Starbucks has a prominent notice. Responsibly Cashless. It might have read better or more honestly as profitably cashless. Avoiding the costs and dangers of handling and transporting cash and the associated bank charges – including the likelihood of cash not making it to the till in the first instance – will surely be in the owner’s interest and justifiably so. On the proviso that the sales lost would not be at all significant as affluent and tech savvy customers tender their telephones. It is not a conclusion the owner manager of a small stand-alone enterprise in control of what goes in or out of the cash register will come to. For them cash is still king.

Starbucks and other cash refusers are probably within its rights refusing legal tender. Only the notes and coins issued by the Reserve Bank qualify as legal tender in SA – money that cannot be refused in proposed settlement of a debt. But presumably can be rejected when offered in exchange for a good or service. SARS would probably approve of a cashless society for obvious income monitoring purposes. The Reserve Bank might, were it a private business, have mixed feelings about reducing the demand for a most valuable monopoly. It pays no interest on the notes it issues and earns interest on the assets the note liabilities help fund. In 2004 the note issue funded 40% of the Assets on the Reserve Bank. That share is now down to 15%. It was 20% before Covid.

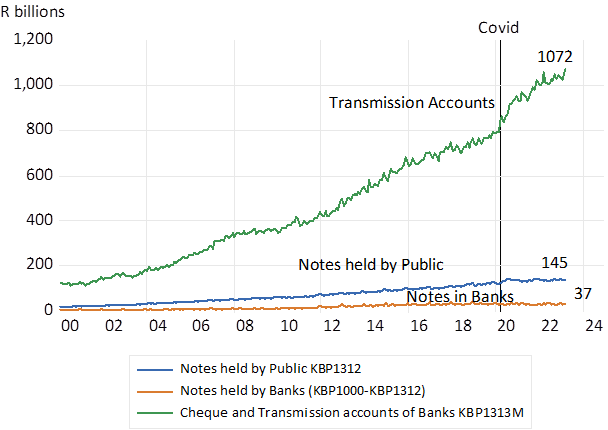

Clearly notes, have lost ground to the digital equivalent- a transfer made and received via a banking account. A trend that becomes conspicuous after the Covid lockdowns. Since then, the transmission and cheque accounts at SA banks have grown very strongly from R790 billion in early 2020 to nearly 1.1 trillion today- or by about a quarter. By contrast the notes issued by the Reserve Bank since have increased only marginally – by R20b – with most of the extra cash issued being held by the public. The private banks have managed to reduce their holdings of non-interest bearing cash in their vaults and ATM’s. By closing branches and ATM’s and retrenchments. Replacing notes with digits- have been a cost saving response. A central bank replacing paper notes with a digital alternative could be an alternative. But it would be very threatening to the deposit base of the private banks and their survival prospects.

South Africa; Money Supply Trends.

Source; SA Reserve Bank and Investec Wealth and Investment

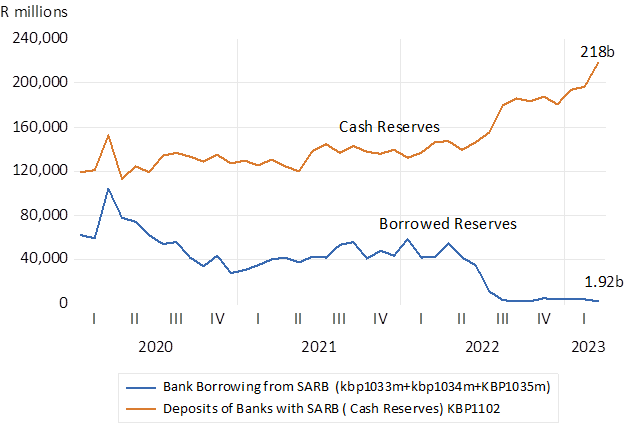

The Banks in SA have however dramatically increased their demands for an alternative form of cash- deposits with the Reserve Bank. They now earn interest on these deposits. What used to be significant interest charged to the banks when they consistently borrowed cash from the SARB – to satisfy the cash reserve requirements set by the SARB – at the Repo rate- has now become interest to be earned on deposits held with the SARB. These deposits have grown by R100bilion since 2020 while cash borrowed from the SARB has fallen away almost completely from an earlier average of about R50 billion a month.

SA Banks – demand for and supply of cash reserves since Covid

Source; SA Reserve Bank and Investec Wealth and Investment

The SARB, following the Fed, regards the interest it pays on these deposits as fit for the purpose of preventing banks from converting excess cash into additional lending. Which would lead to increased supplies of money in the form of additional bank deposits. It takes a willing bank lender and a willing bank borrower to power up the supply of cash supplied to the banking system by a central bank into extra deposits The testing time for central banks in a banking world full of cash will come when increased demands for bank credit accompany the improved ability and willingness of the banks to turn excess cash into extra bank lending. Then interest rate settings may not control the demand by banks for cash reserves to sufficiently restrain the conversion of excess cash into additional bank lending, that in turn will lead to extra and possibly excess supplies of money and so extra spending as money is exchanged for goods, services and other assets, that will force prices higher. Clearly not for now the banking state of SA or of the US where the supply of money is in sharp retreat.