10th June 2019

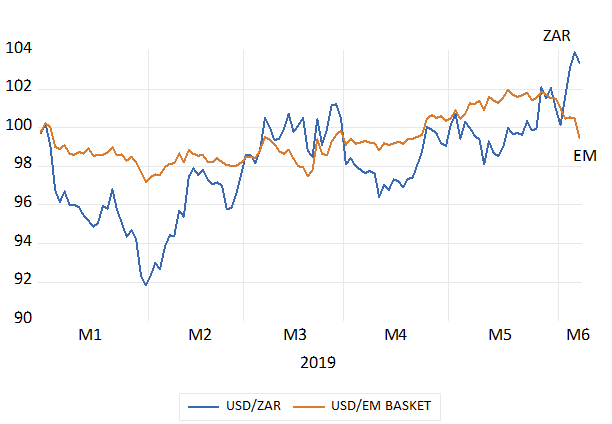

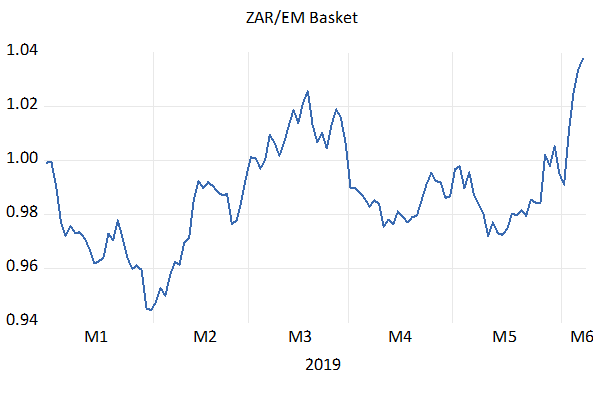

It was one of those interesting weeks that optimistic South Africans could have done without. Early in the week we were informed that the economy did even worse than we had expected – going backwards at a 3.2% annual rate in Q1. The news immediately weakened the rand -not only against the USD – the ZAR also lost about 5% to a peer group of other EM exchange rates. EM currencies generally ended the week stronger against a weaker USD that fell back against the Euro and other developed economy currencies as Fed interest rate cuts loomed.

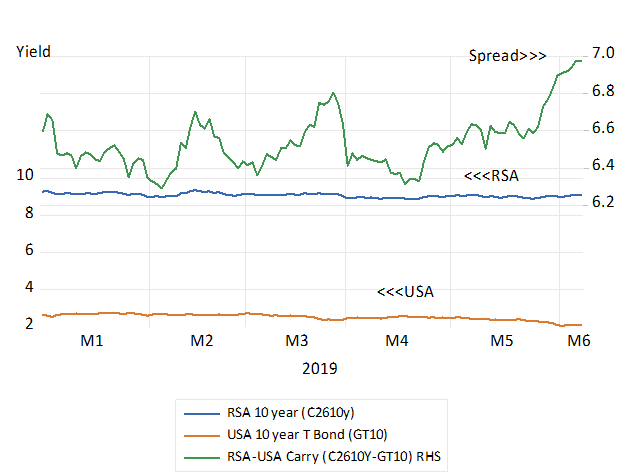

The spread between declining US bond yields and rising RSA yields widened, indicating that the rand was now expected to weaken further at a 7% p.a average annual rate over the next ten years. Consistently with this rand weakness and all that it implies for the higher prices of imported goods in weaker rands, still more inflation to come was priced into the RSA bond market. Inflationary expectations, as measured by the spread between long dated vanilla RSA bonds and their inflation protected alternatives, widened to about 6.5% p.a for 10 year money. The debt trap that might follow slow growth, less tax revenue, wider deficits and printing money to get out of it – seemed a little closer than it was (See charts below)

Fig.1; The ZAR and the EM Basket (2019=100) Daily Data

Source; Bloomberg and Investec Wealth and Investment

Fig.2; The USD/ZAR compared to the USD/EM currency basket. Daily Data (2019=1)

Source; Bloomberg and Investec Wealth and Investment

Fig.3: Long dated RSA and USA Government Bond Yield and Risk Spread (RSA-USA 10 year yield) Daily Data 2019

Source; Bloomberg and Investec Wealth and Investment

And then to compound the weakness in the ZAR and RSA’s markets the surviving Zuma factions in the ANC later in the week mounted a further diversionary attack on the independence of the Reserve Bank and its anti-inflationary zeal. Further rand weakness and higher interest rates followed.

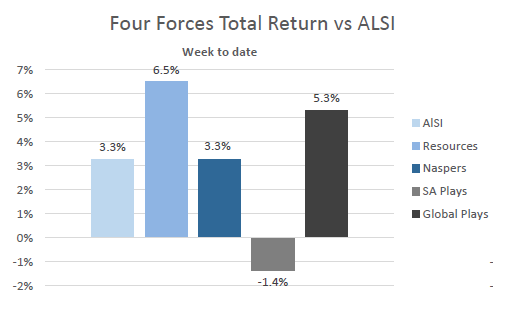

There was however some consolation for investors on the JSE- including everyone with a SA pension plan. The global plays on the JSE – those companies with major interests outside SA – acted as they could be expected to do given rand weakness absent emerging market weakness as was the case. They helped meaningfully to diversify SA specific risks (up over 5% in the week as did Resource companies that were up 6.5% – enough to lift the All Share Index by 3.3% by the week-end. (see below)

Fig. 4; Weekly Performance on the JSE (2nd– 7th June)

Source; Bloomberg and Investec Wealth and Investment

One hopes the Reserve Bank was watching these developments very closely. That is slower growth is associated with more not less inflation expected. Not perhaps what you might find in the macro texts. And more important that the reverse is also likely to be true. That is faster growth will be associated with a stronger rand and so less inflation expected and lower bond yields and less spent paying interest. Even our good friends at Moody’s now expect and would appear to welcome a cut in the repo rate to boost growth. As does the money market that now expects short rates in SA to decline by 50 b.p. over the next twelve months.

The Reserve Bank would be well advised to do what is now expected of them and do what they can to stimulate faster growth in SA. Faster growth leading to less inflation expected and as likely, no more actual inflation, should be very welcome. And also help resist those with ulterior motives when they attack the Bank.

The Reserve Bank attempts to control inflation and inflationary expectations that, in large measure, are beyond its influence. As recent events in the currency and bond markets surely confirm. Supply side shocks (the rand, the weather, the oil price, Eskom and expenditure taxes) dominate the direction of prices and all serve to inhibit disposable incomes and consumption spending. And inflation expected has a political course of its own that can add to upward pressure on prices.

Interest rates set by the Bank do influence the demand for goods and services. Demand has been consistently weak in South Africa for a number of years. Weak enough to counter to some degree the supply side pressures on the price level. But weak enough to inhibit any cyclical recovery. The trade off – less growth for marginally less inflation – has been much too severe for the economy. A more nuanced approach to interest rate settings and a more nuanced narrative to support it would better have served the economy and the Reserve Bank’s independence.