The recent Naspers annual general meeting saw shareholders at serious odds with management about the value of their contribution to the company.

Amidst all the Sturm und Drang and misconceptions about how to measure the performance of the Naspers managers, some facts of the matter deserve proper recognition. Chief among these is that is Naspers managers are expected – emphasis on expected – to destroy shareholders’ value on an heroic (or is it a tragic?) scale.

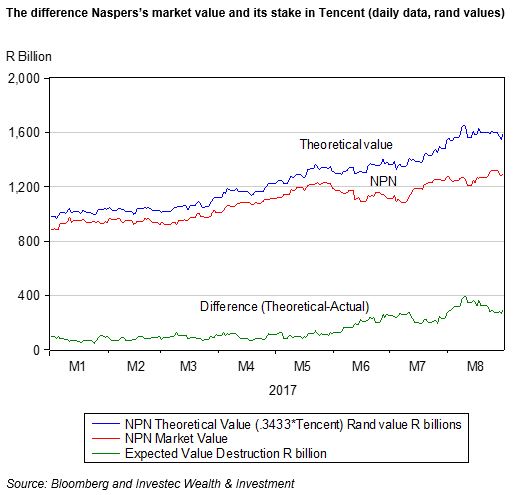

To explain, were Naspers simply a clone of Tencent, that is the company did nothing but collect and distribute to shareholders the dividends it received for its 34.33% share of Tencent, it would be currently valued as is Tencent itself. Currently it would be worth close to R1.6 trillion. The current market value of NPN is much less than this, about R1.3 trillion, or a staggering near R300bn less than the value of its stake in Tencent.

The correct logical conclusion to come to about this fact is that the market expects the Naspers managers to destroy value on their behalf. In other words, the ambitious capital investment programme of Naspers is currently worth much less (on a net present value basis) than the capital NPN management is expected to deploy over the economic life of the company. To be more precise: worth some R300bn less than it is expected to cost. Why not liquidate all those investments and return the money to shareholders, which would surely close the gap?

Unfortunately for Naspers management, the market has recently become more pessimistic about the capabilities of the Naspers managers. In January 2017, the expected destruction of value was a mere R98bn compared to the current R300bn. It may be concluded that the better Tencent performs, and so adds to the balance sheet strength of Naspers, the more ambition and so the more value destruction the market expects from Naspers. (See chart below)

Independently of the success Tencent has enjoyed in the market place, in which Naspers shareholders share to only a lesser degree, given more value destruction expected, the recent operating performance of the Naspers subsidiaries gives very little cause for believing that their fortunes are about to turn around for the better. We rely here on the Credit Suisse HOLT lens for these observations. Naspers’s cash flow return on investment (CFROI) on its operating assets dropped from -3.6% in 2016 to -10% in 2017. In other words, the operating core of Naspers is destroying value by generating a return on capital far below its opportunity cost of capital. This is nothing new. CFROI has been dropping since March 2011.

The expense missing from every income statement is a charge for the use of shareholders’ equity. Equity is not free and no rational investor wants to give it away for nothing. If we apply a capital charge on the use of Naspers operating assets, its economic profit drops from -R6.2bn in 2016 to -R11bn in 2017. Consistent with these negative returns is that the growth in the sales of these operating subsidiaries has turned negative and the operating margins (expressed as an EBITDA percentage), which were well over 20% between 2004 and 2010, are now barely positive. In 2015 and 2016, the growth in Naspers assets, which includes cash but excludes Tencent and other associate investments, has been at an ambitious rate of over 40% p.a.

Naspers managers and its shareholders clearly have a very different view of its prospects. Time will tell who has the more accurate view of the capabilities of Naspers management. One would recommend however that the Naspers management put a time limit on their ability to prove the market wrong. If the market in five years continues to value Naspers as a serial value destroyer, its managers should be willing to cut its losses, by radically reducing its investment spending and to unbundle or dispose of its loss making subsidiaries. Any expectation that Naspers is willing to adopt a much more disciplined approach to its capital allocation would add immediate value for its shareholders. 1 September 2017