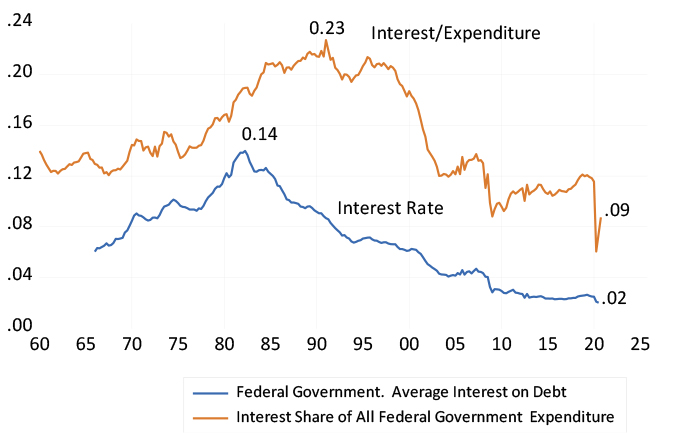

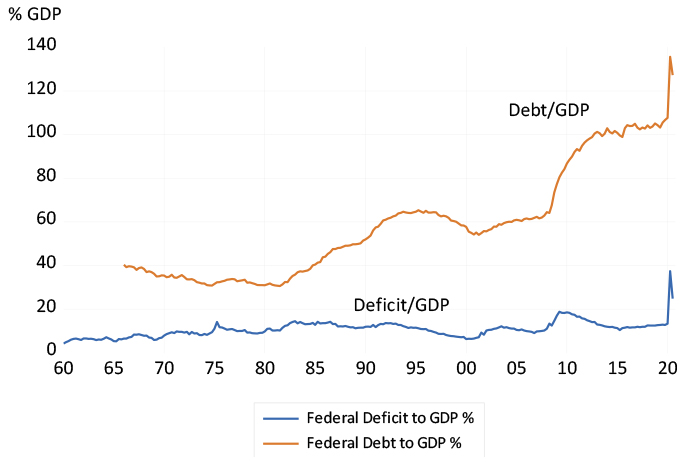

All will depend on the scale of US borrowing expected over the next 10 years. It will have to slow down to something like normal to prevent the US Budget from being overwhelmed by higher interest rates. Janet Yellen, the Treasury Secretary, told Congress that taxes will have to rise to pay for the extra $3 trillion. Will they, or will the unpopular prospect of higher taxes restrain spending ambition? It will take more than taxing the rich to pay the piper.

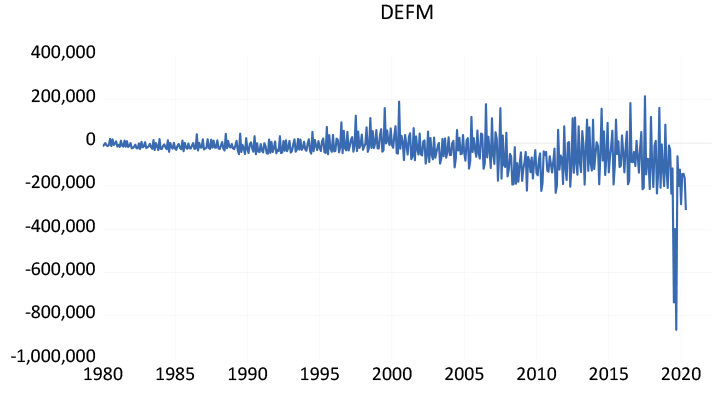

So what are these tools? Mainly, it is the power to control short-term interest rates by adding or taking away dollars from the system. He does not however control how much the government spends, how much it taxes and how much it will have to borrow. The higher he sets short-term interest rates, of course, the less popular he will become. His political independence should not be taken as a permanent given.

Powell is confident that inflation is well anchored around the current 2% annual rate, the Fed target for inflation. Actual inflation however depends on expected inflation and on the difference between actual GDP and potential GDP – the output gap. Powell believes the Fed has this gap under control. But without active co-operation from fiscal policy to restrain government spending over the long run, this inflation anchor could easily slip away. As with the Fed, we will wait and watch.