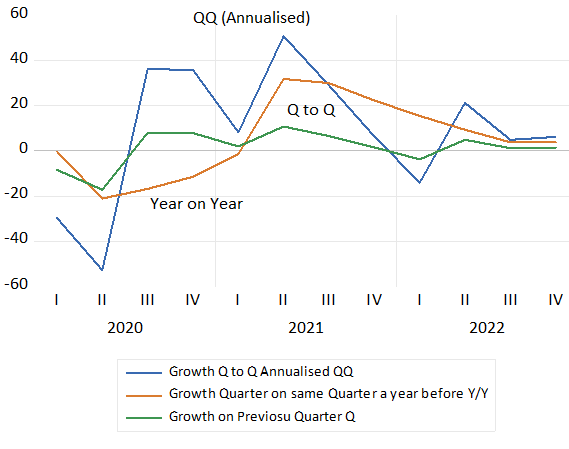

GDP growth rates are most often presented as annual percentage growth from quarter to quarter when the GDP has been adjusted for seasonal influences and converted to an annual equivalent That is growth from one quarter in seasonally adjusted GDP to the next quarter raised to the power of 4. This is the growth rate that attracts headlines. (Q1 is always a below average GDP quarter)

Two consecutive negative growth rates measured this way are regarded as indicating a ‘technical recession’. The implication of this measure is that quarterly growth will continue at that pace for the next year. Clearly under the influence of lock downs growth measured this way is likely to become much more variable than it usually is.

This will be especially true in Q2 2020 when the impact of the lock down will be at its most severe- maybe reducing annual growth to an annual equivalent negative rate of growth of 50% or so. Estimating growth on this quarter to quarter basis over the next few years will be a very poor guide to the underlying growth trends. It may show a very sharp contraction in Q2 2020 to be followed by positive growth of 40% p.a. in Q3 and Q4, 10% in Q4 and then as much as 50% again in Q2 2021. The recession will seemingly have been avoided and the economy will soon be recording boom time growth rates. A likely and highly misleading account of what will be going on with the economy it must be agreed.

If GDP is compared to the same quarter a year before we will get a much smoother series of growth rates. It is likely to show negative growth throughout 2020, (down by as much as -20% p.a in Q2) with strongly positive growth of 30% only resuming in Q2 2021, off a highly depressed base of Q2 2020 when the lock down was at its most severe.

The better way to calculate the impact of the lock down in terms of growth rates would be to calculate the simple percentage change in GDP from quarter to quarter as the impact of the lock down unfolds and gradually, we hope, dissipates. The worst quarters measured this way will be Q2 and Q3 2020 after which quarter to quarter growth in percentage terms will become positive.

Estimated Quarterly Growth rates between 2020 and 2022 under alternative conventions.

Source; SA Reserve Bank and Investec Wealth and Investment

The upshot of this is that growth rates will not be able to tell what has happened to an economy subject to a severe supply side shock – that is temporary in nature. Measuring in absolute terms , in money of the day GDP sacrificed each quarter, as we have attempted to do will tell the full tale of economic destruction.

GDP Normal GDP Adjusted for Corona. R million Aggregate Losses R835b GDP at Current Prices= 5888b in 2019 -Approximately 14% of one year’s GDP